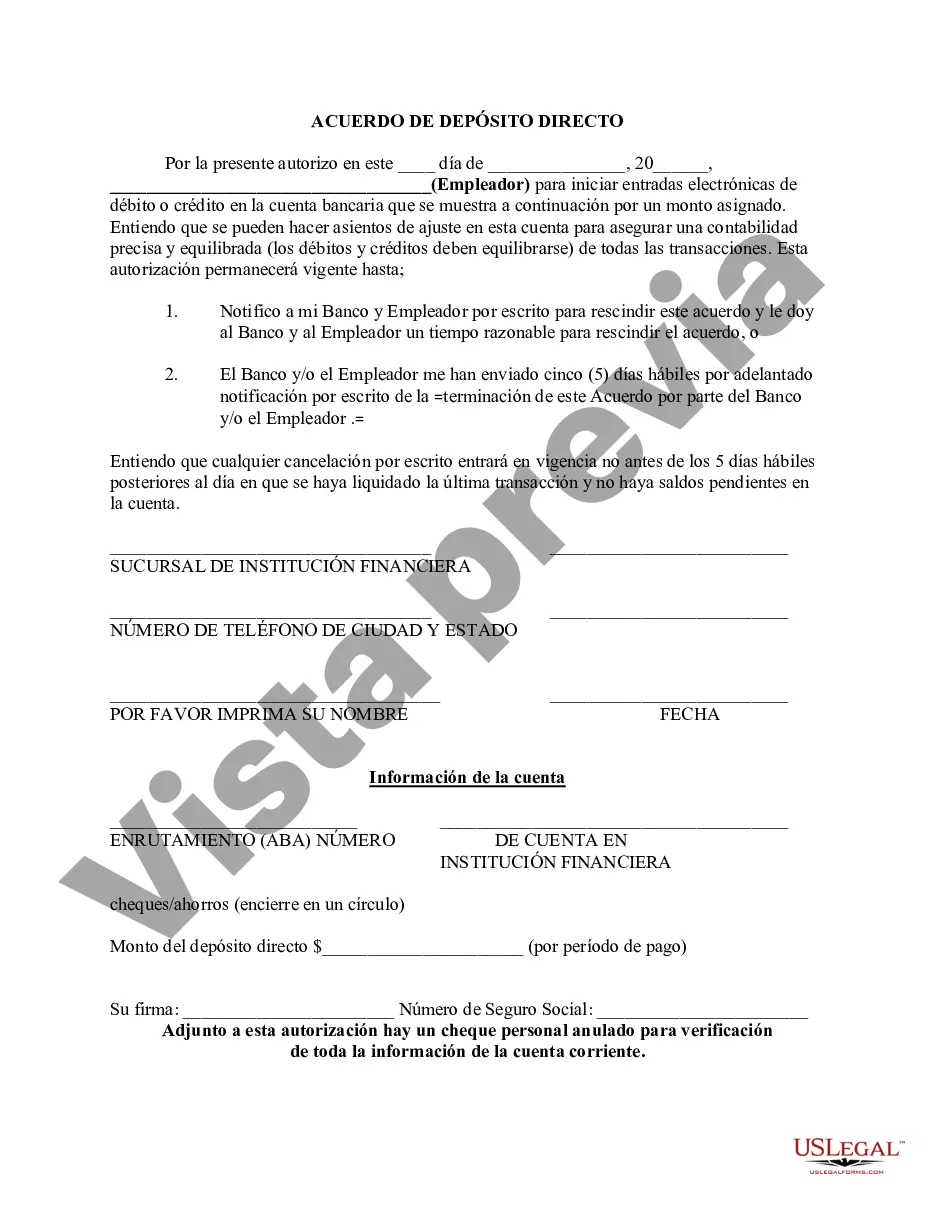

The Florida Direct Deposit Form for Chase is a document provided by Chase Bank specifically for residents of Florida who wish to set up direct deposit to their Chase account. This form is designed to simplify the process of electronically depositing funds into a Chase account, providing a convenient and secure way to receive regular payments such as salary, benefits, or other income sources. The Florida Direct Deposit Form for Chase typically requires the account holder to provide their personal information, including their name, address, social security number, and contact details. This information is necessary to properly identify and link the account to the individual. Additionally, the form requires the account holder to provide their Chase account number and the bank's routing number. These numbers are essential for accurately directing the funds to the correct account. The routing number for Chase Bank in Florida is 267084131. Furthermore, the Florida Direct Deposit Form for Chase may have specific sections or check boxes for different types of direct deposits. Some common variations include payroll direct deposit, Social Security direct deposit, retirement benefit direct deposit, and government assistance direct deposit. By indicating the type of deposit, the account holder ensures that the funds are correctly categorized and deposited into the appropriate account. It is important to note that the Florida Direct Deposit Form for Chase may have multiple copies, with one for the account holder to retain for their records and another to be submitted to the employer, benefits provider, or government agency initiating the direct deposit. This ensures proper documentation and facilitates the seamless transfer of funds. To complete the process, the account holder must carefully review the information provided on the form, ensuring accuracy and completeness. Once all the necessary fields are filled, the form should be signed and dated to validate the authorization for direct deposit. Having multiple variations of the Florida Direct Deposit Form for Chase allows customization to the specific needs of individuals based on their source of income. So, it is important to double-check and use the appropriate form for the desired direct deposit purpose, i.e., payroll, Social Security, retirement benefits, or government assistance. By using the Florida Direct Deposit Form for Chase, account holders can take advantage of the convenience and safety provided by direct deposit, eliminating the need for physical checks and reducing the risk of loss or potential fraud. It streamlines the process of fund allocation and offers a reliable and efficient method to receive regular payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out Florida Formulario De Depósito Directo Para Chase?

Have you been in the place where you will need files for either organization or individual uses nearly every day time? There are tons of lawful document layouts accessible on the Internet, but locating types you can depend on isn`t effortless. US Legal Forms offers a huge number of type layouts, like the Florida Direct Deposit Form for Chase, which can be published to satisfy state and federal specifications.

When you are presently acquainted with US Legal Forms site and possess a merchant account, just log in. Next, it is possible to obtain the Florida Direct Deposit Form for Chase web template.

Unless you come with an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the type you need and ensure it is for your proper town/region.

- Take advantage of the Preview switch to analyze the shape.

- Browse the description to actually have selected the correct type.

- In the event the type isn`t what you`re looking for, use the Research area to get the type that meets your requirements and specifications.

- If you find the proper type, click Acquire now.

- Choose the rates prepare you desire, complete the necessary details to produce your account, and pay for the order making use of your PayPal or credit card.

- Choose a hassle-free document format and obtain your duplicate.

Get every one of the document layouts you might have purchased in the My Forms menu. You can get a more duplicate of Florida Direct Deposit Form for Chase any time, if needed. Just select the needed type to obtain or print the document web template.

Use US Legal Forms, probably the most comprehensive collection of lawful varieties, to save lots of some time and avoid faults. The assistance offers skillfully manufactured lawful document layouts which can be used for an array of uses. Create a merchant account on US Legal Forms and begin creating your lifestyle easier.