Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Obtain entry to the most exhaustive collection of legal documents.

US Legal Forms is indeed a platform where you can discover any state-specific document in just a few clicks, such as Florida Assumption Agreement of Mortgage and Release of Original Mortgagors formats.

No need to waste hours of your time searching for a court-acceptable template.

If everything appears satisfactory, click on the Buy Now button. After choosing a pricing plan, establish your account. Make the payment using a card or PayPal. Save the document to your computer by clicking Download. That's it! You must complete the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors template and finalize it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily discover over 85,000 useful samples.

- To utilize the forms library, select a subscription and set up an account.

- If you have already established it, simply Log In and click on the Download button.

- The Florida Assumption Agreement of Mortgage and Release of Original Mortgagors template will automatically be saved in the My documents tab (a section for all documents you save on US Legal Forms).

- To create a new account, follow the brief instructions listed below.

- If you're going to use a state-specific document, be sure to select the correct state.

- If possible, review the description to comprehend all details of the form.

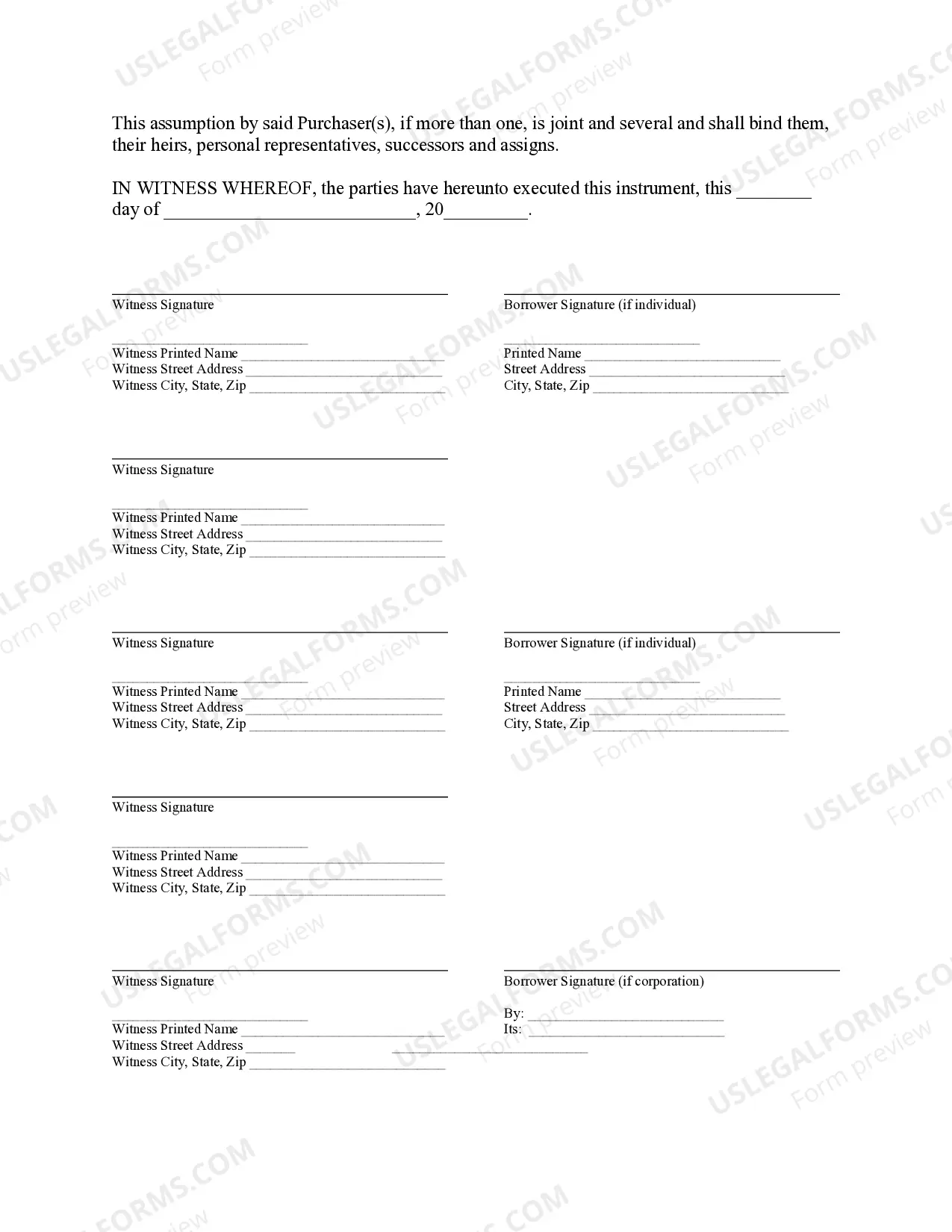

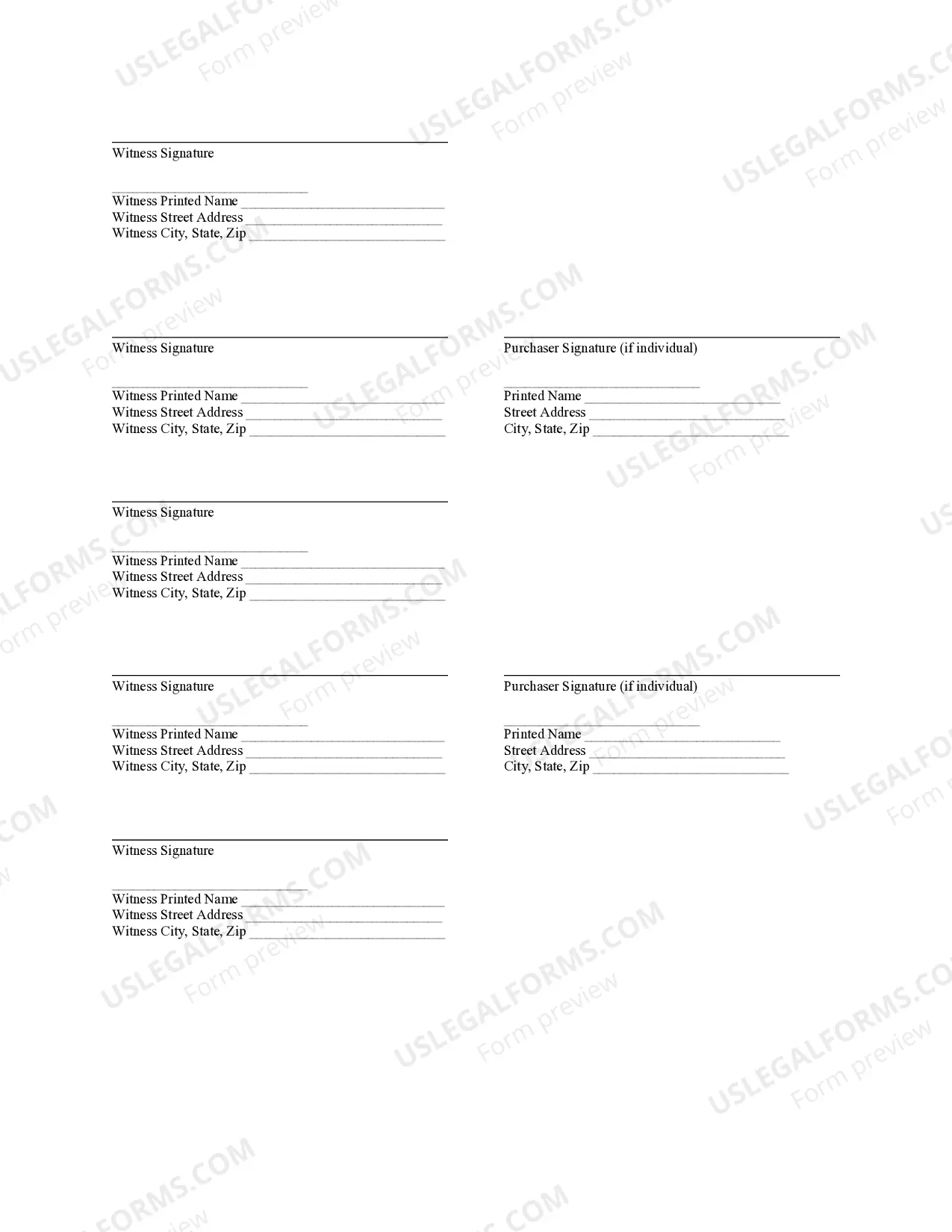

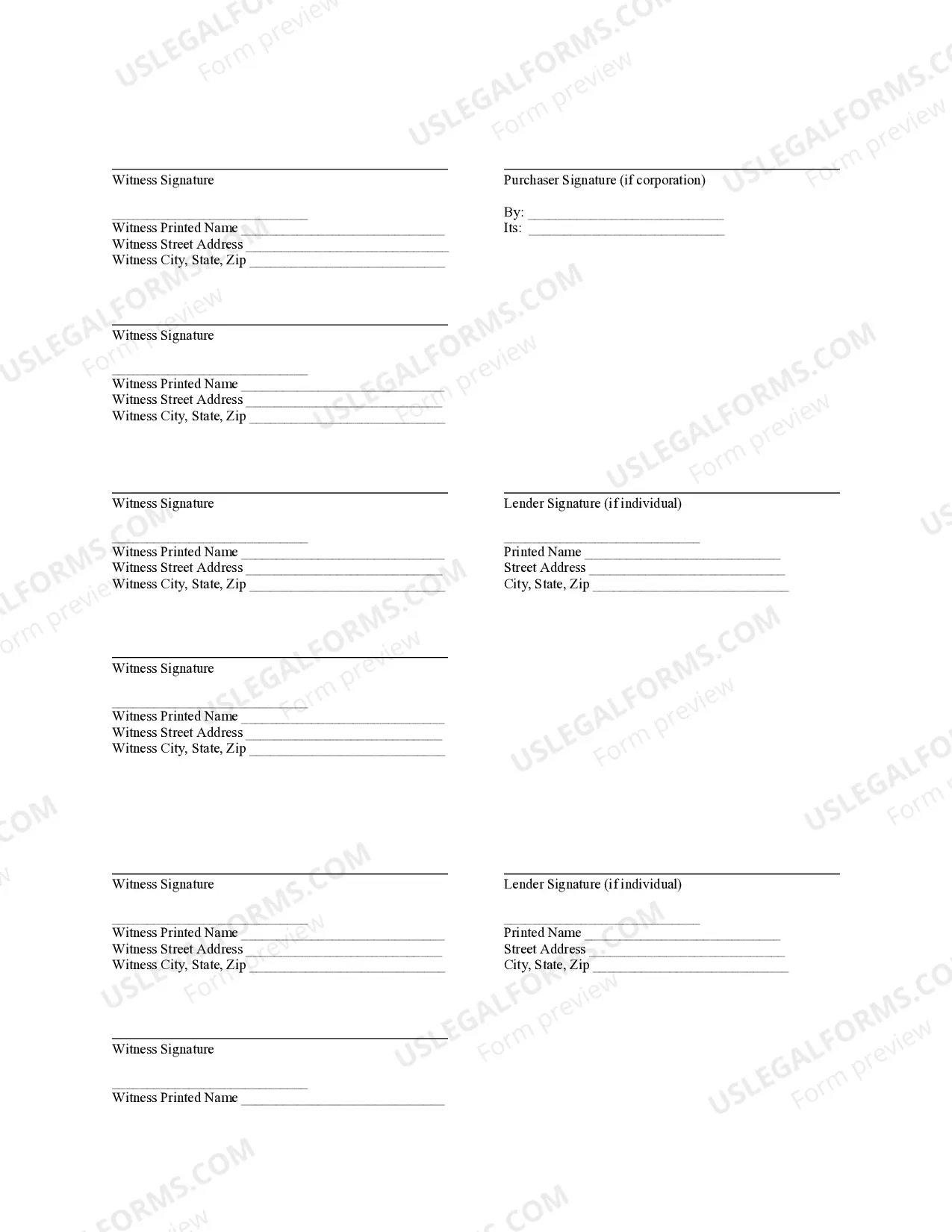

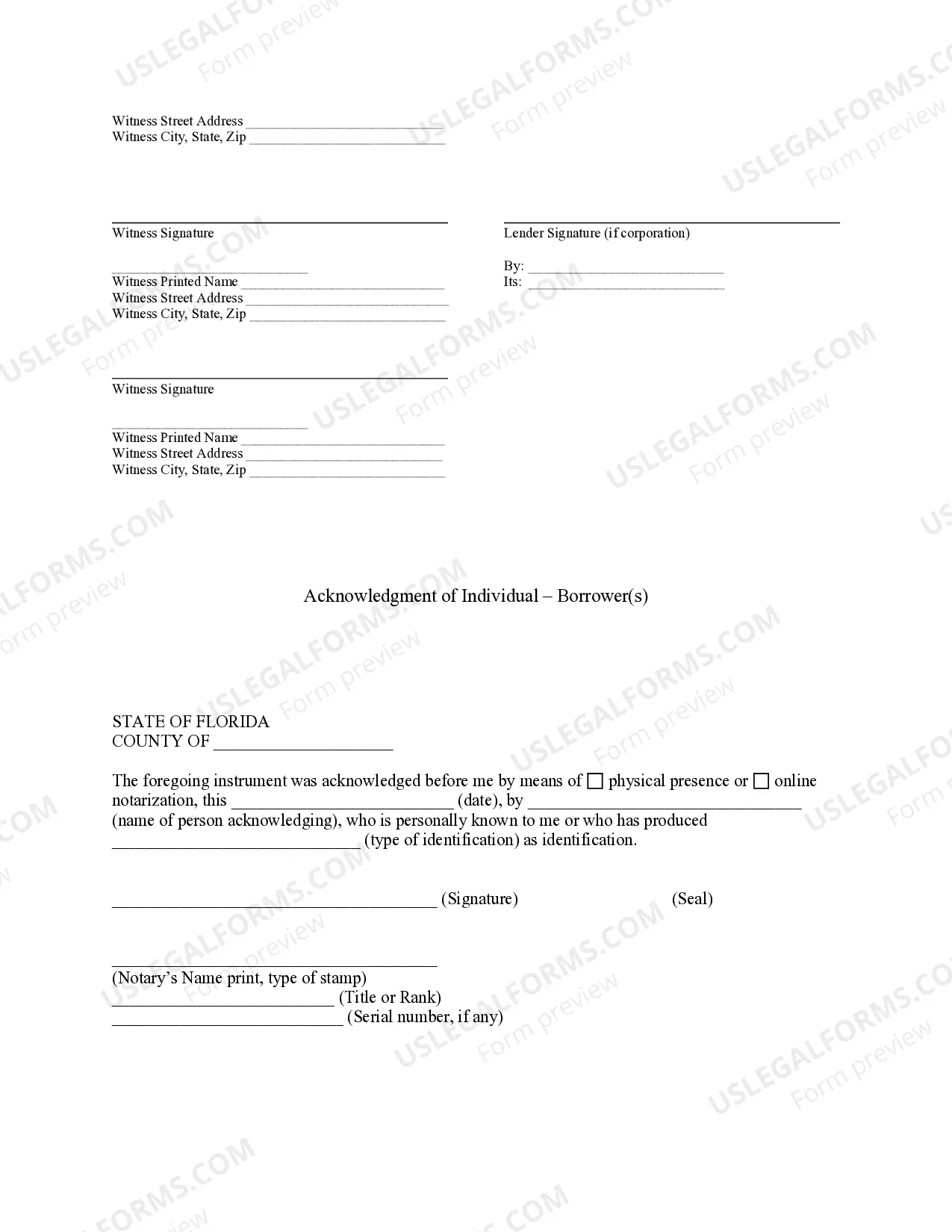

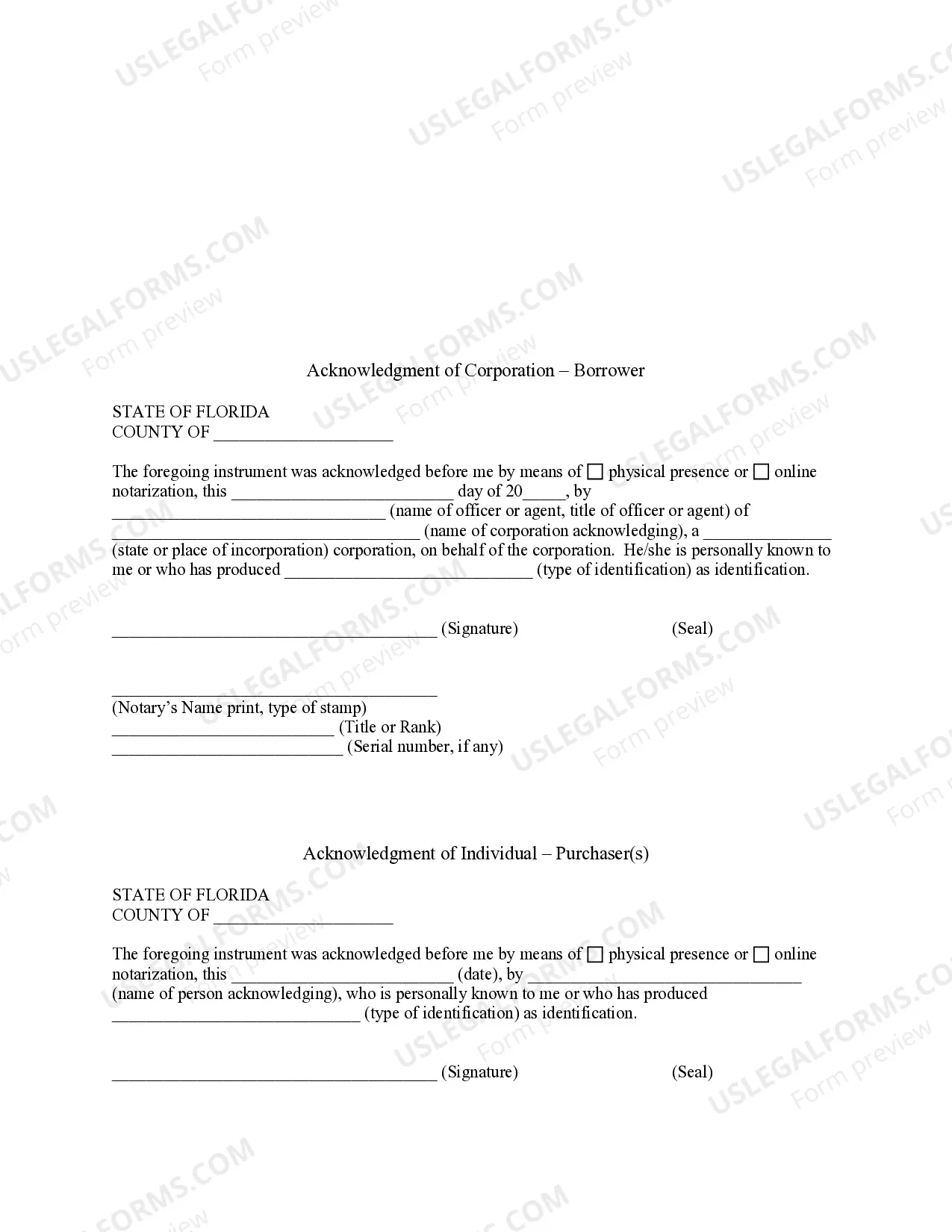

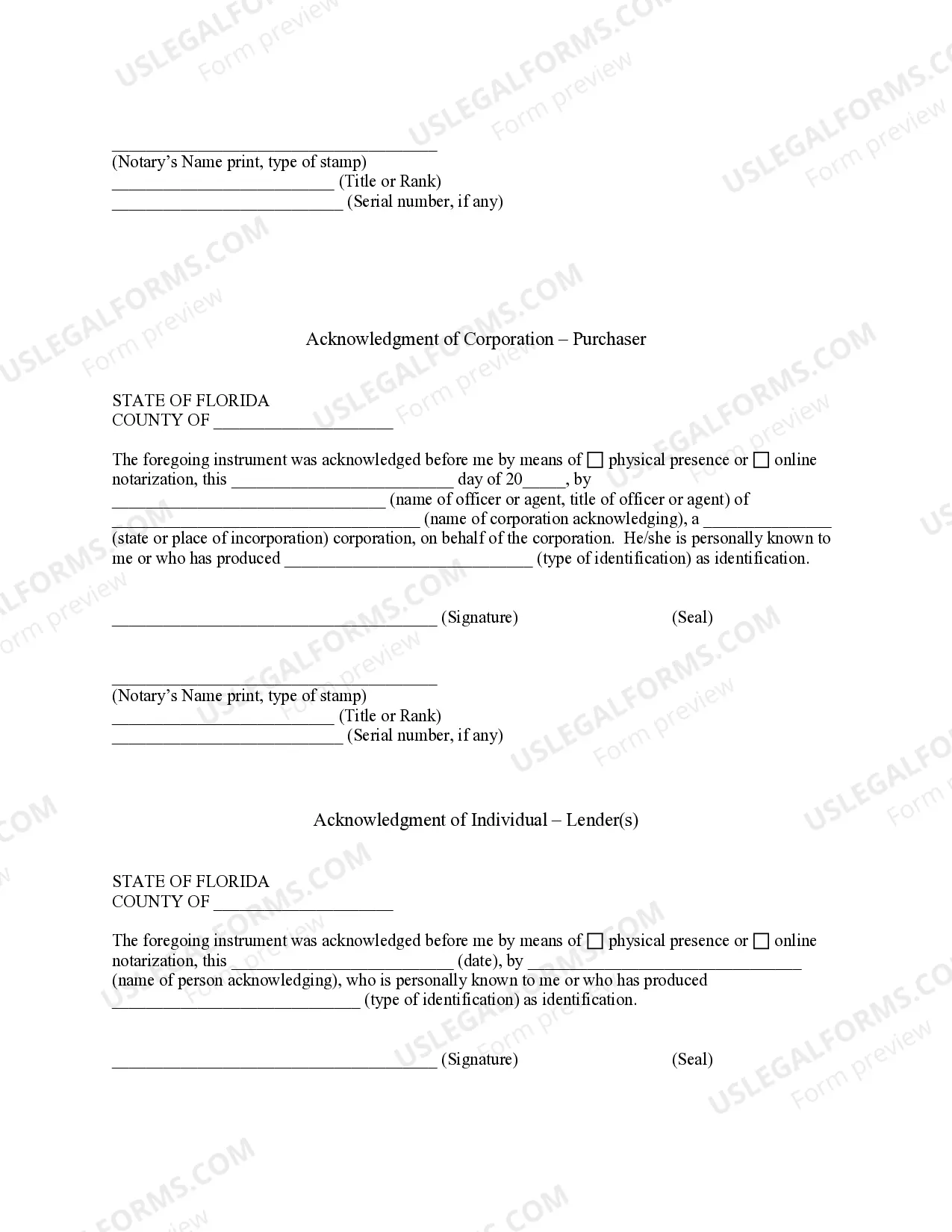

- Utilize the Preview option if it's available to examine the document's details.

Form popularity

FAQ

The Florida Assumption Agreement of Mortgage and Release of Original Mortgagors plays a crucial role in real estate transactions by allowing an existing mortgage to be transferred to a new borrower. This agreement ensures that the new borrower assumes the mortgage responsibilities, while the original mortgagor is released from any future obligations. This process can streamline property sales and protect the interests of all parties involved, making it essential to consult with reputable legal resources like UsLegalForms to navigate the complexities.

The assumption agreement is generally signed by the new borrower, also known as the assumee, and the lender. The original borrower, or original mortgagor, may also need to sign to release their interests and obligations under the terms of the mortgage. In a Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, everyone's signatures are vital for validating the transfer of responsibility and ensuring that the transition is legally sound.

The official document from a mortgage holder that releases the debtor from the mortgage is often referred to as a 'Release of Mortgage.' This document signifies that the lender has accepted the full payment of the mortgage debt and acknowledges that the debtor is no longer liable. In cases involving the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, this release is essential for clearing any obligations tied to the original mortgage.

Acquiring a partial release of a mortgage can be relatively straightforward, especially if you provide proper documentation and reasoning for the request. Lenders will assess whether the remaining mortgage will remain secure after the partial release. Utilizing resources like the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can help facilitate this process and clarify your next steps.

The timeline for a mortgage release can vary, but generally, it takes about 30 to 60 days after all necessary documents are submitted. The process involves the lender verifying that the mortgage has been repaid and then recording the release in public records. For those involved in the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, staying in touch with your lender can help streamline this process.

To assume a mortgage under the Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, you typically need the mortgage agreement, a completed assumption agreement form, and proof of income. Additionally, you may need a credit report or financial statement to demonstrate your ability to take on the mortgage. It's also wise to check with your lender for any specific requirements they might have.

An assumable mortgage process begins with a potential buyer expressing interest in taking over the current mortgage. The seller must inform their lender and request approval for the assumption. After the lender evaluates the buyer's qualification, they will prepare a Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. This formal agreement ensures that the buyer takes over payments from the seller and clarifies the terms moving forward.

To assume a mortgage from a family member, start by discussing the details of the transfer with them. It's crucial to notify the lender and request their permission for the assumption. The lender will review your financial qualifications and may require you to sign a Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, which formally transfers the mortgage. Using platforms like uslegalforms can simplify the paperwork and ensure everything is in order.

The process for assuming a mortgage involves submitting a request to the lender for approval. You will need to provide documentation about your financial situation to demonstrate your ability to take over the payments. Once approved, the lender will prepare a Florida Assumption Agreement of Mortgage and Release of Original Mortgagors to finalize the transfer. It is important to ensure that all parties understand their responsibilities in this new arrangement.

A release of a mortgage signifies that the borrower has fulfilled their obligations and the lender can no longer claim the property. It effectively clears the property's title, allowing for a smooth transition of ownership. This process is often included in a Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, ensuring all parties understand their rights.