A Florida Limited Liability Partnership Agreement is a legally binding document that governs the operation and management of a partnership in the state of Florida. This agreement outlines the rights, responsibilities, and liabilities of each partner, as well as the terms and conditions that govern the partnership. A Florida Limited Liability Partnership (LLP) is a type of partnership that provides limited liability protection to its partners. This means that the personal assets of the partners are protected from the partnership's debts and liabilities, similar to a corporation. This is a popular choice for professionals, such as lawyers, accountants, architects, and healthcare providers, who wish to form a partnership but also want to limit their personal liability. The Florida Limited Liability Partnership Agreement typically includes various provisions that define the partners' roles and responsibilities, the allocation of profits and losses, decision-making processes, dispute resolution mechanisms, admission and withdrawal of partners, and the dissolution of the partnership. It is essential for the partners to carefully draft and execute this agreement to ensure clarity, fairness, and protection for all parties involved. There are several types of Florida Limited Liability Partnership Agreements that may be customized based on the specific needs and requirements of the partners: 1. General Partnership Agreement: This is the most common type of partnership agreement, wherein partners share equal rights and responsibilities, as well as share profits and losses equally. 2. Limited Partnership Agreement: This agreement involves both general partners and limited partners. General partners manage the business and are personally liable for the partnership's debts, while limited partners contribute capital but have limited liability. 3. Silent Partnership Agreement: Also known as a sleeping or dormant partnership agreement, this type allows one or more silent partners to invest capital without actively participating in the day-to-day operations or management of the partnership. 4. Joint Venture Agreement: In this type of partnership agreement, multiple parties come together for a specific project or business venture. Each party contributes towards the common goal and shares the profits and losses based on the agreed terms. It is important for partners considering a Florida Limited Liability Partnership Agreement to seek legal advice and tailor the agreement to their specific needs and circumstances. By clearly outlining the rights and responsibilities of each partner, as well as incorporating appropriate provisions for dispute resolution and partnership dissolution, partners can ensure a smooth and successful operation of their partnership in the state of Florida.

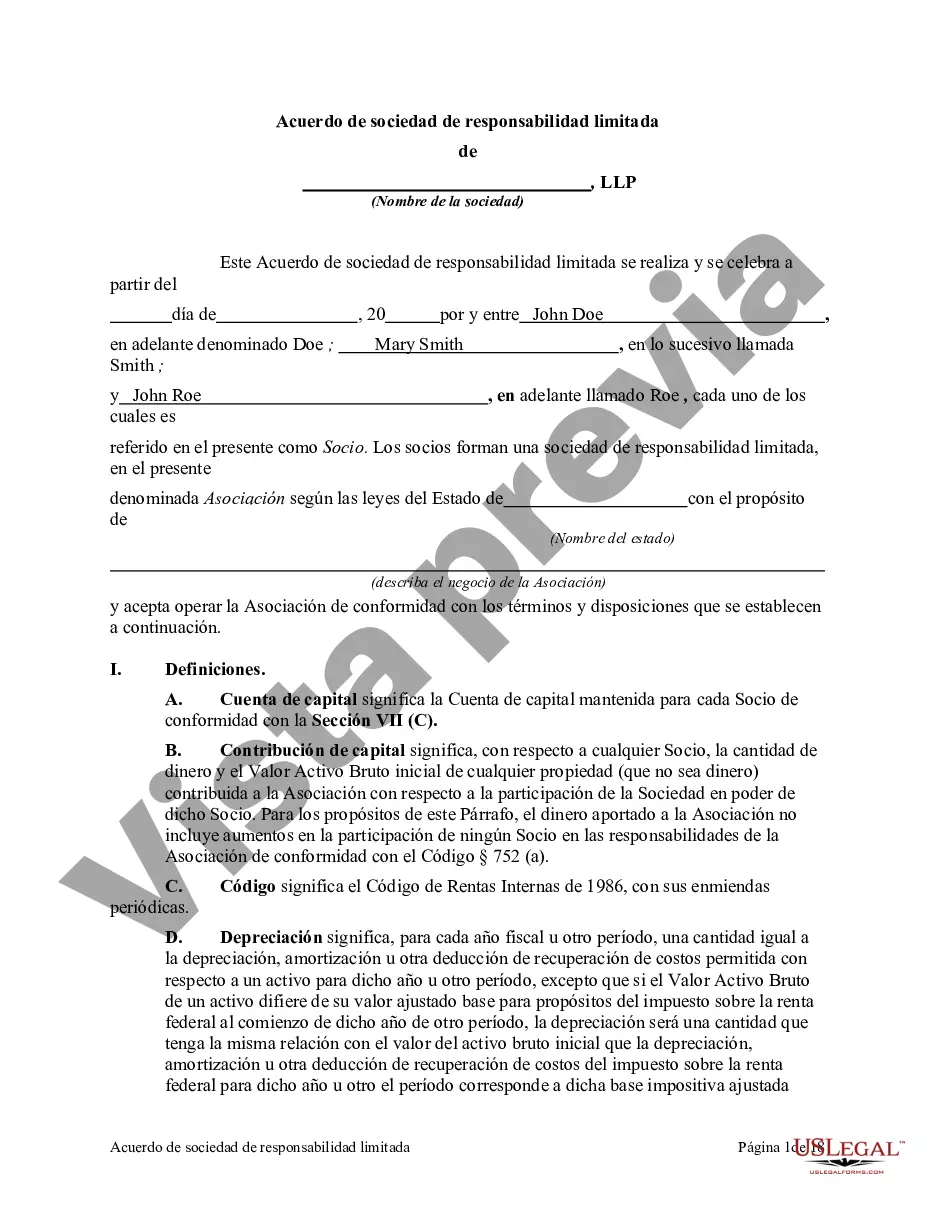

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Florida Acuerdo De Sociedad De Responsabilidad Limitada?

If you need to total, obtain, or produce lawful papers themes, use US Legal Forms, the largest collection of lawful varieties, which can be found on the web. Use the site`s simple and convenient look for to find the papers you need. A variety of themes for business and specific reasons are sorted by categories and says, or search phrases. Use US Legal Forms to find the Florida Limited Liability Partnership Agreement in a handful of click throughs.

In case you are previously a US Legal Forms customer, log in to your bank account and click the Down load key to find the Florida Limited Liability Partnership Agreement. You can even entry varieties you formerly acquired inside the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the appropriate area/nation.

- Step 2. Use the Preview option to look over the form`s information. Never neglect to see the outline.

- Step 3. In case you are not happy with the kind, use the Research discipline on top of the screen to get other variations of your lawful kind format.

- Step 4. Once you have located the shape you need, select the Acquire now key. Choose the rates plan you prefer and add your references to sign up on an bank account.

- Step 5. Method the purchase. You should use your charge card or PayPal bank account to finish the purchase.

- Step 6. Select the file format of your lawful kind and obtain it on your system.

- Step 7. Comprehensive, modify and produce or indicator the Florida Limited Liability Partnership Agreement.

Each and every lawful papers format you purchase is the one you have eternally. You have acces to each and every kind you acquired inside your acccount. Go through the My Forms area and select a kind to produce or obtain once again.

Remain competitive and obtain, and produce the Florida Limited Liability Partnership Agreement with US Legal Forms. There are thousands of specialist and status-certain varieties you can use for your business or specific demands.