A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

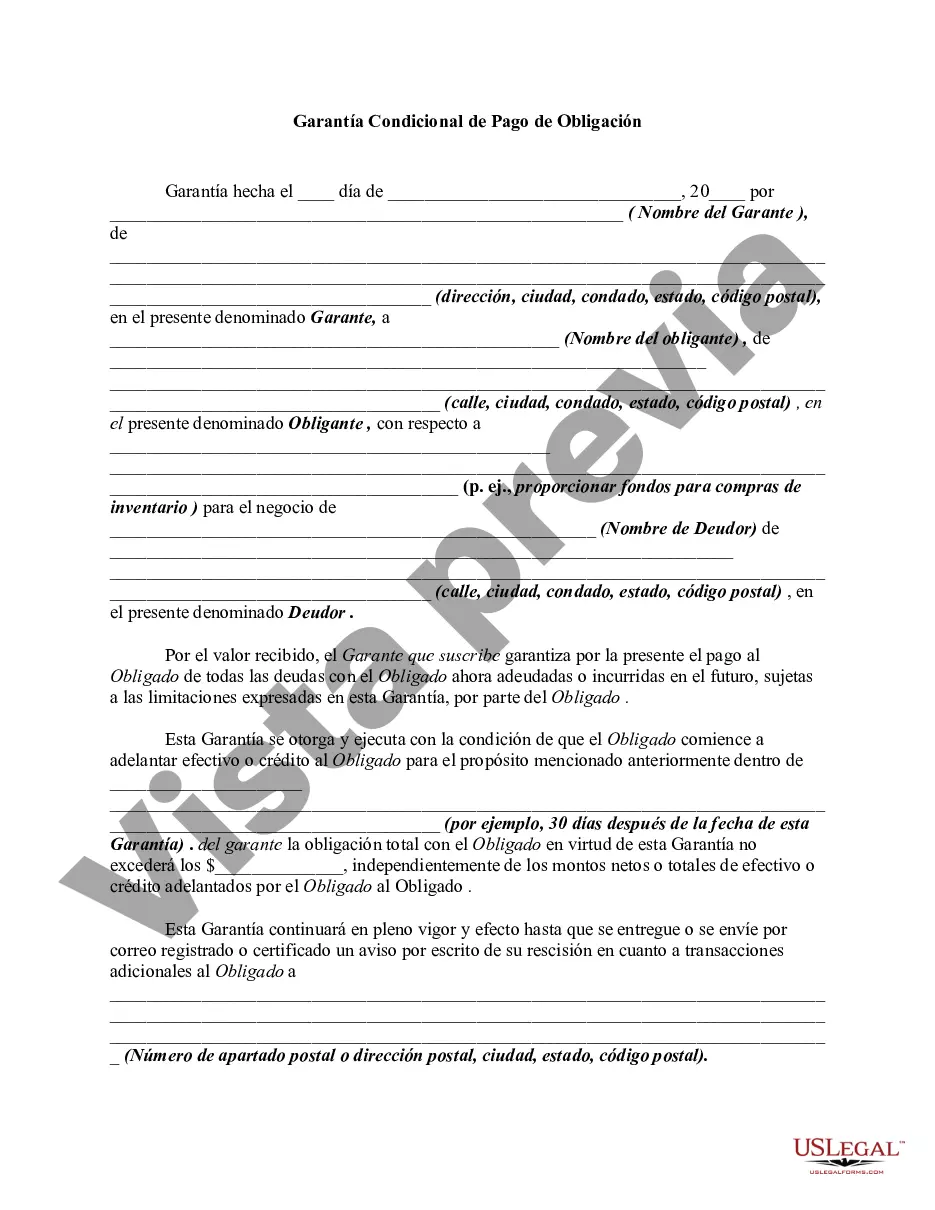

A Florida Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which an individual or entity agrees to guarantee payment of a debt or obligation. This type of guarantee is often utilized in business transactions, contracts, leases, or loans, where one party seeks additional security to ensure payment in case the primary obliged fails to fulfill their financial obligations. The Florida Conditional Guaranty of Payment of Obligation serves as a legally binding contract between the guarantor and the creditor, defining their respective rights and responsibilities. It is important to note that this type of guaranty is "conditional," meaning that it only takes effect if specific conditions or events occur, such as default on the underlying obligation. There are several types of Florida Conditional Guaranty of Payment of Obligation that may be used depending on the specific circumstances: 1. Limited Guaranty: This type of guaranty offers limited liability for the guarantor, usually capping their responsibility to a specific amount or timeframe. Once the conditions set in the agreement are met, the guarantor's obligation is discharged. 2. Unlimited Guaranty: In contrast to a limited guaranty, an unlimited guaranty exposes the guarantor to potentially unlimited liability. This means that the guarantor could be held responsible for the entire debt or obligation, regardless of the amount. 3. Continuing Guaranty: A continuing guaranty is a type of guaranty that remains in effect until it is revoked or terminated by the guarantor or the creditor. It provides ongoing financial security for the creditor, ensuring that the guarantor will be responsible for any future obligations of the primary obliged. 4. Demand Guaranty: A demand guaranty allows the creditor to demand immediate payment from the guarantor if the primary obliged defaults on the obligation. This type of guaranty typically eliminates the need for the creditor to take legal action or prove the default. It is crucial to consult a legal professional while drafting or entering into any Florida Conditional Guaranty of Payment of Obligation to ensure that it complies with Florida state laws and adequately protects the rights of both parties involved. In summary, a Florida Conditional Guaranty of Payment of Obligation is a legally binding agreement where a guarantor, under specific conditions, agrees to assume the payment responsibility of a debt or obligation if the primary obliged fails to fulfill their financial obligations. The different types of guaranties available in Florida include limited, unlimited, continuing, and demand guaranties. Seeking legal guidance during this process is strongly advised.A Florida Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which an individual or entity agrees to guarantee payment of a debt or obligation. This type of guarantee is often utilized in business transactions, contracts, leases, or loans, where one party seeks additional security to ensure payment in case the primary obliged fails to fulfill their financial obligations. The Florida Conditional Guaranty of Payment of Obligation serves as a legally binding contract between the guarantor and the creditor, defining their respective rights and responsibilities. It is important to note that this type of guaranty is "conditional," meaning that it only takes effect if specific conditions or events occur, such as default on the underlying obligation. There are several types of Florida Conditional Guaranty of Payment of Obligation that may be used depending on the specific circumstances: 1. Limited Guaranty: This type of guaranty offers limited liability for the guarantor, usually capping their responsibility to a specific amount or timeframe. Once the conditions set in the agreement are met, the guarantor's obligation is discharged. 2. Unlimited Guaranty: In contrast to a limited guaranty, an unlimited guaranty exposes the guarantor to potentially unlimited liability. This means that the guarantor could be held responsible for the entire debt or obligation, regardless of the amount. 3. Continuing Guaranty: A continuing guaranty is a type of guaranty that remains in effect until it is revoked or terminated by the guarantor or the creditor. It provides ongoing financial security for the creditor, ensuring that the guarantor will be responsible for any future obligations of the primary obliged. 4. Demand Guaranty: A demand guaranty allows the creditor to demand immediate payment from the guarantor if the primary obliged defaults on the obligation. This type of guaranty typically eliminates the need for the creditor to take legal action or prove the default. It is crucial to consult a legal professional while drafting or entering into any Florida Conditional Guaranty of Payment of Obligation to ensure that it complies with Florida state laws and adequately protects the rights of both parties involved. In summary, a Florida Conditional Guaranty of Payment of Obligation is a legally binding agreement where a guarantor, under specific conditions, agrees to assume the payment responsibility of a debt or obligation if the primary obliged fails to fulfill their financial obligations. The different types of guaranties available in Florida include limited, unlimited, continuing, and demand guaranties. Seeking legal guidance during this process is strongly advised.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.