The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

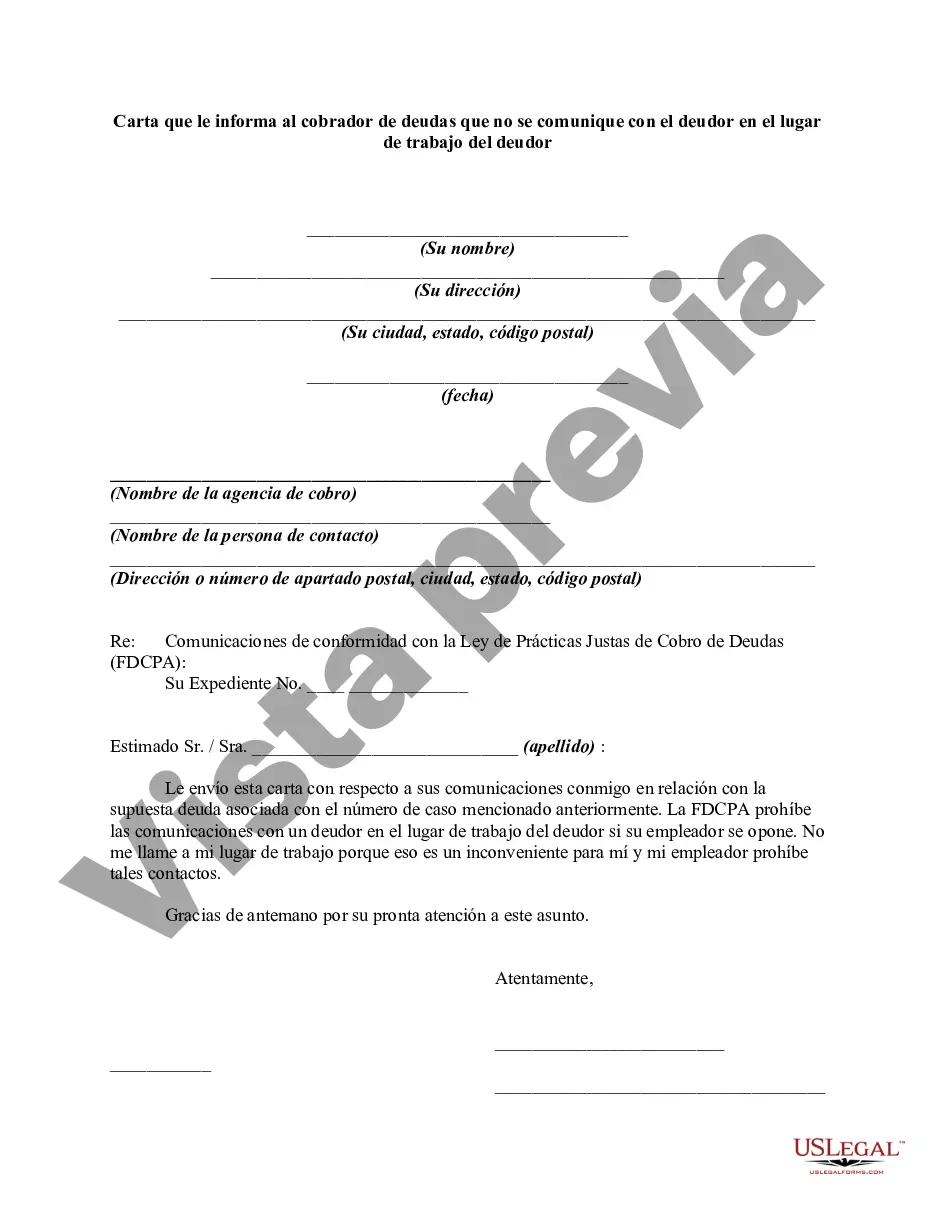

Title: Understanding the Florida Letter Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment Introduction: In the state of Florida, debtors have certain rights and protections when it comes to communicating with debt collectors. One such protection is the ability to request that debt collectors refrain from contacting them at their place of employment. This article will provide a detailed description of the Florida Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment, covering its purpose, the process of sending it, and different types of such letters. Keywords: Florida, letter, debt collector, debtor, place of employment, communication, protection, process, types. 1. Purpose of Filling a Florida Letter: — Debtors in Florida can utilize a formal request known as the "Florida Letter" to ask debt collectors to no longer contact them at their workplace. — The primary objective of this letter is to maintain privacy and preserve a debtor's professional reputation by eliminating unnecessary communication at their place of employment. — By law, debt collectors must honor the request outlined in the Florida Letter, ensuring debtors' rights are respected. 2. Process of Sending a Florida Letter: — Begin by writing a professional and concise letter, including your name, address, contact information, and the date. — Address the letter to the specific debt collector, providing their name, the collection agency's name, and their mailing address. — Clearly state the purpose of the letter, requesting that the debt collector refrains from contacting you at your place of employment. — Provide any relevant account or reference numbers to help the debt collector identify your specific debt. — Sign and date the letter before sending it via certified mail with a return receipt requested. — Keep a copy of the letter and the return receipt for your records as proof of delivery. 3. Types of Florida Letters Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment: a) Initial Request Letter: — Debtors initially use this type of letter to inform the debt collector about their preference not to be contacted at their place of employment. — It sets the stage for clear communication boundaries, allowing for resolution outside the workplace. b) Cease and Desist Letter: — If the debt collector continues to contact the debtor at their place of employment after receiving the initial request, a Cease and Desist Letter may be sent. — This letter asserts the debtor's demand for communication to cease entirely, not only at the workplace but also via other means, such as phone calls or letters. c) Attorney Representation Letter: — If the debtor retains legal representation, an Attorney Representation Letter can be sent, notifying the debt collector that all future communication regarding the debt should be directed to the debtor's attorney. — This type of letter emphasizes the seriousness of the debtor's request and the involvement of legal professionals in the matter. Conclusion: Understanding the Florida Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment is crucial for debtors seeking to protect their privacy and professional reputation. By following the proper process and utilizing various types of letters based on the specific circumstances, debtors can assert their rights and communicate effectively with debt collectors in the state of Florida.Title: Understanding the Florida Letter Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment Introduction: In the state of Florida, debtors have certain rights and protections when it comes to communicating with debt collectors. One such protection is the ability to request that debt collectors refrain from contacting them at their place of employment. This article will provide a detailed description of the Florida Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment, covering its purpose, the process of sending it, and different types of such letters. Keywords: Florida, letter, debt collector, debtor, place of employment, communication, protection, process, types. 1. Purpose of Filling a Florida Letter: — Debtors in Florida can utilize a formal request known as the "Florida Letter" to ask debt collectors to no longer contact them at their workplace. — The primary objective of this letter is to maintain privacy and preserve a debtor's professional reputation by eliminating unnecessary communication at their place of employment. — By law, debt collectors must honor the request outlined in the Florida Letter, ensuring debtors' rights are respected. 2. Process of Sending a Florida Letter: — Begin by writing a professional and concise letter, including your name, address, contact information, and the date. — Address the letter to the specific debt collector, providing their name, the collection agency's name, and their mailing address. — Clearly state the purpose of the letter, requesting that the debt collector refrains from contacting you at your place of employment. — Provide any relevant account or reference numbers to help the debt collector identify your specific debt. — Sign and date the letter before sending it via certified mail with a return receipt requested. — Keep a copy of the letter and the return receipt for your records as proof of delivery. 3. Types of Florida Letters Informing Debt Collector Not to Communicate with Debtor at Debtor's Place of Employment: a) Initial Request Letter: — Debtors initially use this type of letter to inform the debt collector about their preference not to be contacted at their place of employment. — It sets the stage for clear communication boundaries, allowing for resolution outside the workplace. b) Cease and Desist Letter: — If the debt collector continues to contact the debtor at their place of employment after receiving the initial request, a Cease and Desist Letter may be sent. — This letter asserts the debtor's demand for communication to cease entirely, not only at the workplace but also via other means, such as phone calls or letters. c) Attorney Representation Letter: — If the debtor retains legal representation, an Attorney Representation Letter can be sent, notifying the debt collector that all future communication regarding the debt should be directed to the debtor's attorney. — This type of letter emphasizes the seriousness of the debtor's request and the involvement of legal professionals in the matter. Conclusion: Understanding the Florida Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment is crucial for debtors seeking to protect their privacy and professional reputation. By following the proper process and utilizing various types of letters based on the specific circumstances, debtors can assert their rights and communicate effectively with debt collectors in the state of Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.