This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Florida Agreement of Purchase and Sale of Business — Short Form is a legal document used in the state of Florida to outline the terms and conditions of a business sale transaction. This contract serves as a binding agreement between the buyer and the seller, providing a comprehensive framework to protect the interests of both parties involved. The Florida Agreement of Purchase and Sale of Business — Short Form contains several crucial elements that must be addressed to ensure a smooth and fair transaction. It covers important details such as the purchase price, payment terms, included assets and liabilities, representations and warranties, closing date, and other relevant terms and conditions. There are different types of Florida Agreement of Purchase and Sale of Business — Short Form that may be used depending on the specific nature of the business being sold. Some of these variations include: 1. Asset Purchase Agreement: This type of agreement primarily focuses on the sale of specific assets of the business, rather than the purchase of the entire business entity. It identifies the assets being transferred, their value, and any terms or conditions related to the transfer. 2. Stock Purchase Agreement: In this form of agreement, the buyer purchases the shares of the business entity, acquiring controlling interest and assuming ownership of the entire business. The agreement outlines the number and price of shares being purchased, any post-closing obligations, and warranties regarding the ownership of the stock. 3. Bulk Sale Agreement: This type of agreement is commonly used when the business being sold involves retail inventory. It ensures that the buyer is protected from any undisclosed debts or liabilities associated with the business at the time of the sale, as creditors may claim against the buyer if proper procedures are not followed. 4. Franchise Purchase Agreement: If the business being sold is a franchise, a specialized agreement known as the Franchise Purchase Agreement is used. It includes provisions that address the transfer of the franchise rights, obligations of the buyer and seller, and compliance with the franchisor's requirements. The Florida Agreement of Purchase and Sale of Business — Short Form is an essential legal document that facilitates the transfer of ownership and ensures a fair and transparent transaction. It is always advisable to seek legal counsel and assistance when drafting or reviewing such agreements to protect the rights and interests of all parties involved.The Florida Agreement of Purchase and Sale of Business — Short Form is a legal document used in the state of Florida to outline the terms and conditions of a business sale transaction. This contract serves as a binding agreement between the buyer and the seller, providing a comprehensive framework to protect the interests of both parties involved. The Florida Agreement of Purchase and Sale of Business — Short Form contains several crucial elements that must be addressed to ensure a smooth and fair transaction. It covers important details such as the purchase price, payment terms, included assets and liabilities, representations and warranties, closing date, and other relevant terms and conditions. There are different types of Florida Agreement of Purchase and Sale of Business — Short Form that may be used depending on the specific nature of the business being sold. Some of these variations include: 1. Asset Purchase Agreement: This type of agreement primarily focuses on the sale of specific assets of the business, rather than the purchase of the entire business entity. It identifies the assets being transferred, their value, and any terms or conditions related to the transfer. 2. Stock Purchase Agreement: In this form of agreement, the buyer purchases the shares of the business entity, acquiring controlling interest and assuming ownership of the entire business. The agreement outlines the number and price of shares being purchased, any post-closing obligations, and warranties regarding the ownership of the stock. 3. Bulk Sale Agreement: This type of agreement is commonly used when the business being sold involves retail inventory. It ensures that the buyer is protected from any undisclosed debts or liabilities associated with the business at the time of the sale, as creditors may claim against the buyer if proper procedures are not followed. 4. Franchise Purchase Agreement: If the business being sold is a franchise, a specialized agreement known as the Franchise Purchase Agreement is used. It includes provisions that address the transfer of the franchise rights, obligations of the buyer and seller, and compliance with the franchisor's requirements. The Florida Agreement of Purchase and Sale of Business — Short Form is an essential legal document that facilitates the transfer of ownership and ensures a fair and transparent transaction. It is always advisable to seek legal counsel and assistance when drafting or reviewing such agreements to protect the rights and interests of all parties involved.

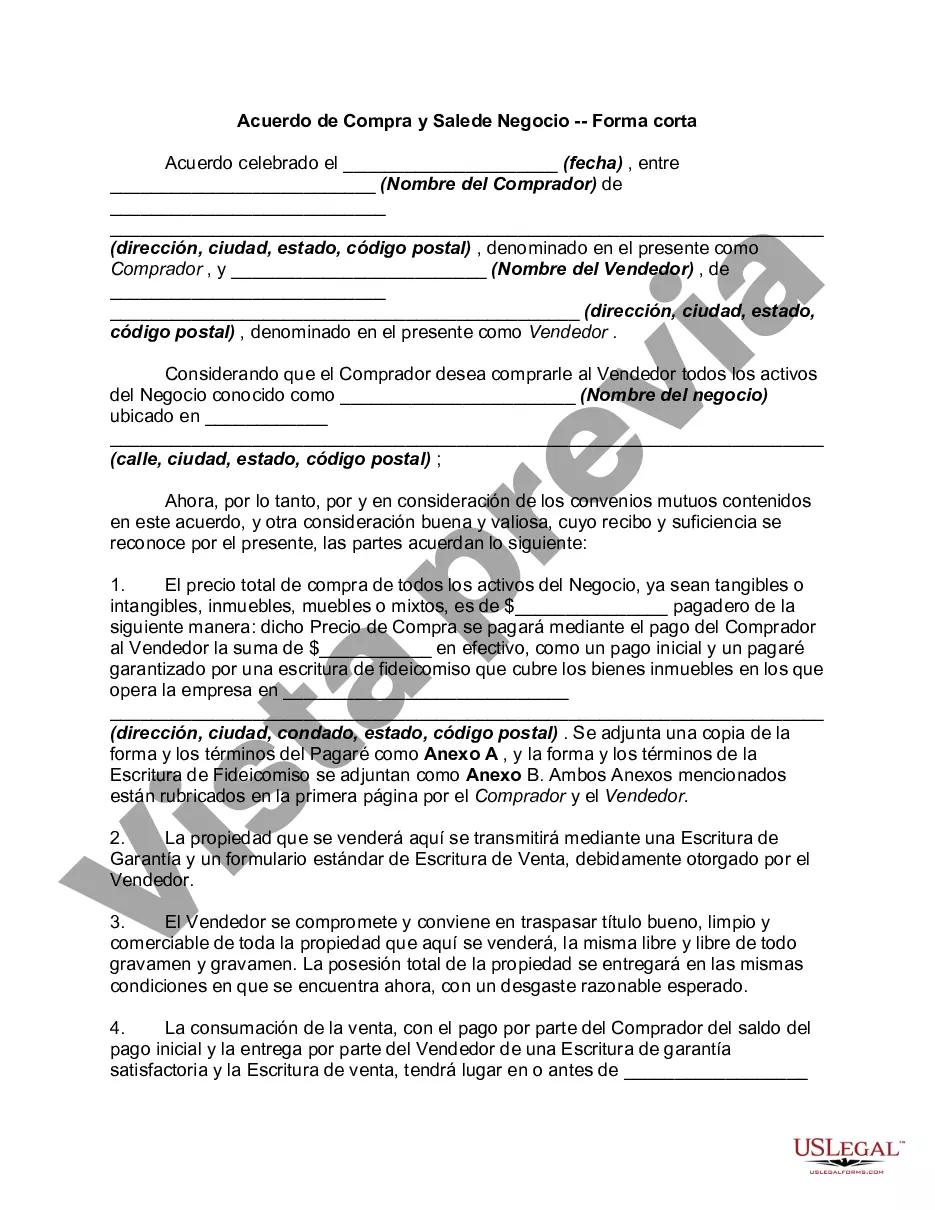

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.