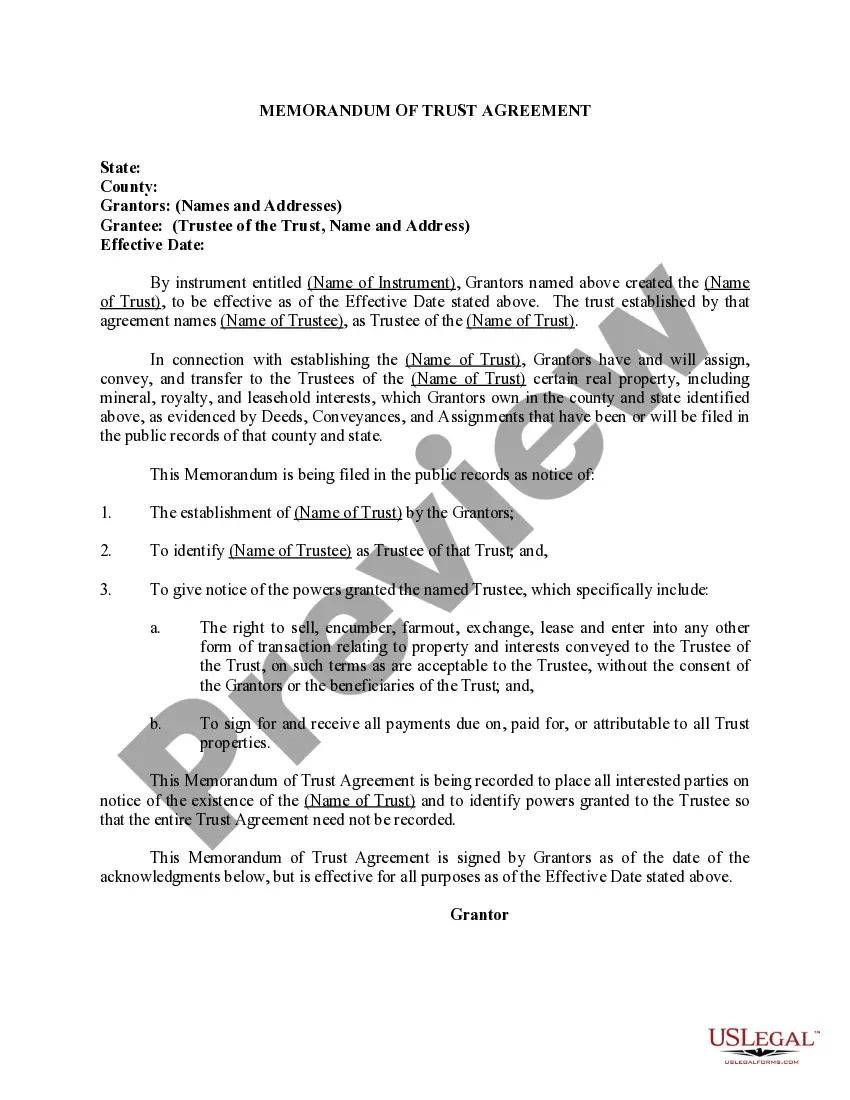

Delaware Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

You are able to devote hours on-line searching for the lawful document template that meets the federal and state specifications you will need. US Legal Forms gives a huge number of lawful varieties which can be evaluated by specialists. You can actually acquire or printing the Delaware Memorandum of Trust Agreement from our services.

If you already have a US Legal Forms account, you may log in and click on the Acquire button. After that, you may total, modify, printing, or indicator the Delaware Memorandum of Trust Agreement. Every lawful document template you purchase is your own property for a long time. To acquire yet another version associated with a obtained kind, go to the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms internet site the very first time, adhere to the basic instructions under:

- Very first, ensure that you have selected the correct document template for that region/metropolis that you pick. See the kind description to ensure you have chosen the correct kind. If available, make use of the Review button to check from the document template at the same time.

- If you would like find yet another edition of the kind, make use of the Lookup discipline to discover the template that meets your requirements and specifications.

- Once you have located the template you would like, just click Acquire now to carry on.

- Select the rates plan you would like, enter your references, and sign up for a free account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal account to fund the lawful kind.

- Select the structure of the document and acquire it to your system.

- Make alterations to your document if required. You are able to total, modify and indicator and printing Delaware Memorandum of Trust Agreement.

Acquire and printing a huge number of document templates using the US Legal Forms website, which provides the largest assortment of lawful varieties. Use specialist and state-specific templates to take on your small business or specific needs.

Form popularity

FAQ

A living trust is created in Delaware by signing a Declaration of Trust, which will name the trustee, beneficiary and terms of the trust. You need to sign the declaration in the presence of a notary. Once that is complete, the trust must be funded by transferring assets into it.

Delaware's directed trust law provides: Freedom to engage in estate planning or asset protection planning using illiquid assets, such as stock in the family business, real estate, or hedge fund/private equity investments, when a trustee may otherwise be reluctant to hold these types of assets.

Firstly, investors form a DST by filing a Certificate of Statutory Trust with the Delaware Division of Corporations. Investors then choose to create a statutory trust that names a Delaware trustee or statutory trust that has become a registered investment corporation, along with a registered agent.

You might choose to put just a few vital assets, such as your house, in a trust and have everything else be decided by your will. This can help ensure a speedy transfer for your most important assets while the rest of your estate goes through the normal probate process.

To make a living trust in Delaware, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The cost of setting up a trust in Delaware varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

You need to sign the declaration in the presence of a notary. Once that is complete, the trust must be funded by transferring assets into it. You can choose any assets you want to transfer but cannot transfer IRAs, 401(k)s or Keough plans.