Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

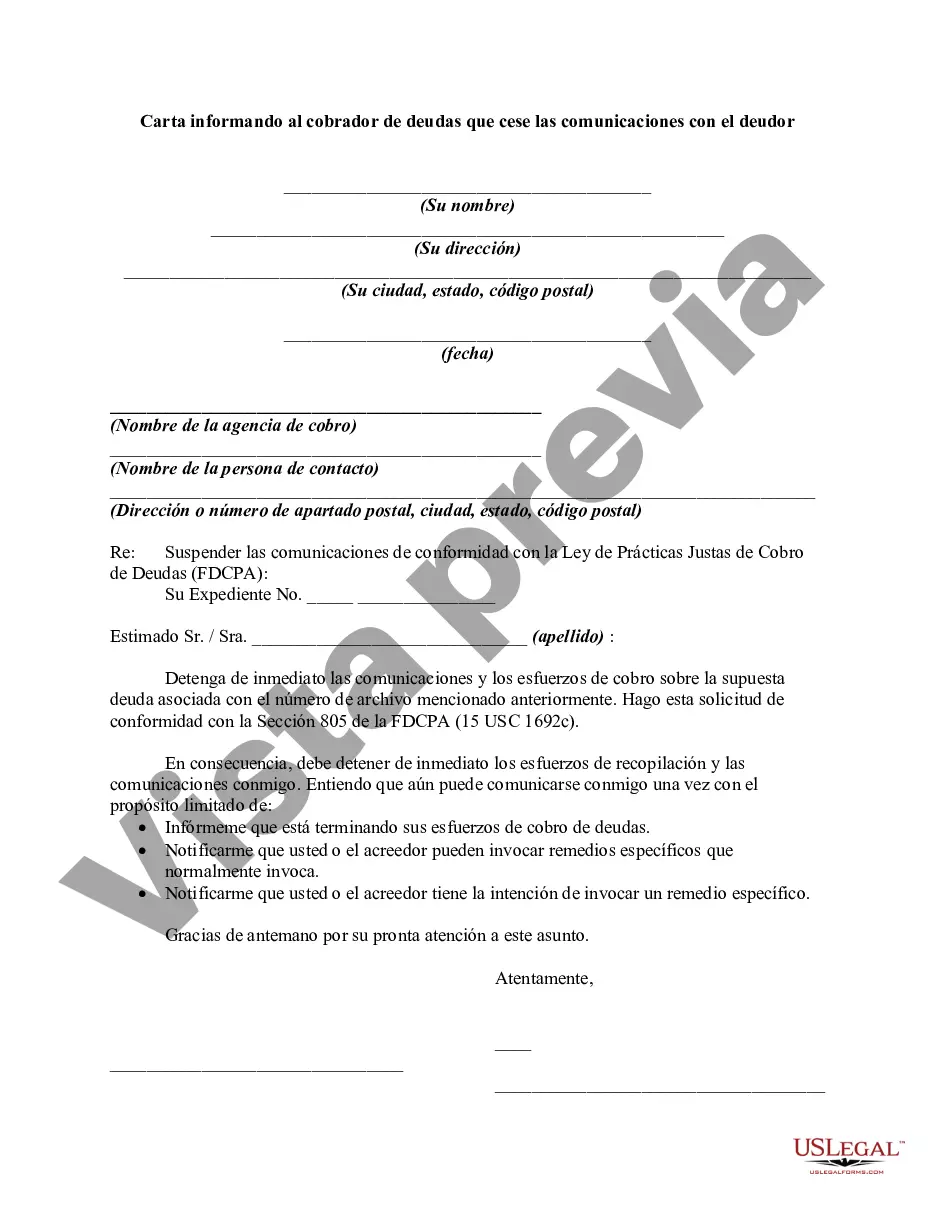

A Florida Letter Informing to Debt Collector to Cease Communications with Debtor is a written document sent by a debtor to a debt collector requesting them to stop contacting the debtor in regard to the outstanding debt. This letter is an essential step for debtors seeking relief from aggressive or excessive communication tactics employed by debt collectors. It is designed to assert the debtor's rights under the Fair Debt Collection Practices Act (FD CPA) and the Florida Consumer Collection Practices Act (FC CPA). When writing a Florida Letter Informing to Debt Collector to Cease Communications with Debtor, there are a few key points to include: 1. Sender's information: Begin the letter with the debtor's complete name, mailing address, and phone number. This information is crucial in ensuring that the debt collector can identify and update their records accordingly. 2. Debt information: Provide details about the debt in question, including the name of the original creditor, the debt amount, and the date the debt was incurred. This information helps establish the validity and specificity of the debt. 3. Request to cease communication: Clearly state the purpose of the letter, instructing the debt collector to immediately stop any further communication attempts. Use keywords such as "cease," "desist," "stop," or "halt" to emphasize the desired action. 4. Citing legal rights and acts: Refer to relevant laws, such as the FD CPA and FC CPA, to reinforce the debtor's rights. These acts outline the requirements debt collectors must adhere to and provide the debtor with legal grounds for requesting communication cessation. By mentioning them, debt collectors are more likely to take the request seriously. 5. Method of communication: Specify the preferred method of communication for any future correspondence, if applicable. For example, debtors may request that all future communication be conducted only via written letters or emails. This helps establish a clear channel for any future discussions. 6. Warning against legal action: To put additional pressure on the debt collector to comply, it may be beneficial to include a statement highlighting potential legal consequences for failing to honor the request. Mentioning the possibility of legal action against the debt collector's violation of the FD CPA and FC CPA can prompt compliance. Different types of Florida Letters Informing to Debt Collector to Cease Communications with Debtor can be classified based on the varying circumstances and objectives of the debtor. Some common types include: 1. Standard Cease and Desist Letter: A general letter utilized by debtors to inform debt collectors of their intent to cease all communication regarding a specific debt. 2. Harassment Cease and Desist Letter: Employed when the debt collector engages in aggressive or abusive tactics, such as frequent phone calls, using threatening language, or making false statements. This type of letter seeks to halt such behavior and asserts the debtor's rights to protection against harassment. 3. Attorney Representation Cease and Desist Letter: Written when the debtor has retained legal representation, this letter requests that all future communication regarding the debt be directed to the debtor's attorney. This ensures that communication is handled by an attorney who can navigate legal matters on behalf of the debtor. In summary, a Florida Letter Informing to Debt Collector to Cease Communications with Debtor is a written document that allows debtors to request a halt in communication from debt collectors regarding outstanding debts. By including essential details, asserting legal rights, and specifying the desired means of future communication, debtors can effectively communicate their wishes and potentially alleviate excessive or aggressive collection efforts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.