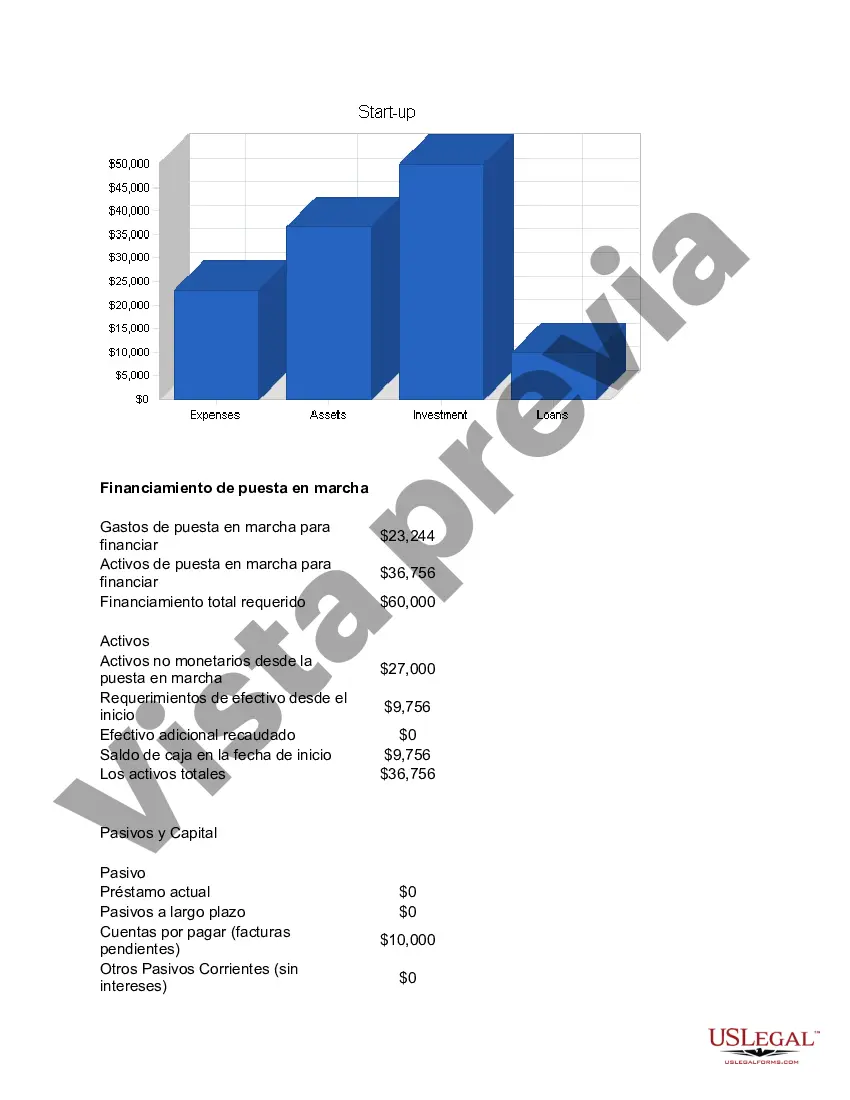

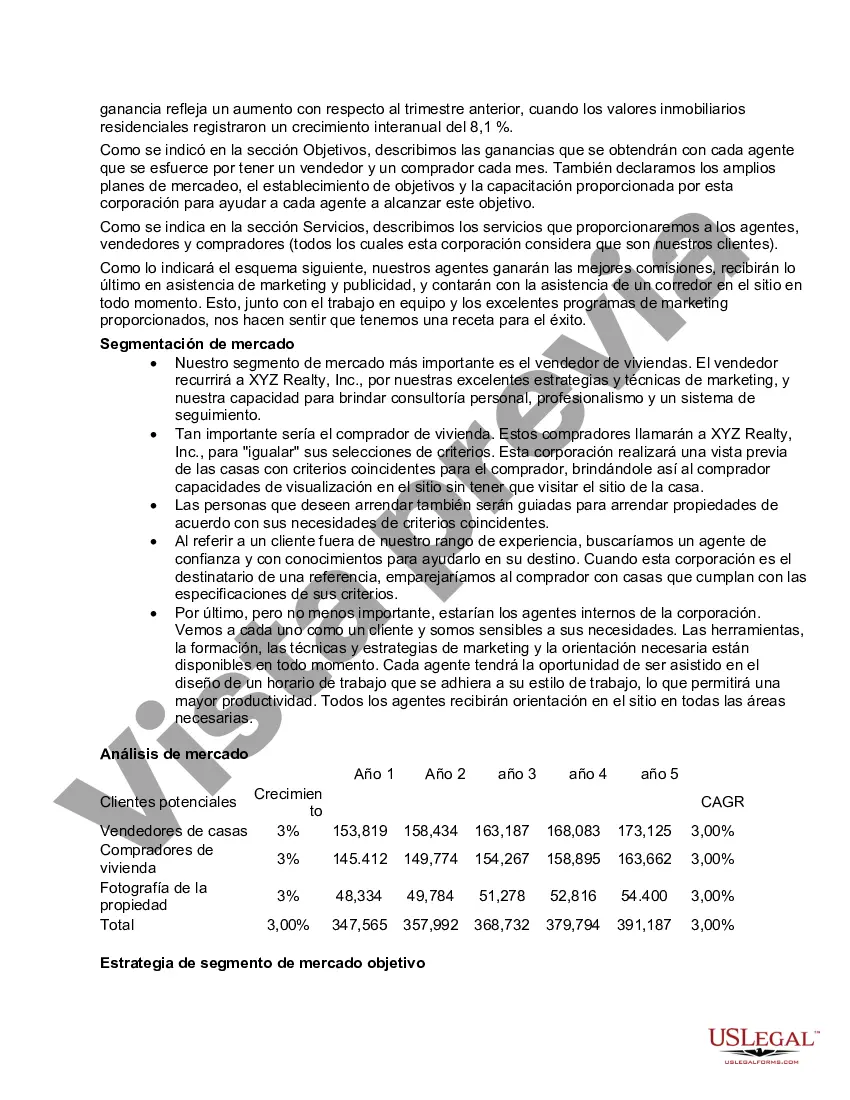

Florida Real Estate Brokerage Business Plan is a comprehensive and strategic document that outlines the objectives, strategies, and steps required to establish and operate a successful real estate brokerage in the state of Florida. It serves as a roadmap for entrepreneurs and real estate professionals to guide their efforts in building a profitable and sustainable brokerage business. A well-crafted Florida Real Estate Brokerage Business Plan typically includes the following key components: 1. Executive Summary: This section provides a concise overview of the brokerage business plan, highlighting its goals, target market, competitive advantages, and financial projections. 2. Company Description: It entails an in-depth analysis of the brokerage's mission, vision, values, and business model. It outlines the legal structure, ownership, and leadership team of the brokerage. 3. Market Analysis: This section examines the Florida real estate market, identifying trends, growth opportunities, and target market segments. It also includes a competitive analysis to assess other brokerage firms operating in the area and their strengths and weaknesses. 4. Services and Pricing: Here, the business plan outlines the range of services the brokerage will offer, such as property sales, leasing, property management, investment consultation, and more. The pricing strategy for each service will also be detailed. 5. Marketing and Sales Strategy: This section outlines the marketing and advertising efforts to attract clients and generate leads. It includes strategies for utilizing online platforms, social media, traditional advertising, networking, and building partnerships with real estate professionals. 6. Organizational Structure: It presents the organizational structure of the brokerage, defining the roles and responsibilities of key personnel, including brokers, agents, managers, and administrative staff. It also addresses the recruitment and training strategies for hiring qualified real estate professionals. 7. Financial Projections: This crucial section includes a detailed analysis of the brokerage's financials, including start-up costs, projected revenues, operating expenses, and profitability. It also presents cash flow projections, break-even analysis, and sales forecasts for a specified period. 8. Risk Management: This section assesses potential risks and challenges that the brokerage may encounter, such as market fluctuations, legal and regulatory issues, competition, and economic downturns. It outlines strategies to mitigate these risks and develop contingency plans. Different types of Florida Real Estate Brokerage Business Plans may include variations based on the specific goals and focus of the brokerage. For instance, there may be plans catering to residential real estate, commercial real estate, property management, or investment brokerage. Each type of brokerage plan would have tailored market analysis, services, and pricing structures to meet the unique needs and demands of the respective real estate sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Plan de Negocios de Corretaje de Bienes Raíces - Real Estate Brokerage Business Plan

Description

How to fill out Florida Plan De Negocios De Corretaje De Bienes Raíces?

You are able to commit several hours on the web attempting to find the authorized papers web template which fits the state and federal requirements you want. US Legal Forms offers thousands of authorized kinds which are reviewed by specialists. It is simple to obtain or printing the Florida Real Estate Brokerage Business Plan from my service.

If you already possess a US Legal Forms bank account, you may log in and then click the Down load switch. Following that, you may comprehensive, change, printing, or signal the Florida Real Estate Brokerage Business Plan. Each authorized papers web template you get is the one you have eternally. To get one more duplicate of any purchased develop, proceed to the My Forms tab and then click the related switch.

If you are using the US Legal Forms site for the first time, stick to the easy instructions listed below:

- Very first, be sure that you have selected the right papers web template for that region/area of your choice. Look at the develop explanation to ensure you have picked the proper develop. If readily available, utilize the Preview switch to appear with the papers web template as well.

- If you wish to locate one more variation of your develop, utilize the Lookup area to get the web template that fits your needs and requirements.

- Once you have located the web template you would like, simply click Buy now to move forward.

- Pick the costs program you would like, key in your references, and sign up for an account on US Legal Forms.

- Full the purchase. You should use your bank card or PayPal bank account to pay for the authorized develop.

- Pick the formatting of your papers and obtain it in your gadget.

- Make modifications in your papers if required. You are able to comprehensive, change and signal and printing Florida Real Estate Brokerage Business Plan.

Down load and printing thousands of papers themes utilizing the US Legal Forms website, that offers the greatest selection of authorized kinds. Use expert and status-distinct themes to take on your company or individual requirements.