A Florida Simple Promissory Note for Family Loan is a legal document that outlines the terms and conditions of a loan between family members in the state of Florida. This agreement is commonly used when a family member provides financial assistance to another family member in the form of a loan. It establishes the borrower's obligation to repay the loaned funds, including the principal amount, interest rate (if applicable), repayment schedule, and any penalties or fees. The Florida Simple Promissory Note for Family Loan serves as evidence of the loan and protects the lender's rights in case of default or nonpayment. It ensures that both parties are clear about the loan's terms and helps prevent any misunderstandings or disputes that may arise later. In Florida, there are different types of Simple Promissory Notes that can be used for family loans, depending on specific circumstances: 1. Fixed-Term Promissory Note: This type of promissory note sets a specific repayment schedule with equal monthly installments over a predetermined period. It typically includes the principal amount, interest rate, payment due dates, and the repayment duration. 2. Demand Promissory Note: Unlike a fixed-term note, a demand promissory note does not specify a repayment schedule. Instead, it allows the lender to demand repayment in full at any time they choose. This arrangement provides flexibility to both parties and allows for an earlier settlement if circumstances allow. 3. Secured Promissory Note: This type of promissory note includes a provision for collateral that secures the loan. It specifies the property or assets that will serve as security in case the borrower defaults on repayment. This offers additional protection to the lender and may provide better interest rates or terms due to reduced risk. 4. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral or security. It relies solely on the borrower's creditworthiness and trust. This type of note may have a higher interest rate as it poses a greater risk to the lender. Family loans in Florida can be a practical alternative to traditional financing options, such as bank loans, allowing family members to support one another financially. A Florida Simple Promissory Note for Family Loan ensures that the loan transaction is properly documented and legally binding, protecting both the lender and the borrower.

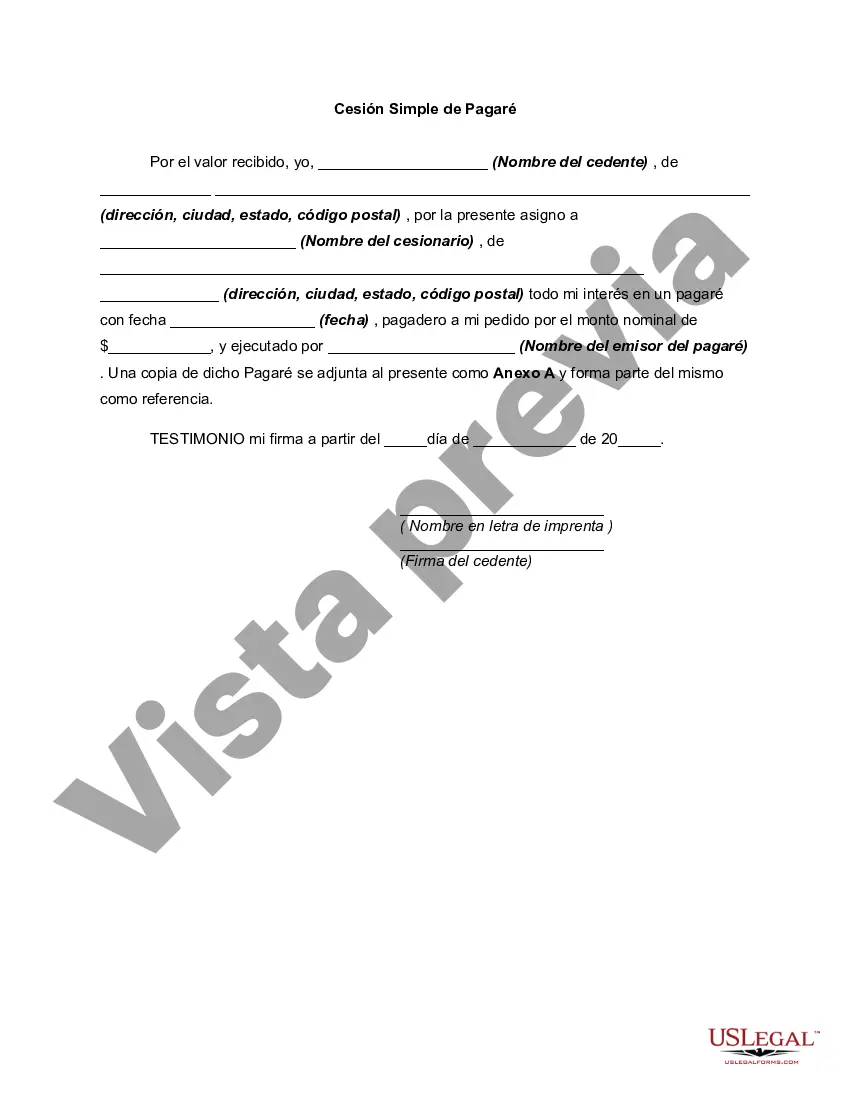

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Florida Pagaré Simple Para Préstamo Familiar?

Are you presently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the Florida Simple Promissory Note for Family Loan, designed to meet federal and state requirements.

Once you locate the correct form, click Buy now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Simple Promissory Note for Family Loan template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Structure Family LoansTREAT THE DECISION TO LEND SERIOUSLY. Give careful thought to whether you honestly want to loan money to your son, daughter, or other family member.PUT IT IN WRITING.SET AN INTEREST RATE.BE AWARE OF RULES CONCERNING IMPUTED INTEREST.TREAD CAREFULLY.

All parties must sign the promissory note. Florida law does not require that the promissory note be notarized, but parties often take this extra step.

Pros. Easier approval: There's typically no formal application process, credit check or verification of income when you're borrowing from family. Traditional lenders often require documents such as W-2s, pay stubs and tax forms as part of the loan application process.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

The name and address of the person loaning the money. The name and address of the person borrowing the money. Terms of repayment: schedule of repayment, amount of each payment and manner of payments (in-person, cash, check, etc.) Interest to be charged related to the loan, if any.

How to Lend Money to Family and FriendsTell your friend or relative you'll think about it.Look at your finances before making a loan.Get everything in writing.Consider setting the debt payment plan on autopay.Understand the legal and tax consequences.Consider whether to charge interest.Learn to say no next time.

The Internal Revenue Service has released the Applicable Federal Rates (AFRs) for March 2020. AFRs are published monthly and represent the minimum interest rates that should be charged for family loans to avoid tax complications. The Section 7520 interest rate for March 2020 is 1.8 percent.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

More info

Com Mortgage Loan Terms Mortgage Term.