The Florida Deferred Compensation Agreement — Long Form is a legally binding contract commonly used in the state of Florida to outline the terms and conditions of a deferred compensation plan between an employer and employee. This agreement allows eligible employees to contribute a portion of their income on a pre-tax basis into a retirement savings account. The purpose of a deferred compensation agreement is to provide employees with a tax-deferred method of saving for retirement, increasing their overall retirement income. It is often used as a supplement to other retirement plans, such as a 401(k) or pension plan. The agreement typically includes several key elements, such as the employee's eligibility to participate in the deferred compensation plan, the employee's voluntary contribution amount, the employer's matching contribution (if applicable), investment options available to the employee, vesting schedule, distribution options, and any applicable tax regulations. The Florida Deferred Compensation Agreement — Long Form is specifically tailored to comply with the laws and regulations of the state of Florida. It may include additional provisions specific to Florida state employees or public sector workers. It is essential to note that different types of Florida Deferred Compensation Agreement — Long Form may exist based on the specific category of employees and organizations. For example: 1. State Employee Deferred Compensation Agreement — This type of agreement is specific to employees working for the state government of Florida, including agencies, departments, and state universities. 2. Municipal Employee Deferred Compensation Agreement — This agreement is designed for municipal employees, including those working for cities, counties, or other local governmental entities within the state. 3. Teacher Deferred Compensation Agreement — This agreement caters to educational professionals working in public schools and colleges within Florida. 4. Public Sector Employee Deferred Compensation Agreement — This type of agreement serves employees of various public entities, such as public hospitals, public transit authorities, or public utilities. These variations exist to accommodate the different requirements and regulations applicable to specific categories of employees within the state of Florida. Overall, the Florida Deferred Compensation Agreement — Long Form provides a comprehensive framework for employees to save for retirement while enjoying potential tax benefits, employer matching contributions, and flexible investment options. It ensures compliance with state laws and protects the rights and interests of both employees and employers participating in the plan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Acuerdo de Compensación Diferida - Forma Larga - Deferred Compensation Agreement - Long Form

Description

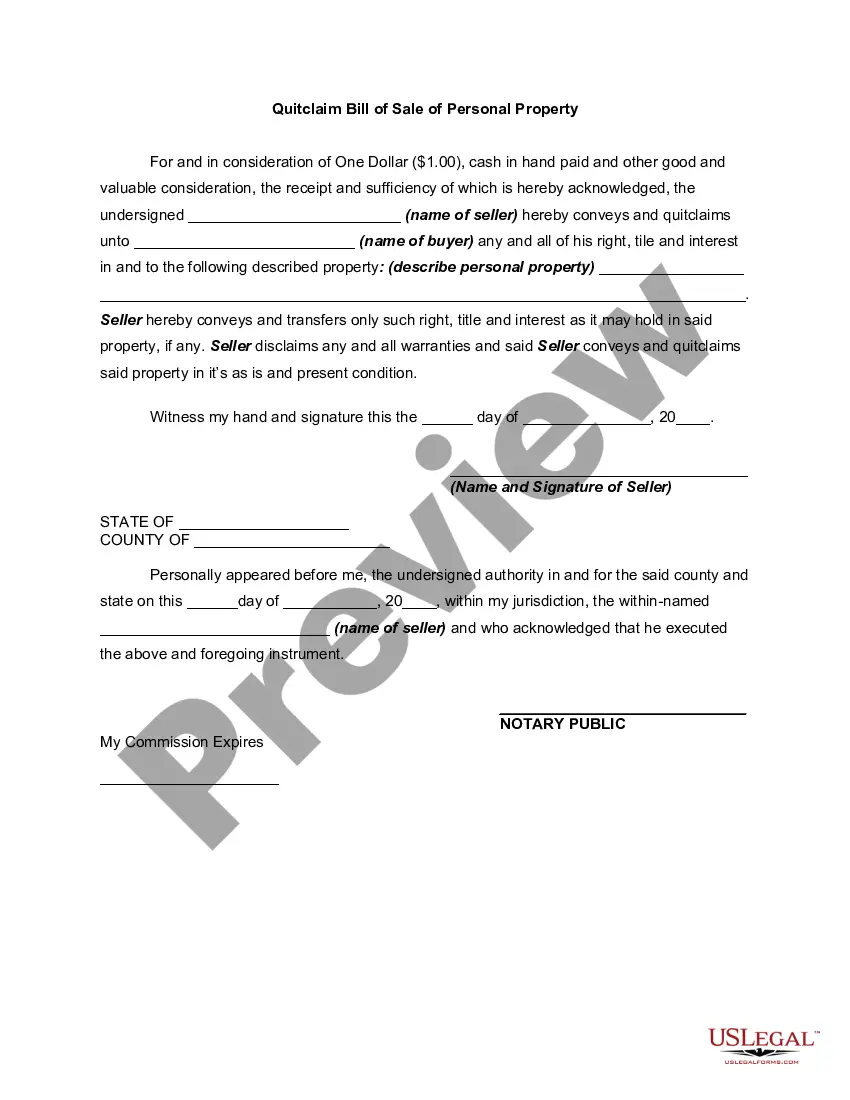

How to fill out Florida Acuerdo De Compensación Diferida - Forma Larga?

If you wish to total, obtain, or printing lawful document templates, use US Legal Forms, the most important selection of lawful forms, that can be found online. Take advantage of the site`s simple and easy hassle-free search to get the documents you require. Various templates for enterprise and specific functions are categorized by categories and states, or search phrases. Use US Legal Forms to get the Florida Deferred Compensation Agreement - Long Form in just a number of clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and click on the Acquire switch to get the Florida Deferred Compensation Agreement - Long Form. Also you can accessibility forms you formerly downloaded from the My Forms tab of your accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for that right area/country.

- Step 2. Make use of the Preview method to look over the form`s content material. Never forget about to learn the explanation.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Search field on top of the display screen to find other variations of your lawful develop template.

- Step 4. After you have discovered the shape you require, go through the Acquire now switch. Opt for the rates plan you favor and put your credentials to sign up for the accounts.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Pick the structure of your lawful develop and obtain it in your gadget.

- Step 7. Total, edit and printing or indication the Florida Deferred Compensation Agreement - Long Form.

Every lawful document template you purchase is your own eternally. You possess acces to every develop you downloaded inside your acccount. Click the My Forms segment and pick a develop to printing or obtain once more.

Be competitive and obtain, and printing the Florida Deferred Compensation Agreement - Long Form with US Legal Forms. There are many expert and state-distinct forms you may use to your enterprise or specific demands.