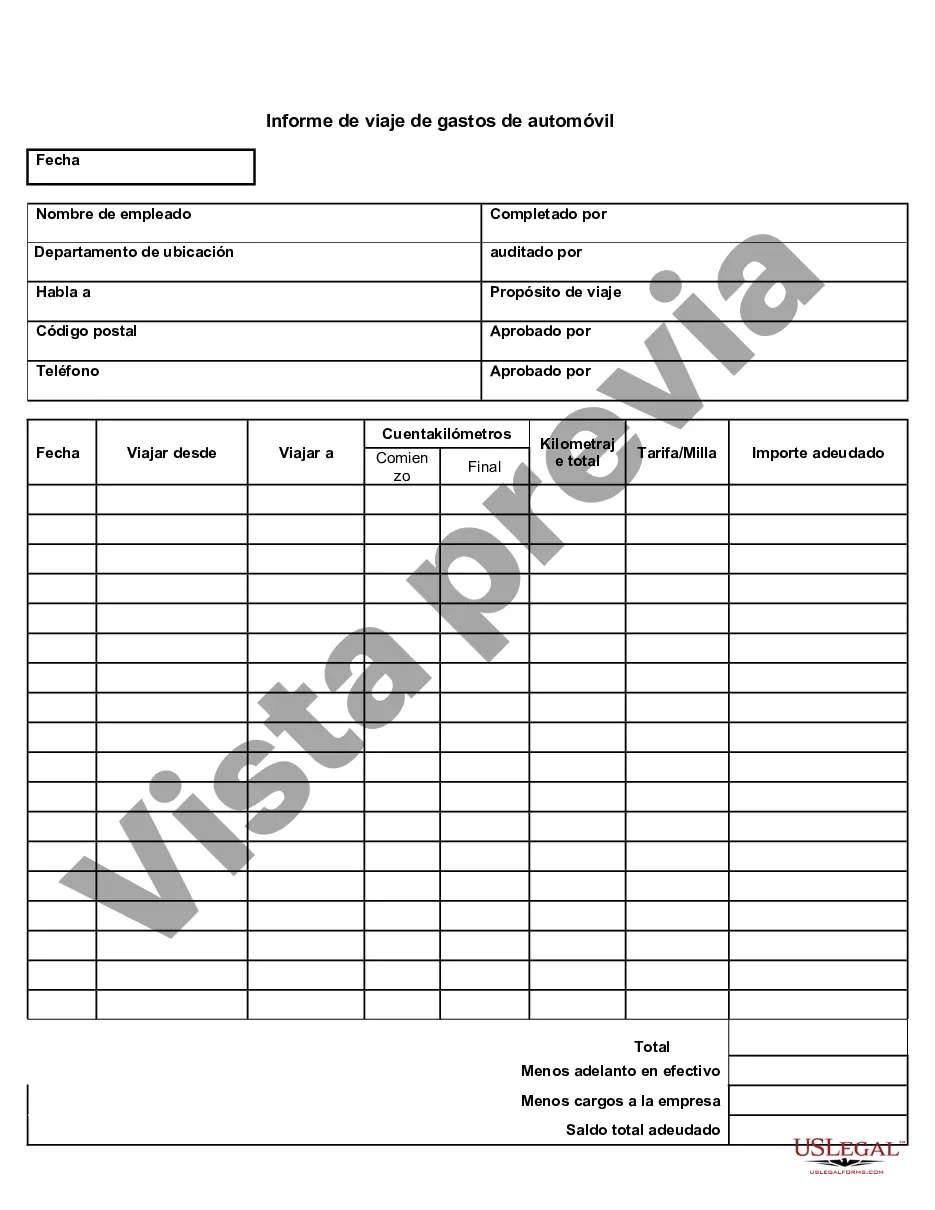

Florida Auto Expense Travel Report is a comprehensive document that provides a detailed breakdown of expenses incurred during travel in Florida using an automobile. This report is typically utilized by individuals, businesses, or organizations to track and account for various expenses related to their travel within the state. The Florida Auto Expense Travel Report is designed to capture and record expenses accurately, allowing for proper reimbursement, taxation, or financial analysis. It includes various categories of expenditures, ensuring that every aspect of the travel-related spending is documented efficiently. The key sections of the Florida Auto Expense Travel Report cover the following areas: 1. Transportation Expenses: This includes costs associated with fuel, tolls, parking fees, and vehicle maintenance incurred during the travel. It ensures that all the expenses related to the automobile's usage are recorded. 2. Accommodation Expenses: This section accounts for the costs of lodging during the trip. It includes expenses incurred at hotels, motels, or vacation rentals, providing a clear picture of the accommodation expenses. 3. Food Expenses: This category covers the cost of meals and snacks consumed during the travel period. It includes expenses at restaurants, cafés, grocery stores, or other dining establishments. 4. Miscellaneous Expenses: This section captures any additional costs that do not fit into the other categories. It may include fees for attractions, entertainment, or other personal expenses relevant to the travel. Furthermore, the Florida Auto Expense Travel Report also allows for the inclusion of relevant keywords to further categorize and analyze the expenses. Some keywords could be: — Mileage: If the report includes mileage reimbursement, this keyword helps calculate the distance traveled and the reimbursement amount based on a predetermined rate per mile. — Business vs. Personal: Differentiating between business-related travel expenses and personal expenses is crucial. Keywords like "business-related" or "personal" help distinguish between the two types of expenditures. — Receipts: This keyword implies attaching relevant receipts to each expense entry, ensuring accurate reporting and providing supporting documentation for audit purposes. — Per Diem: Per diem refers to daily allowances provided for meals and incidental expenses during travel. This keyword helps identify and document the per diem reimbursements. Although there may not be specific "types" of Florida Auto Expense Travel Reports, variations can occur based on the purpose of the travel, such as business travel reports, employee reimbursement reports, or tax deduction reports. These distinctions are made to align with different accounting or reimbursement policies within organizations. In conclusion, the Florida Auto Expense Travel Report is a comprehensive tool used to track and report expenses incurred during travel within Florida. Its detailed breakdown and use of relevant keywords ensure accurate and efficient reporting, making it an indispensable asset for travel-related expense management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Informe de viaje de gastos de automóvil - Auto Expense Travel Report

Description

How to fill out Florida Informe De Viaje De Gastos De Automóvil?

US Legal Forms - one of several greatest libraries of authorized kinds in the United States - provides an array of authorized papers web templates it is possible to download or printing. While using web site, you will get a large number of kinds for organization and individual uses, categorized by classes, claims, or search phrases.You can get the latest variations of kinds such as the Florida Auto Expense Travel Report within minutes.

If you currently have a registration, log in and download Florida Auto Expense Travel Report from the US Legal Forms catalogue. The Acquire option will appear on every single develop you view. You gain access to all earlier saved kinds from the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, allow me to share simple directions to get you started:

- Make sure you have picked out the best develop for your metropolis/area. Click on the Review option to analyze the form`s content material. See the develop outline to actually have selected the correct develop.

- In the event the develop doesn`t suit your needs, use the Lookup field at the top of the display screen to get the one which does.

- In case you are happy with the form, confirm your decision by clicking on the Purchase now option. Then, select the costs strategy you like and give your qualifications to register for an account.

- Method the financial transaction. Utilize your bank card or PayPal account to finish the financial transaction.

- Find the formatting and download the form on your own device.

- Make modifications. Complete, edit and printing and signal the saved Florida Auto Expense Travel Report.

Every design you included with your money lacks an expiration particular date and is also the one you have eternally. So, in order to download or printing another version, just proceed to the My Forms area and then click about the develop you need.

Get access to the Florida Auto Expense Travel Report with US Legal Forms, probably the most extensive catalogue of authorized papers web templates. Use a large number of professional and express-specific web templates that satisfy your business or individual requires and needs.