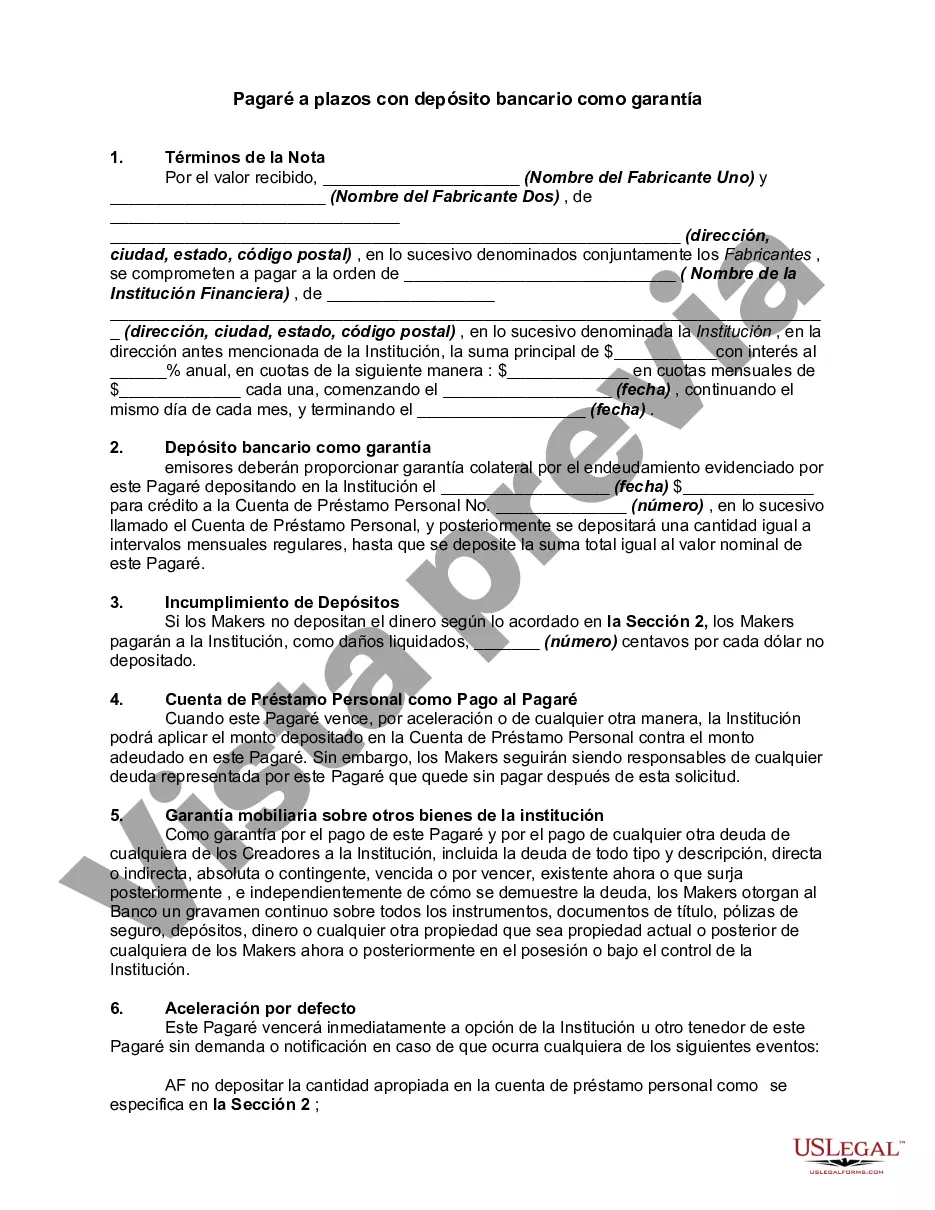

A Florida Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Florida. This type of promissory note allows for a bank deposit to be used as collateral to secure the loan. In this agreement, the borrower promises to repay the lender a specific amount of money, plus any applicable interest, in regular installments over a predetermined period of time. The lender, in turn, agrees to provide the loan amount and accepts the bank deposit as collateral to safeguard their investment. Florida Installment Promissory Notes with Bank Deposit as Collateral can be categorized into different types based on various factors: 1. Secured Installment Promissory Note: This type of promissory note is backed by a bank deposit, which serves as collateral to protect the lender's interest. If the borrower fails to repay the loan as per the agreed terms, the lender has the right to seize the bank deposit to recover the outstanding amount. 2. Unsecured Installment Promissory Note: Unlike the secured option, this type of promissory note does not require the borrower to provide a bank deposit as collateral. However, it still outlines the repayment terms and conditions, including the installment amounts and any applicable interest. 3. Fixed Rate Installment Promissory Note: This variation of the promissory note specifies a fixed interest rate that remains constant throughout the loan term. The borrower knows exactly how much interest they need to pay, making budgeting and financial planning more manageable. 4. Variable Rate Installment Promissory Note: In contrast to the fixed rate option, a variable rate promissory note includes an interest rate that can fluctuate based on market conditions. The interest amount may change periodically, impacting the installment amounts paid by the borrower. 5. Balloon Installment Promissory Note: This type of promissory note involves regular installments for a specific period, followed by a larger 'balloon' payment at the end. The balloon payment typically covers the remaining principal and any outstanding interest. A Florida Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that protects both the borrower and the lender's interests. It ensures that the loan is repaid as agreed upon, using the bank deposit as security. It is essential to consult with legal professionals in Florida to draft and review this promissory note to ensure its compliance with relevant state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Florida Pagaré A Plazos Con Depósito Bancario Como Garantía?

If you want to complete, down load, or printing legitimate record themes, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on-line. Utilize the site`s easy and hassle-free search to obtain the paperwork you want. Different themes for organization and person purposes are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Florida Installment Promissory Note with Bank Deposit as Collateral in just a handful of clicks.

In case you are already a US Legal Forms consumer, log in in your profile and click on the Down load switch to obtain the Florida Installment Promissory Note with Bank Deposit as Collateral. You can also entry kinds you formerly downloaded inside the My Forms tab of the profile.

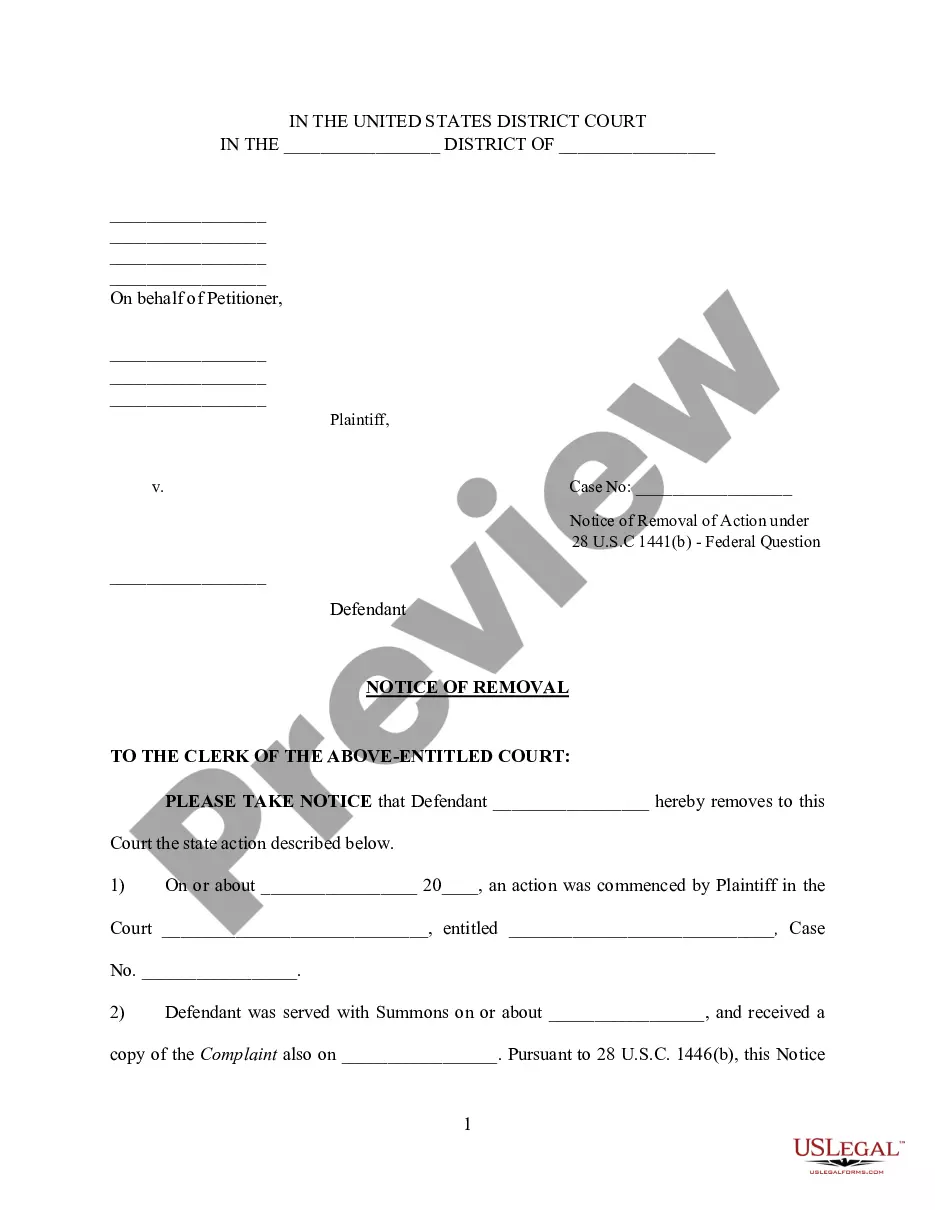

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for your right area/country.

- Step 2. Take advantage of the Preview choice to look through the form`s content. Do not neglect to read the explanation.

- Step 3. In case you are not happy using the form, make use of the Look for industry near the top of the screen to locate other types from the legitimate form format.

- Step 4. When you have discovered the form you want, click on the Acquire now switch. Opt for the costs prepare you like and include your accreditations to register for the profile.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal profile to finish the financial transaction.

- Step 6. Pick the format from the legitimate form and down load it on your own product.

- Step 7. Full, change and printing or sign the Florida Installment Promissory Note with Bank Deposit as Collateral.

Every single legitimate record format you get is yours for a long time. You may have acces to each and every form you downloaded with your acccount. Click on the My Forms portion and select a form to printing or down load yet again.

Compete and down load, and printing the Florida Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms. There are thousands of professional and state-certain kinds you may use for your personal organization or person requires.