As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

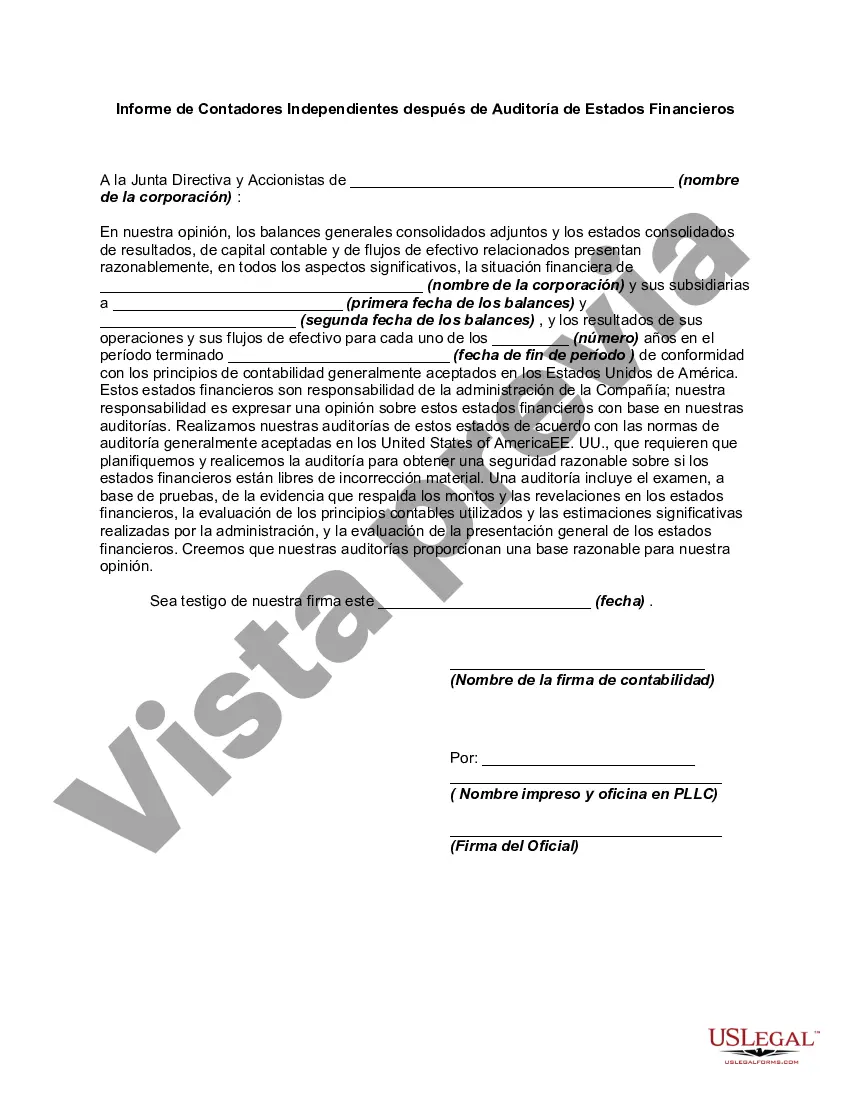

The Florida Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides a comprehensive and detailed analysis of the financial statements of an entity. This report is prepared by independent accountants who are specifically engaged to conduct an audit and render their professional opinion on the financial statements. The primary purpose of the Florida Report of Independent Accountants after Audit of Financial Statements is to enhance the credibility and reliability of the financial information presented by an organization. It serves as an assurance to various stakeholders that the financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) and that they fairly represent the entity's financial position, results of operations, and cash flows. The content of the Florida Report of Independent Accountants after Audit of Financial Statements typically includes the following key elements: 1. Title and Introductory Information: This section identifies the report as an independent auditor's report and mentions the specific entity whose financial statements have been audited. It may also include references to the applicable auditing standards. 2. Management's Responsibility: The report elaborates on management's responsibility for the preparation, presentation, and fair presentation of the financial statements. It clarifies that the responsibility for the selection and application of accounting policies lies with management. 3. Auditor's Responsibility: This section outlines the independent auditor's responsibility in conducting the audit in accordance with relevant auditing standards. It explains the nature of an audit and the procedures performed to obtain reasonable assurance about whether the financial statements are free from material misstatement. 4. Opinion: The primary aspect of the report is the auditor's opinion, which is the culmination of their audit work. The auditor expresses their professional opinion on whether the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows in accordance with GAAP. The opinion is typically categorized as unqualified (clean), qualified, adverse, or a disclaimer. 5. Basis for Opinion: In this section, the auditor provides an explanation of the basis for their opinion. It highlights the scope of the audit, including assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. 6. Other Reporting Responsibilities: If applicable, the auditor may include additional information or required supplementary data related to specific regulatory or statutory requirements. It is important to note that the Florida Report of Independent Accountants after Audit of Financial Statements can have variations depending on the type of audit engagement being conducted. For example, there may be specific reports for audits of publicly traded companies, non-profit organizations, governmental entities, or special purpose financial statements. These variations are designed to address specific reporting requirements and cater to the unique needs of different entities or industries. Keywords: Florida Report of Independent Accountants, audit, financial statements, credibility, GAAP, assurance, stakeholders, management's responsibility, auditor's responsibility, opinion, basis for opinion, regulatory requirements.The Florida Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides a comprehensive and detailed analysis of the financial statements of an entity. This report is prepared by independent accountants who are specifically engaged to conduct an audit and render their professional opinion on the financial statements. The primary purpose of the Florida Report of Independent Accountants after Audit of Financial Statements is to enhance the credibility and reliability of the financial information presented by an organization. It serves as an assurance to various stakeholders that the financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) and that they fairly represent the entity's financial position, results of operations, and cash flows. The content of the Florida Report of Independent Accountants after Audit of Financial Statements typically includes the following key elements: 1. Title and Introductory Information: This section identifies the report as an independent auditor's report and mentions the specific entity whose financial statements have been audited. It may also include references to the applicable auditing standards. 2. Management's Responsibility: The report elaborates on management's responsibility for the preparation, presentation, and fair presentation of the financial statements. It clarifies that the responsibility for the selection and application of accounting policies lies with management. 3. Auditor's Responsibility: This section outlines the independent auditor's responsibility in conducting the audit in accordance with relevant auditing standards. It explains the nature of an audit and the procedures performed to obtain reasonable assurance about whether the financial statements are free from material misstatement. 4. Opinion: The primary aspect of the report is the auditor's opinion, which is the culmination of their audit work. The auditor expresses their professional opinion on whether the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows in accordance with GAAP. The opinion is typically categorized as unqualified (clean), qualified, adverse, or a disclaimer. 5. Basis for Opinion: In this section, the auditor provides an explanation of the basis for their opinion. It highlights the scope of the audit, including assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. 6. Other Reporting Responsibilities: If applicable, the auditor may include additional information or required supplementary data related to specific regulatory or statutory requirements. It is important to note that the Florida Report of Independent Accountants after Audit of Financial Statements can have variations depending on the type of audit engagement being conducted. For example, there may be specific reports for audits of publicly traded companies, non-profit organizations, governmental entities, or special purpose financial statements. These variations are designed to address specific reporting requirements and cater to the unique needs of different entities or industries. Keywords: Florida Report of Independent Accountants, audit, financial statements, credibility, GAAP, assurance, stakeholders, management's responsibility, auditor's responsibility, opinion, basis for opinion, regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.