Title: Florida Employment Verification Letter for Contractor: A Comprehensive Guide Introduction: In the state of Florida, an Employment Verification Letter for Contractors serves as a document that confirms an individual's employment status and details for contracting purposes. This letter ensures that the contractor has a valid working relationship with the employer and provides essential information to clients, lenders, and other entities involved in business transactions. Types of Florida Employment Verification Letters for Contractors: 1. Standard Employment Verification Letter: This type of letter is issued by the employer or contracting company and contains basic information about the contractor's employment, including their position, duration of employment, and salary details. It serves as proof of the contractor's legitimacy and can be requested during the bidding process or by clients for verification purposes. 2. Project-Specific Employment Verification Letter: Sometimes, contractors may need to provide verification letters specific to a particular project they are involved in. These letters typically include additional details such as project duration, project description, and the contractor's role and responsibilities. They are necessary when dealing with government entities or obtaining permits for specialized projects in Florida. 3. Self-Employed Contractor Verification Letter: For self-employed contractors, an alternative format of verification letter may be required. This letter verifies the contractor's self-employment status, business registration details (if applicable), and other relevant information necessary for obtaining contracts, loans, or licenses. It confirms that the contractor is not an employee but operates as a separate business entity. Important Elements in a Florida Employment Verification Letter for Contractors: 1. Contact Information: The letter should include the employer/contractor's full legal business name, physical address, phone number, and email address. This helps recipients verify the letter's authenticity and facilitates any follow-up communication. 2. Contractor Information: The contractor's name, official identification number (e.g., social security number or contractor license number), and contact details should be included. This information ensures accurate identification and helps prevent any form of identity misrepresentation. 3. Employment Details: The letter should specify the contractor's position/title, start date, end date (if applicable), and the nature of their contract (part-time, full-time, temporary). It should also highlight any significant achievements or notable contributions made by the contractor during their employment. 4. Compensation Information: Include details about the contractor's compensation structure, such as hourly rate, fixed fee, or commission-based agreement. Additionally, mention the payment frequency and any additional benefits (if applicable) provided to the contractor during their employment. Conclusion: Obtaining a Florida Employment Verification Letter for Contractors is crucial for establishing professional credibility and securing contracts or loans. The letter must accurately outline the contractor's employment details, including their role, duration, and compensation structure. Depending on the specific needs, project-specific or self-employment verification letters may be required. By providing this document, contractors can instill confidence in their clients, lenders, and other stakeholders, ensuring successful business transactions and collaborations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Carta de Verificación de Empleo para Contratista - Employment Verification Letter for Contractor

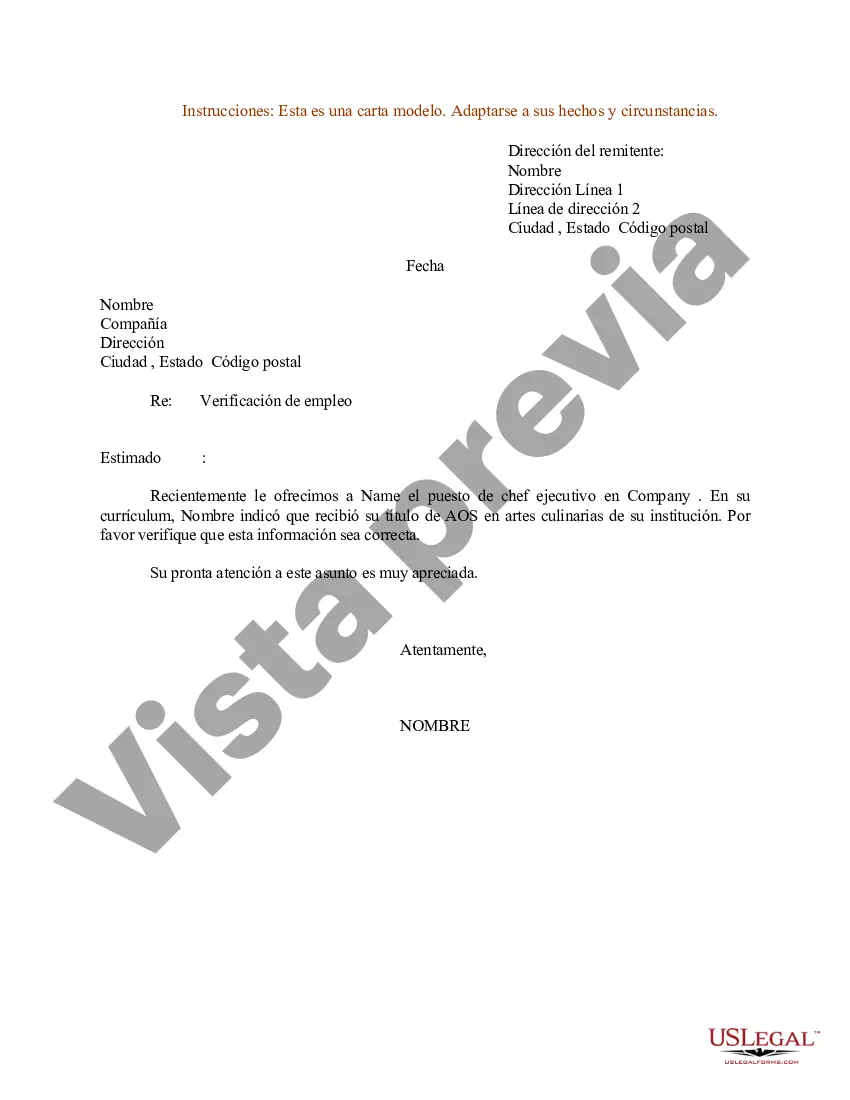

Description

How to fill out Florida Carta De Verificación De Empleo Para Contratista?

You are able to commit several hours on the Internet looking for the authorized document format that suits the federal and state specifications you need. US Legal Forms offers 1000s of authorized varieties which can be analyzed by professionals. You can easily download or produce the Florida Employment Verification Letter for Contractor from the service.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Obtain key. Afterward, it is possible to comprehensive, modify, produce, or sign the Florida Employment Verification Letter for Contractor. Every authorized document format you acquire is your own property permanently. To acquire yet another version of any purchased kind, visit the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site the very first time, keep to the basic recommendations listed below:

- First, make sure that you have chosen the best document format to the region/city of your choice. Look at the kind explanation to ensure you have picked the appropriate kind. If offered, utilize the Preview key to appear throughout the document format as well.

- If you want to get yet another model of the kind, utilize the Look for industry to find the format that meets your needs and specifications.

- Once you have identified the format you need, simply click Acquire now to carry on.

- Choose the costs plan you need, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can use your charge card or PayPal accounts to cover the authorized kind.

- Choose the format of the document and download it to the product.

- Make adjustments to the document if possible. You are able to comprehensive, modify and sign and produce Florida Employment Verification Letter for Contractor.

Obtain and produce 1000s of document themes making use of the US Legal Forms Internet site, which provides the most important variety of authorized varieties. Use expert and status-particular themes to deal with your business or personal needs.