Florida Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

You might spend countless hours online seeking the correct legal document format that meets the federal and state criteria you require.

US Legal Forms provides a wide selection of legal templates that can be assessed by professionals.

You can effortlessly obtain or create the Florida Revocable Living Trust for Home using their service.

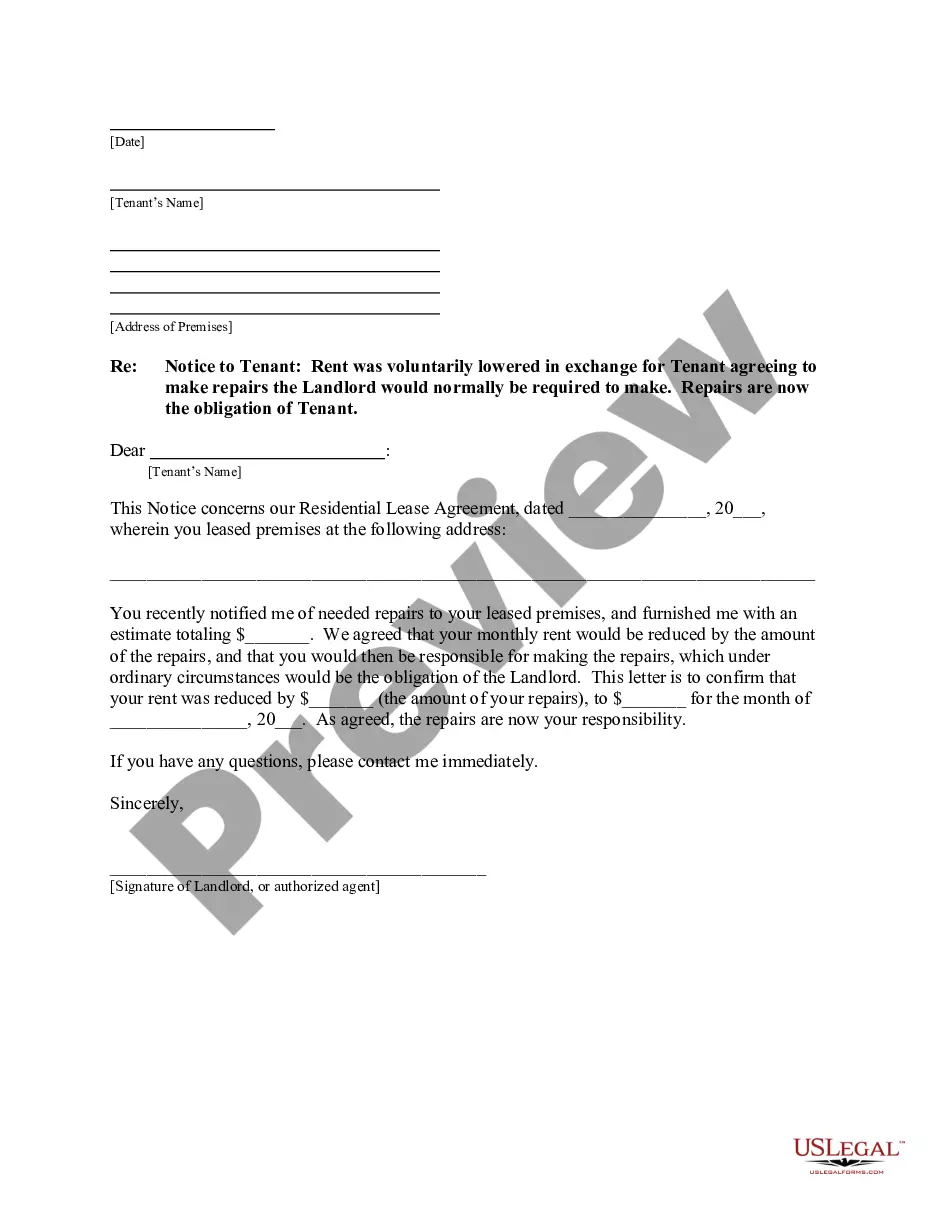

If available, use the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Florida Revocable Living Trust for Home.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure you have selected the correct document format for the region/city of your choice.

- Review the form description to make sure you have chosen the right form.

Form popularity

FAQ

To transfer your property to a Florida Revocable Living Trust for House, you need to create the trust document first. Once the trust is established, you must execute a new deed that transfers the title of your property into the trust's name. It's essential to file the new deed with your local county clerk's office to ensure proper documentation. Using platforms like uslegalforms can simplify this process, providing guidance and templates tailored for Florida residents.

When you pass away, a Florida Revocable Living Trust for House allows for the swift transfer of ownership to your named beneficiaries. Since the trust avoids probate, your heirs can access the property without the lengthy court process. This can provide peace of mind knowing your wishes are carried out without unnecessary delays.

Including your home in a Florida Revocable Living Trust for House can offer significant advantages. It helps manage your assets effectively and streamlines the transfer process upon death. This simplified transfer can save your loved ones time and stress. Evaluate your options and consider seeking professional advice tailored to your needs.

Typically, transferring your house into a Florida Revocable Living Trust for House does not trigger a property tax reassessment. The property remains under your control, and the tax assessment usually stays the same. It’s essential to ensure that the trust is set up correctly to maintain this benefit, keeping your taxes stable.

Placing your house in a Florida Revocable Living Trust for House can be beneficial for estate planning. It can help avoid probate, which simplifies the process for your heirs. However, consider your specific financial situation and goals. Consulting with an attorney can provide clarity on the best approach for your circumstances.

In a Florida Revocable Living Trust for House, you, as the grantor, retain ownership of the property during your lifetime. This means you can sell, mortgage, or alter the property as desired. The trust acts as a vehicle for managing your asset, ensuring that it passes seamlessly to your beneficiaries upon your death.

Trusts generally do not need to be recorded in Florida. A Florida Revocable Living Trust for House operates privately and remains outside the public registry. This aspect helps protect your privacy and keeps your estate matters confidential.

A revocable trust does not need to be recorded in Florida. This key feature of a Florida Revocable Living Trust for House allows you to maintain control over your assets without making your trust terms publicly accessible. You only need to record the property deed to indicate that the trust owns the house.

To put your house in a Florida Revocable Living Trust for House, you must first create the trust document. Next, you will need to transfer the title of your house into the trust, which usually involves filing a new deed with the county. Consulting with a legal expert or using platforms like US Legal Forms can simplify this process and ensure all steps are completed correctly.

No, a trust does not have to be filed with the state in Florida. A Florida Revocable Living Trust for House remains private, and you control its contents and distribution without government intervention. This privacy is one of the key benefits of establishing a living trust.