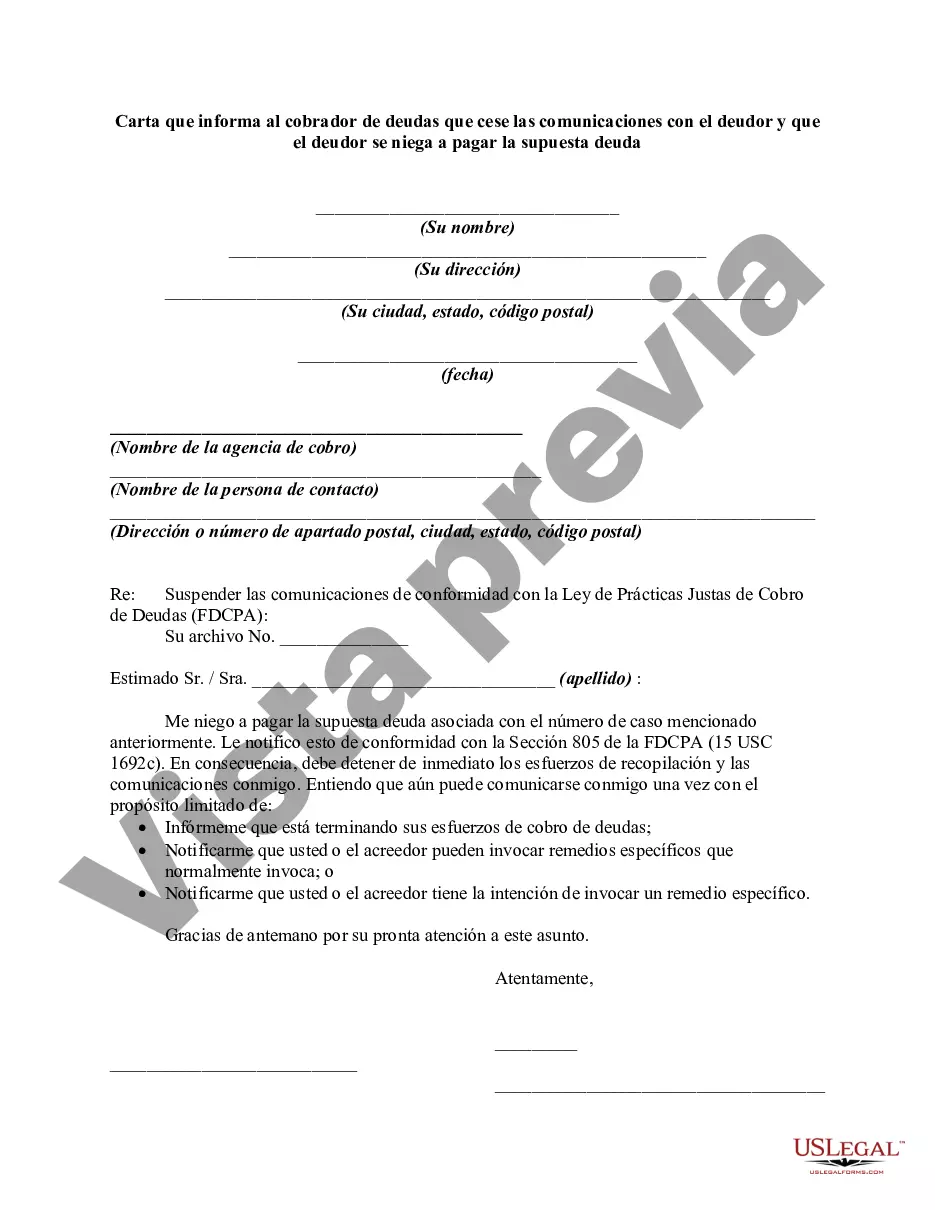

Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

Title: Florida Letter Informing Debt Collector to Cease Communications with Debtor and Debtor's Refusal to Pay Alleged Debt Introduction: In the state of Florida, debtors have specific rights when it comes to dealing with debt collectors. One important tool available to debtors is a letter informing the collector to cease further communications regarding an alleged debt. This comprehensive guide will provide a detailed description of this process, emphasizing the debtor's refusal to pay the debt. Furthermore, it will highlight different types of Florida letters that can be drafted depending on the specific circumstances. Keywords: Florida, letter, informing, debt collector, cease communications, debtor, refusal, alleged debt 1. Understanding Florida's Debt Collection Laws: Florida has laws in place that protect debtors from harassment and abuse by debt collectors. Debtors have the right to request that collectors cease communication efforts, enabling them to regain control over the situation. 2. Purpose of a Florida Letter Informing Debt Collector: The main goal of a Florida letter informing a debt collector to cease communications is to provide written notice that the debtor no longer wishes to be contacted regarding an alleged debt. It is essential to clarify the debtor's refusal to pay the alleged debt, setting clear boundaries for future interactions. 3. Components of a Florida Letter Informing Debt Collector: — Debtor's contact information: Include the full name, address, and contact details of the debtor. — Debt collector's information: Include the name, address, contact details, and any relevant account information of the debt collector. — Reference to the Fair Debt Collection Practices Act (FD CPA): Cite the FD CPA and emphasize that the debtor is aware of their rights. — Request to cease communication: Explicitly state that the debtor refuses to pay the alleged debt and requests a halt in further communication attempts. — Proof of delivery: Request that the debt collector confirm receipt of the letter and ensure future compliance. 4. Different Types of Florida Letters Informing Debt Collectors: Depending on the debtor's situation and goals, there are several types of Florida letters that can be drafted. These include: a) General Cease and Desist Letter: A regular letter to inform the debt collector to cease communications completely. b) Stop Calling My Workplace Letter: Specifically directed at preventing the debt collector from contacting the debtor's workplace. c) Restrictive Contact Letter: Limits the debt collector's communication to specific methods (e.g., emails only). d) Written Confirmation Letter: Requests written confirmation from the debt collector regarding the cessation of communication attempts. Conclusion: Debtors in Florida can utilize a variety of letters to inform debt collectors about their refusal to pay an alleged debt and to demand a cessation of unwanted communications. These letters provide debtors with legal safeguards and help establish clear boundaries between themselves and debt collectors. By understanding these letters and their different types, debtors can assert their rights while maintaining control over their financial situation. Keywords: Florida, letter, informing, debt collector, cease communications, debtor, refusal, alleged debt, different types

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.