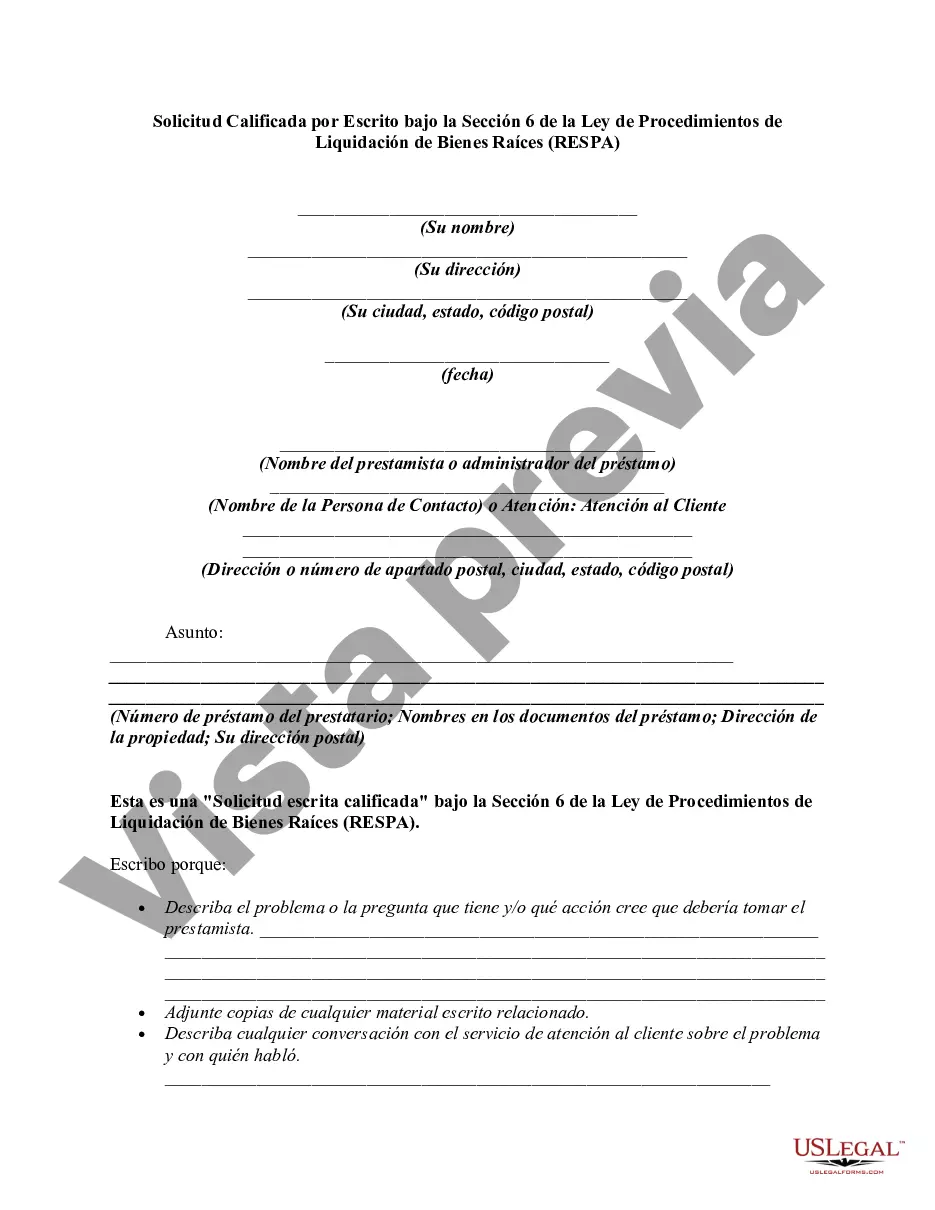

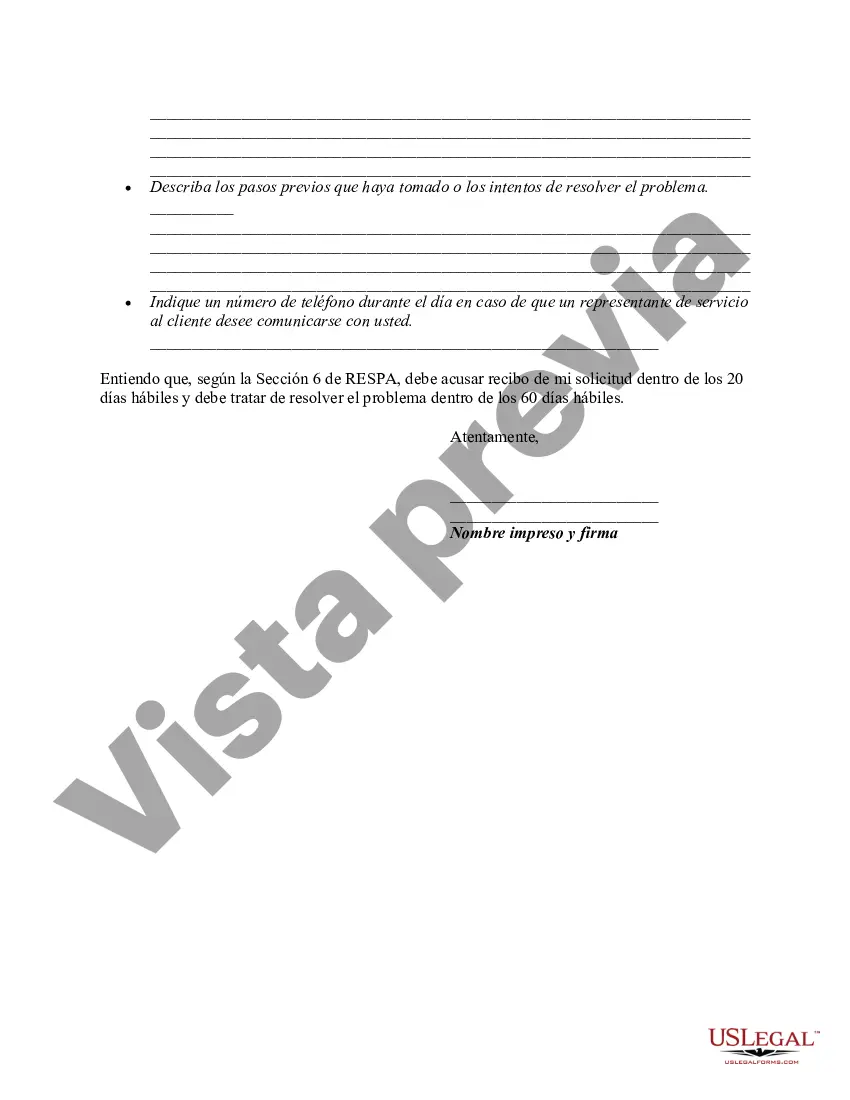

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

Florida Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a legal mechanism that allows homeowners in the state of Florida to request information and dispute errors related to their mortgage loan servicing. The BWR serves as a formal communication method, providing specific requirements and guidelines for homeowners to follow when submitting their request. Under Section 6 of RESP, a BWR must be written and sent to the loan service, who is responsible for the collection and management of mortgage loan payments. This request enables homeowners to seek information about their loan account, such as the amount owed, outstanding fees, and any errors or discrepancies noticed in the loan servicing. Key components of a Florida BWR under Section 6 of RESP include: 1. Identification of the borrower: The request must include the name, account number, and property address of the borrower. This ensures that the loan service can accurately identify the borrower and locate their mortgage account. 2. Detailed description of the information sought: Homeowners should specify the specific information they require or dispute. This may include account statements, transaction history, fees, escrow details, and any other relevant loan documents. 3. Explanation of the error or discrepancy: If the homeowner believes that an error has occurred in the loan servicing, they should provide a thorough explanation of what they believe to be incorrect and provide any supporting evidence or documentation. 4. Requested action: Homeowners can request specific actions from the loan service, such as correcting errors, providing missing documentation, or refunding fees if applicable. It is essential to clearly state the desired outcome in the BWR. 5. Deadline for response: The borrower should specify a reasonable timeframe within which they expect a response from the loan service. Typically, a 30-day deadline is reasonable, but this may vary depending on the circumstances. Different types of Florida Was under Section 6 of RESP may include: a. Standard BWR: This type of request is often used to seek general information about the loan account and resolve minor disputes or errors. b. Escrow Analysis Error BWR: If there is a disagreement or discrepancy related to the escrow account, homeowners may submit a BWR specifically addressing this issue. c. Loan Modification BWR: If a borrower is seeking loan modification options or adjustments, they can submit a BWR specifying their intent and desired terms. d. Foreclosure Defense BWR: In cases where a homeowner is facing foreclosure, they can submit a BWR to request information and documentation related to the foreclosure process, potentially uncovering potential errors or violations that could be used as a defense. In conclusion, a Florida BWR under Section 6 of RESP provides homeowners with a formalized method to seek information and dispute errors related to their mortgage loan servicing. By following the specific guidelines mentioned above and using the correct type of BWR required, borrowers can effectively communicate with loan services and resolve any issues that may arise.Florida Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a legal mechanism that allows homeowners in the state of Florida to request information and dispute errors related to their mortgage loan servicing. The BWR serves as a formal communication method, providing specific requirements and guidelines for homeowners to follow when submitting their request. Under Section 6 of RESP, a BWR must be written and sent to the loan service, who is responsible for the collection and management of mortgage loan payments. This request enables homeowners to seek information about their loan account, such as the amount owed, outstanding fees, and any errors or discrepancies noticed in the loan servicing. Key components of a Florida BWR under Section 6 of RESP include: 1. Identification of the borrower: The request must include the name, account number, and property address of the borrower. This ensures that the loan service can accurately identify the borrower and locate their mortgage account. 2. Detailed description of the information sought: Homeowners should specify the specific information they require or dispute. This may include account statements, transaction history, fees, escrow details, and any other relevant loan documents. 3. Explanation of the error or discrepancy: If the homeowner believes that an error has occurred in the loan servicing, they should provide a thorough explanation of what they believe to be incorrect and provide any supporting evidence or documentation. 4. Requested action: Homeowners can request specific actions from the loan service, such as correcting errors, providing missing documentation, or refunding fees if applicable. It is essential to clearly state the desired outcome in the BWR. 5. Deadline for response: The borrower should specify a reasonable timeframe within which they expect a response from the loan service. Typically, a 30-day deadline is reasonable, but this may vary depending on the circumstances. Different types of Florida Was under Section 6 of RESP may include: a. Standard BWR: This type of request is often used to seek general information about the loan account and resolve minor disputes or errors. b. Escrow Analysis Error BWR: If there is a disagreement or discrepancy related to the escrow account, homeowners may submit a BWR specifically addressing this issue. c. Loan Modification BWR: If a borrower is seeking loan modification options or adjustments, they can submit a BWR specifying their intent and desired terms. d. Foreclosure Defense BWR: In cases where a homeowner is facing foreclosure, they can submit a BWR to request information and documentation related to the foreclosure process, potentially uncovering potential errors or violations that could be used as a defense. In conclusion, a Florida BWR under Section 6 of RESP provides homeowners with a formalized method to seek information and dispute errors related to their mortgage loan servicing. By following the specific guidelines mentioned above and using the correct type of BWR required, borrowers can effectively communicate with loan services and resolve any issues that may arise.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.