Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC

What this document covers

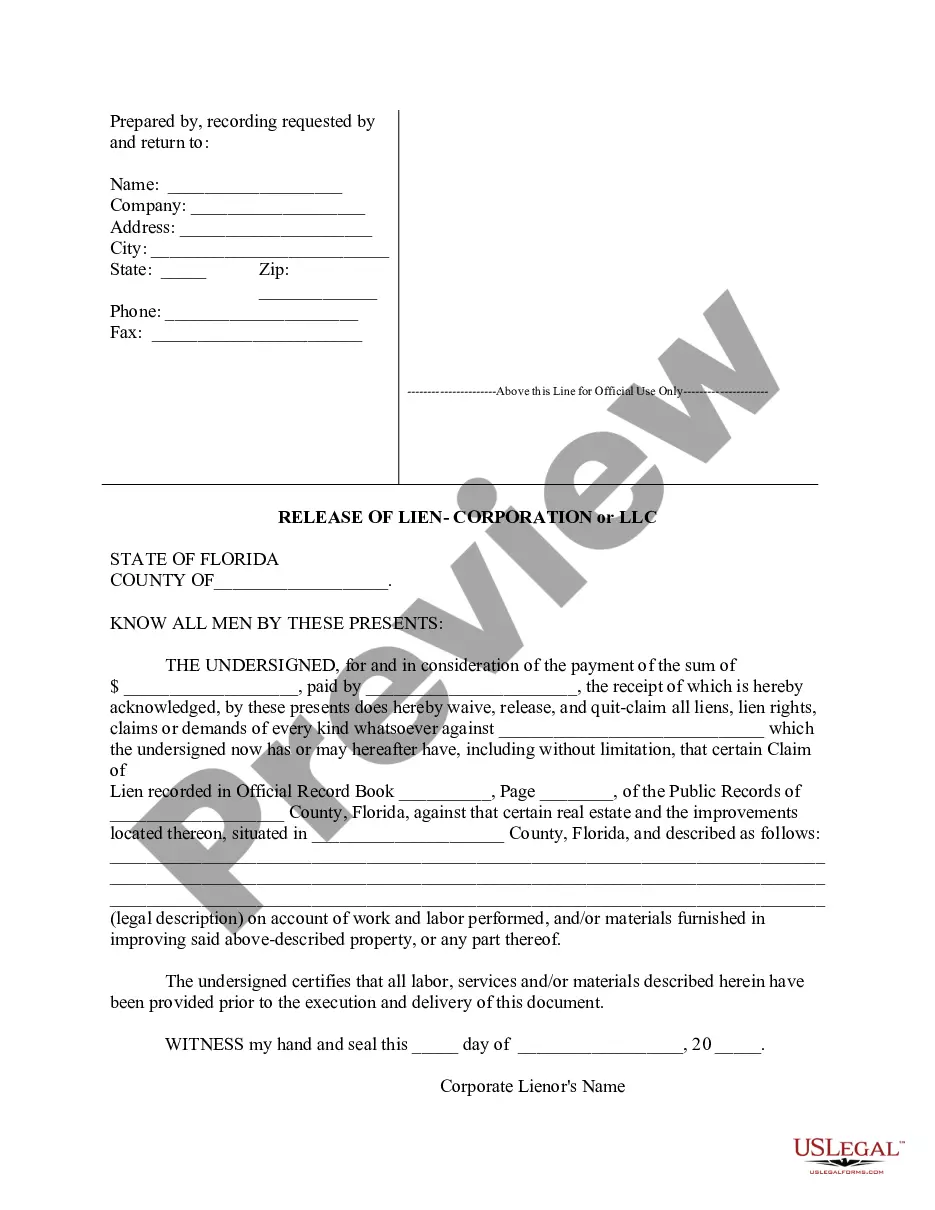

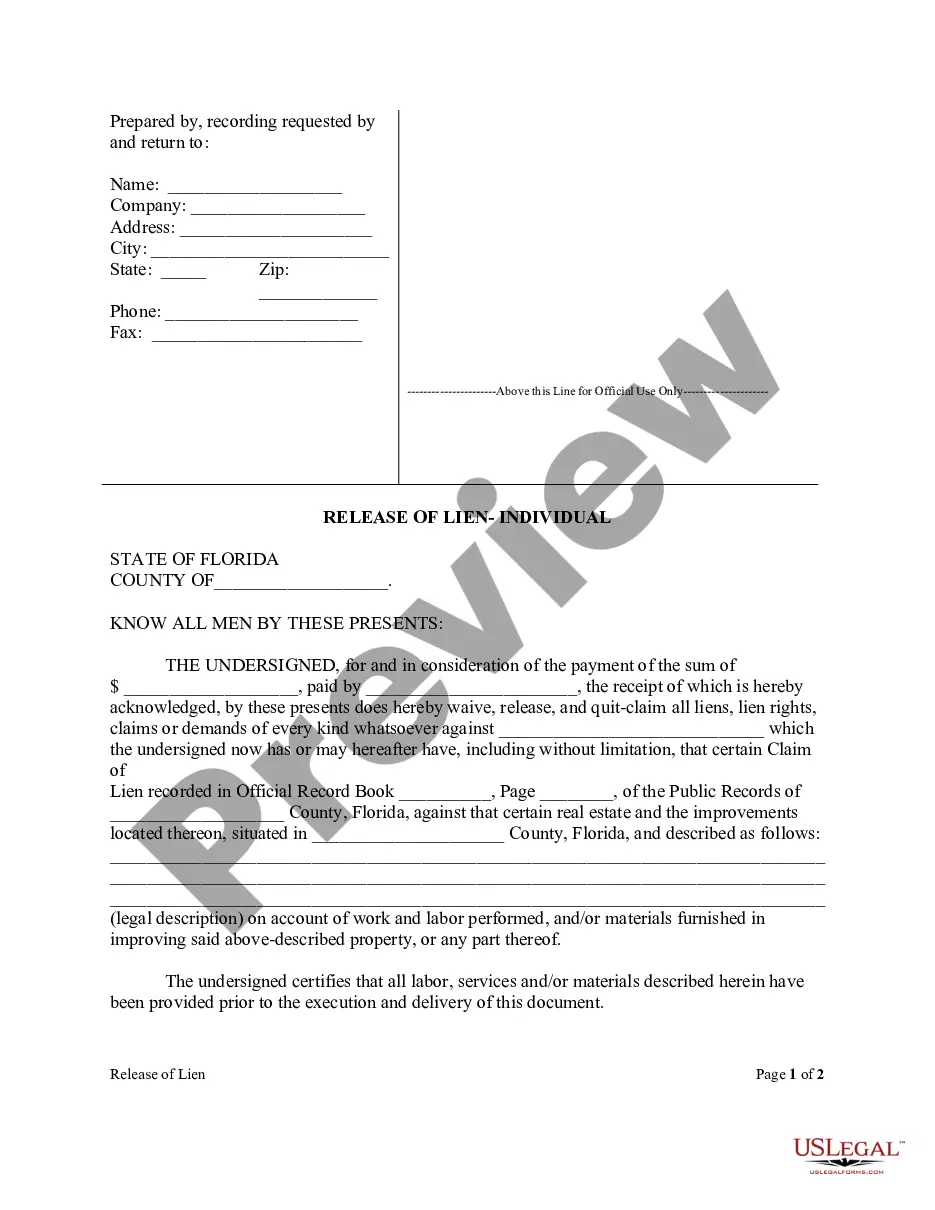

The Release of Lien form is a legal document used by corporations or limited liability companies (LLCs) to formally waive and release any liens or claims against a property. This document affirms that the lienor has received payment for work or materials supplied related to construction or improvement of the property. Unlike similar forms, this Release of Lien specifically caters to corporate entities, ensuring that they are legally liberated from any demands concerning their lien rights.

Key parts of this document

- Identification of the lienor's corporate or LLC name and contact information.

- Details of the payment received to execute the release.

- Description of the property affected by the lien.

- Legal acknowledgment of any previous claims or liens recorded against the property.

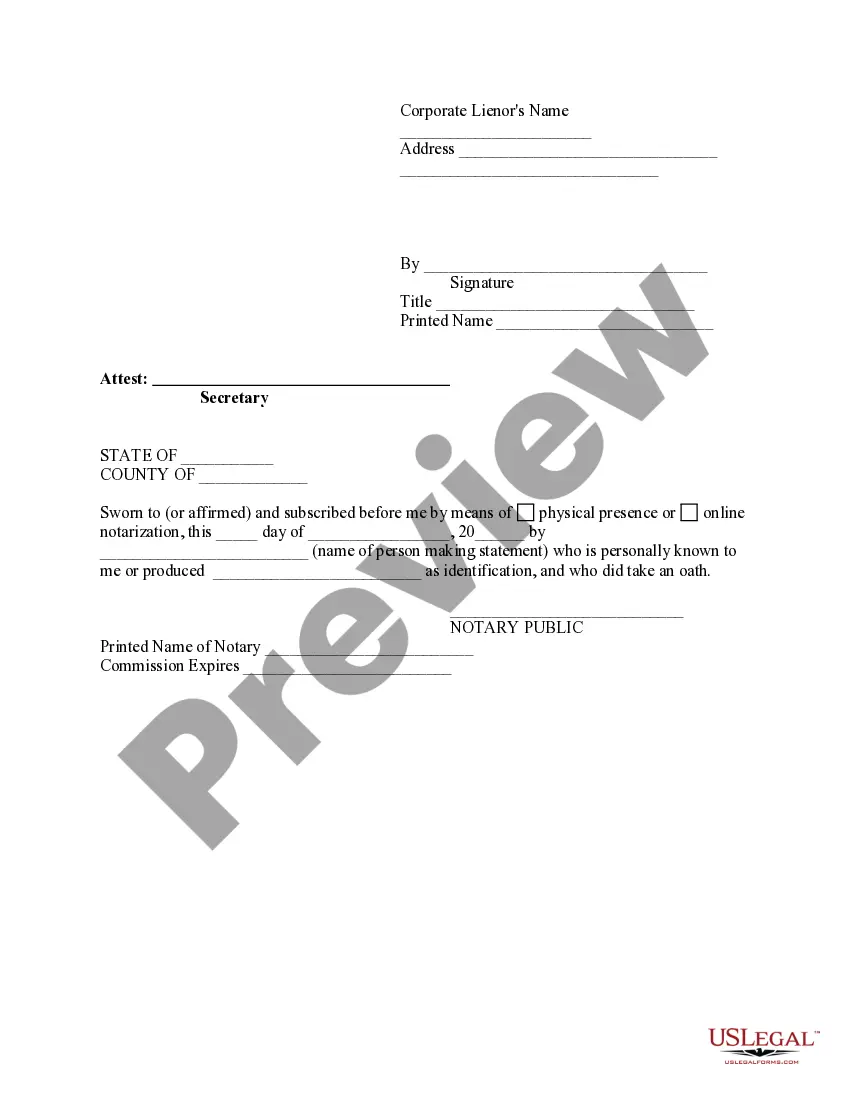

- Signature of the corporate representative along with their title.

- Notarization section to formally verify the document's authenticity.

When this form is needed

This form is needed when a corporation or LLC has completed work on a property and received full payment. It should be used to officially release any mechanic lien claims against the property, thereby clearing the title for the property owner. It is particularly relevant after construction, renovation, or any improvement work where materials were supplied, ensuring that there are no outstanding claims affecting the property.

Intended users of this form

- Corporations or LLCs that have provided construction services or materials.

- Companies looking to release a mechanic lien after receiving payment.

- Contractors and subcontractors who need to document the release of lien rights.

How to complete this form

- Identify the lienor by entering the corporate or LLC name and contact details at the top of the form.

- Specify the amount received as payment under the consideration clause.

- Provide detailed information about the property being released from the lien, including its legal description.

- Ensure the corporate representative signs the document and includes their title.

- Complete the notarization section to validate the document legally.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to include accurate property descriptions, which may render the release invalid.

- Not obtaining the necessary signatures from corporate representatives.

- Neglecting to notarize the form when required, which can lead to challenges in enforceability.

- Misunderstanding the payment section, leading to incorrect amounts being recorded.

Benefits of using this form online

- Convenient access to legal forms that can be quickly downloaded and completed.

- Editability allows users to easily customize the form to fit their specific needs.

- Reliability, as forms are drafted by licensed attorneys to ensure legal compliance.

- 24/7 availability for creating and submitting forms, providing flexibility for users.

Main things to remember

- This form is essential for corporations or LLCs releasing liens after payment.

- Ensure accurate completion to prevent legal disputes.

- Notarization is required for the document to be enforceable.

- Review state-specific rules to ensure compliance with local laws.

Form popularity

FAQ

Creating a release of lien involves filling out the appropriate form with correct information and signatures. The Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC is specifically designed for this purpose. After completing the form, ensure that all required parties sign it before submitting it to your local authority for recording.

The timeline for obtaining a lien release can vary based on submission methods. If you use the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC from US Legal Forms, you can fill it out and download it immediately. After signing and submitting it to the relevant county office, processing can take anywhere from a few days to a couple of weeks, depending on local regulations.

Getting a lien release form is straightforward. You can download it from an online service like US Legal Forms, where you will find the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC. This platform offers user-friendly options to fill out your form, ensuring you have all the necessary information for completion.

You can obtain a lien release form from various sources, including legal offices or government websites. However, the most efficient way is to visit a trusted platform like US Legal Forms, which provides specifically designed forms such as the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC. This ensures you get a compliant and ready-to-use document tailored to your needs.

To create a lien release, you need to start by preparing the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC. This form requires specific details like the property description, the amount satisfied, and the parties involved. Once you complete the form, ensure all parties sign it properly. After that, you can submit it to the county clerk to finalize the process.

Yes, a lien release in Florida needs to be signed in front of a notary public to be legally enforceable. Notarization serves to verify the identity of the person signing the release document. Ensure compliance with these requirements using the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC, which includes notarization guidelines for your convenience.

In Illinois, the rules for mechanic's liens vary significantly from Florida’s regulations. Generally, a contractor or supplier must file a lien within four months of completing work on residential properties and within two years for commercial properties. Ensure you understand these rules and consider preparing the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC specifically for Florida needs.

To release a mechanics lien in Florida, you must complete a lien release form and file it with the county clerk where the original lien was recorded. Make sure to indicate that the debt has been satisfied. Consider using uslegalforms for easy access to the necessary form called the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC, which helps simplify this process.

Generally, property owners who do not provide services or materials directly associated with a construction project cannot file a mechanic's lien. For example, simply being a service provider or general contractor without a direct contract or relationship to the project does not qualify. Always check local regulations to confirm eligibility when considering the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC.

Yes, you can file a lien against a business's property in Florida if you meet specific requirements regarding the materials or services you provided. The process is similar to filing against residential properties. To ensure your lien is effective, utilize the Florida Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC, which lays the groundwork for your claim.