A limited partnership is a modified partnership and is a creature of State statutes. Most States have either adopted the Uniform Limited Partnership Act (ULPA) or the Revised Uniform Limited Partnership Act (RULPA). In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. A limited partnership can have one or more general partners and one or more limited partners.

The general partners manage the business of the partnership and are personally liable for its debts. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

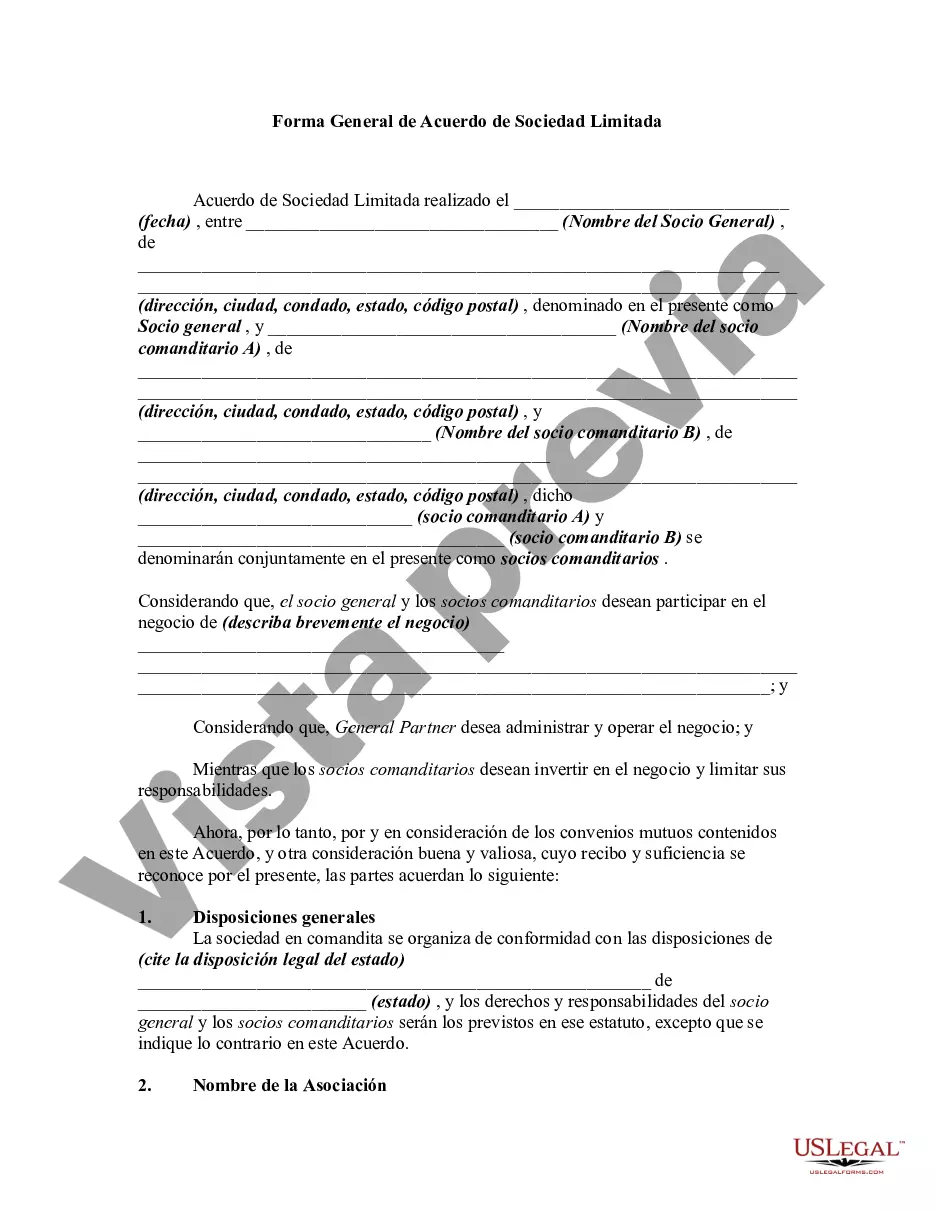

The Florida General Form of Limited Partnership Agreement is a legal document that outlines the terms and conditions of a limited partnership in the state of Florida. It serves as a binding contract between the general partners and limited partners, defining their rights, responsibilities, and contributions in the partnership. This partnership agreement typically includes several key elements, such as the name of the partnership, its principal place of business, and the duration of the partnership. It also outlines the contributions made by each partner, whether in the form of capital, property, or services. In addition, the agreement specifies the distribution of profits and losses among the partners. It details how profits will be allocated, whether proportionally based on their contributions or through a predetermined formula. It also outlines the rules for sharing losses and how they will be distributed. The Florida General Form of Limited Partnership Agreement also addresses the decision-making process within the partnership. It outlines whether the partnership will be managed by the general partners or if a designated manager will be appointed. It also specifies the voting rights and decision-making power of each partner. Furthermore, the agreement outlines the restrictions and limitations on a partner's transfer of interest or withdrawal from the partnership. It may include provisions for buyout options, rights of first refusal, or restrictions on transferring partnership interests to outside parties. It is important to note that while the Florida General Form of Limited Partnership Agreement provides a basic framework for partnership arrangements, it can be customized and tailored to meet the specific needs and preferences of the partners. Partners can add additional provisions or modify existing ones as necessary. In terms of different types of Florida General Form of Limited Partnership Agreements, there may be variations based on the specific industry, purpose, or structure of the partnership. For example, specialized agreements may exist for real estate partnerships, investment funds, or joint ventures. These agreements may include specific provisions related to the unique characteristics of the partnership type and are often drafted to comply with state laws and regulations governing those industries. In conclusion, the Florida General Form of Limited Partnership Agreement is a crucial legal document that establishes the foundation for a limited partnership in Florida. It outlines the rights, obligations, and terms of the partnership, providing clarity and protection for all parties involved.The Florida General Form of Limited Partnership Agreement is a legal document that outlines the terms and conditions of a limited partnership in the state of Florida. It serves as a binding contract between the general partners and limited partners, defining their rights, responsibilities, and contributions in the partnership. This partnership agreement typically includes several key elements, such as the name of the partnership, its principal place of business, and the duration of the partnership. It also outlines the contributions made by each partner, whether in the form of capital, property, or services. In addition, the agreement specifies the distribution of profits and losses among the partners. It details how profits will be allocated, whether proportionally based on their contributions or through a predetermined formula. It also outlines the rules for sharing losses and how they will be distributed. The Florida General Form of Limited Partnership Agreement also addresses the decision-making process within the partnership. It outlines whether the partnership will be managed by the general partners or if a designated manager will be appointed. It also specifies the voting rights and decision-making power of each partner. Furthermore, the agreement outlines the restrictions and limitations on a partner's transfer of interest or withdrawal from the partnership. It may include provisions for buyout options, rights of first refusal, or restrictions on transferring partnership interests to outside parties. It is important to note that while the Florida General Form of Limited Partnership Agreement provides a basic framework for partnership arrangements, it can be customized and tailored to meet the specific needs and preferences of the partners. Partners can add additional provisions or modify existing ones as necessary. In terms of different types of Florida General Form of Limited Partnership Agreements, there may be variations based on the specific industry, purpose, or structure of the partnership. For example, specialized agreements may exist for real estate partnerships, investment funds, or joint ventures. These agreements may include specific provisions related to the unique characteristics of the partnership type and are often drafted to comply with state laws and regulations governing those industries. In conclusion, the Florida General Form of Limited Partnership Agreement is a crucial legal document that establishes the foundation for a limited partnership in Florida. It outlines the rights, obligations, and terms of the partnership, providing clarity and protection for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.