A Florida Simple Promissory Note for Tuition Fee is a legally binding document that lays out the terms and conditions of a loan made between the lender and the borrower for educational expenses. This note serves as a written agreement to repay the borrowed amount along with any accrued interest within a specified time frame. It is essential for both parties to understand the details of the agreement before signing. The Florida Simple Promissory Note for Tuition Fee consists of several important components. Firstly, it includes the names and contact information of both the lender and the borrower. Additionally, it outlines the principal amount borrowed and the interest rate agreed upon. The note also specifies the repayment schedule, including monthly or quarterly installments, and the due dates for each payment. It is crucial to mention that there can be different types of Florida Simple Promissory Notes for Tuition Fee, depending on the specific circumstances of the loan agreement. Some common variations include: 1. Fixed Interest Rate Promissory Note: This type of promissory note has a predetermined interest rate that remains constant throughout the repayment period. It ensures that the borrower knows the exact amount of interest they will be paying over the loan term. 2. Variable Interest Rate Promissory Note: Unlike a fixed interest rate note, this type of promissory note includes an interest rate that may fluctuate based on market conditions. The interest rate can be tied to an external financial index, such as the prime rate, which may result in varying monthly payments. 3. Balloon Payment Promissory Note: This note requires the borrower to make smaller, regular payments for a specific period, followed by a lump sum payment (balloon payment) due at the end of the loan term. It is essential to carefully consider if the borrower will have the means to make the final large payment. Whether it is a fixed or variable interest rate, or if it involves a balloon payment, the Florida Simple Promissory Note for Tuition Fee serves as a legal instrument that protects both parties' interests. It ensures clarity and transparency regarding the loan terms, repayment schedule, and any associated penalties or fees in case of default. Prior to entering into such an agreement, it is advisable to consult with legal professionals or financial advisors to ensure compliance with state laws and to safeguard the rights of both parties.

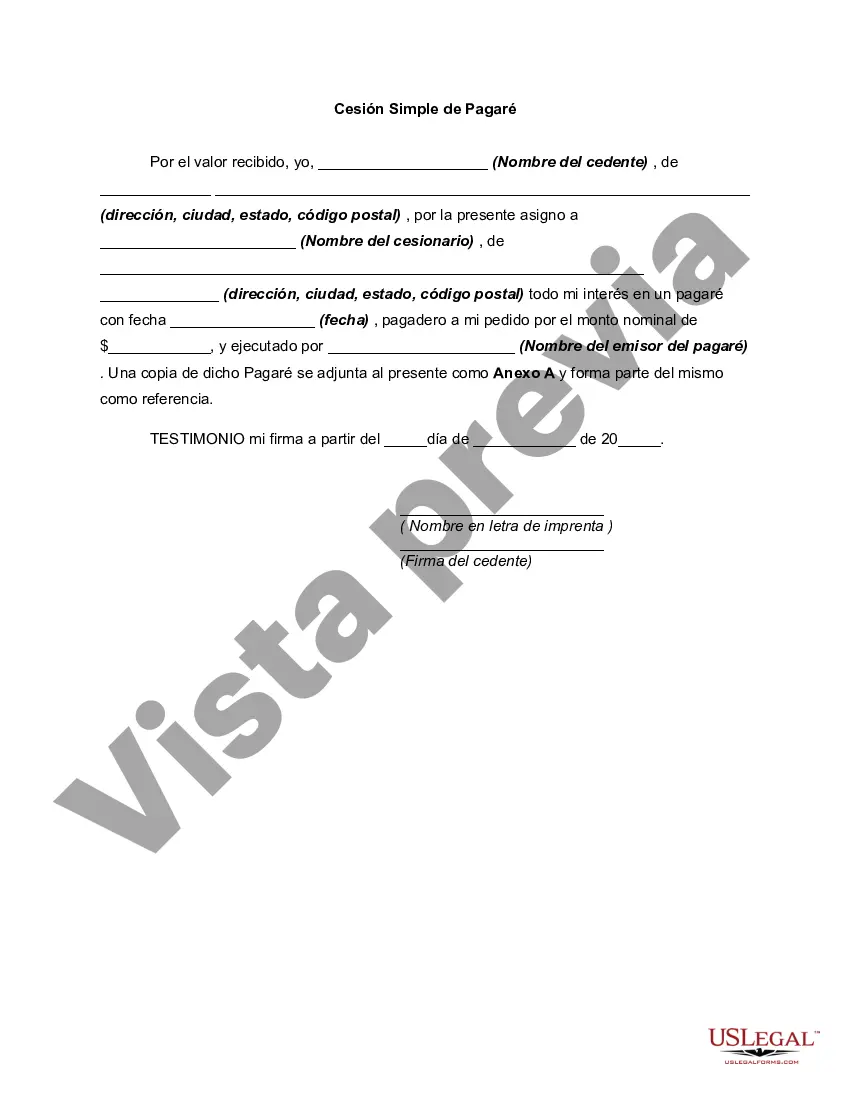

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Florida Pagaré Simple De Matrícula?

It is possible to invest time online attempting to find the legal document format that fits the state and federal specifications you want. US Legal Forms gives thousands of legal forms that happen to be reviewed by pros. You can actually download or produce the Florida Simple Promissory Note for Tutition Fee from my service.

If you have a US Legal Forms accounts, you may log in and click on the Download key. Following that, you may complete, revise, produce, or sign the Florida Simple Promissory Note for Tutition Fee. Each legal document format you purchase is your own property for a long time. To obtain yet another duplicate of any obtained develop, visit the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site for the first time, follow the easy guidelines below:

- First, ensure that you have chosen the best document format for the state/metropolis that you pick. Read the develop information to ensure you have chosen the appropriate develop. If accessible, use the Review key to check throughout the document format at the same time.

- In order to discover yet another edition of the develop, use the Lookup field to discover the format that suits you and specifications.

- Once you have located the format you desire, click Get now to proceed.

- Pick the prices program you desire, type your credentials, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your Visa or Mastercard or PayPal accounts to pay for the legal develop.

- Pick the structure of the document and download it in your device.

- Make modifications in your document if needed. It is possible to complete, revise and sign and produce Florida Simple Promissory Note for Tutition Fee.

Download and produce thousands of document templates while using US Legal Forms site, that provides the greatest collection of legal forms. Use skilled and status-certain templates to take on your business or person requires.