Florida Miller Trust Forms for Assisted Living: A Comprehensive Guide Introduction: Florida Miller Trust Forms for Assisted Living are legal documents used to establish and manage a specific type of trust that allows individuals with high medical expenses to qualify for Medicaid benefits while residing in an assisted living facility. The Miller Trust, also known as a Qualified Income Trust (QIT), enables individuals whose income exceeds the Medicaid eligibility threshold to still receive the financial assistance they require for long-term care services. In this article, we will explore the purpose, benefits, and different types of Florida Miller Trust Forms available for individuals seeking assisted living services. Purpose and Benefits: The primary purpose of a Florida Miller Trust Form for Assisted Living is to help individuals with a high income gain Medicaid eligibility. Medicaid is a federally funded program that provides healthcare coverage to low-income individuals, including those in assisted living facilities. However, Florida has income limitations for Medicaid eligibility, making it challenging for individuals with excess income to qualify. By establishing a Miller Trust, individuals can divert their income into the trust, subsequently reducing their income below the Medicaid threshold, and thus qualifying for Medicaid assistance. 1. Miller Trust Single Beneficiary Form: The Miller Trust Single Beneficiary Form is designed for individuals who require assisted living services and have excess income exceeding the Medicaid eligibility threshold. This form is applicable to those who are single and need to establish a Miller Trust to meet the income limitations necessary to qualify for Medicaid benefits. 2. Miller Trust Married Beneficiary Form: For married individuals seeking assisted living services, the Miller Trust Married Beneficiary Form is required. This form is specifically designed to address the unique circumstances that arise when both spouses need to qualify for Medicaid while residing in an assisted living facility. It allows for the combined income of both spouses to be directed into the Miller Trust. 3. Miller Trust Termination Form: The Miller Trust Termination Form is utilized when the need for assisted living services or the Medicaid program ends for the beneficiary. This form is crucial for officially dissolving the Miller Trust and ensuring that any remaining funds are appropriately disbursed or transferred to the beneficiary. Conclusion: Florida Miller Trust Forms for Assisted Living serve as a vital mechanism for individuals with high income to qualify for Medicaid benefits while residing in assisted living facilities. By utilizing these forms, individuals can navigate the complex Medicaid eligibility criteria and avail themselves of essential long-term care services. It is necessary to consult with a knowledgeable estate planning attorney or Medicaid specialist to understand the specific requirements and guidelines associated with the different types of Florida Miller Trust Forms mentioned above.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Formularios de confianza de Miller para vida asistida - Miller Trust Forms for Assisted Living

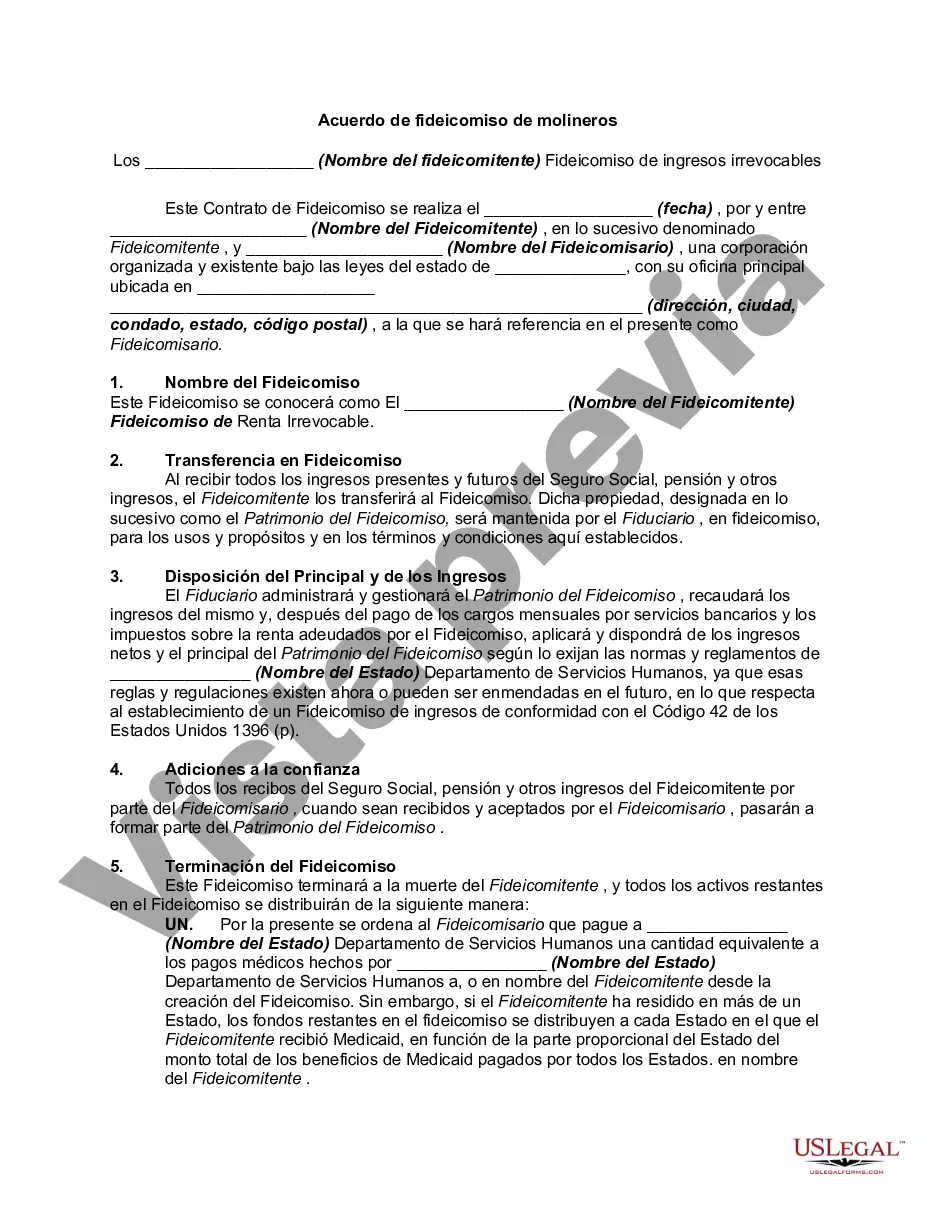

Description

How to fill out Florida Formularios De Confianza De Miller Para Vida Asistida?

Are you presently inside a position where you need papers for either company or specific uses just about every time? There are plenty of authorized papers layouts available on the net, but finding ones you can depend on isn`t simple. US Legal Forms provides a huge number of type layouts, like the Florida Miller Trust Forms for Assisted Living, which can be published to fulfill state and federal specifications.

When you are already acquainted with US Legal Forms web site and possess an account, just log in. Following that, you are able to acquire the Florida Miller Trust Forms for Assisted Living design.

Should you not come with an profile and need to begin using US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for that appropriate metropolis/state.

- Take advantage of the Preview option to analyze the shape.

- See the explanation to ensure that you have chosen the appropriate type.

- If the type isn`t what you are looking for, take advantage of the Lookup industry to obtain the type that meets your requirements and specifications.

- When you get the appropriate type, click Acquire now.

- Opt for the prices plan you desire, fill out the desired info to create your money, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Pick a practical data file structure and acquire your copy.

Discover all the papers layouts you might have purchased in the My Forms menus. You can aquire a further copy of Florida Miller Trust Forms for Assisted Living any time, if required. Just select the needed type to acquire or printing the papers design.

Use US Legal Forms, one of the most extensive collection of authorized kinds, to conserve time as well as prevent errors. The service provides expertly manufactured authorized papers layouts which can be used for an array of uses. Produce an account on US Legal Forms and begin producing your way of life a little easier.