It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

Title: Exploring the Florida Business Purchase Proposal: Types and Key Elements Introduction: A Florida Business Purchase Proposal refers to a comprehensive document outlining a potential buyer's proposition to acquire an existing business situated in the state of Florida. It encompasses various significant aspects of the purchase agreement, including the terms, financials, framework, and considerations. This article will delve into the different types of Florida Business Purchase Proposals and provide a detailed description of the key elements typically included in such proposals. Types of Florida Business Purchase Proposals: 1. Acquisition Proposal: An acquisition proposal involves a potential buyer presenting a formal offer to purchase an existing Florida business outright. It details the buyer's intentions, terms, expected acquisition timeline, and the overall strategic fit. 2. Merger Proposal: A merger proposal outlines the integration of two or more businesses into a single entity. In Florida, business owners can propose merging their company with another to increase market share, pool resources, and expand operations. This type of proposal highlights the potential synergies and benefits the merger would yield. 3. Asset Purchase Proposal: An asset purchase proposal is specifically designed for buyers interested in acquiring specific assets of an existing Florida business, instead of acquiring the entire company. It clearly outlines the identified assets, their valuation, and the agreed-upon terms of transfer. Key Elements of a Florida Business Purchase Proposal: 1. Executive Summary: A brief overview of the buyer's intentions, including the purpose, rationale, and desired outcome of the acquisition. 2. Business Profile: A comprehensive description of the target Florida business, including its history, core operations, market position, competitive analysis, and financial performance. 3. Purchase Price and Terms: A detailed explanation of the proposed purchase price, payment structure, methods, and any additional terms related to the financial transaction. 4. Due Diligence: An outline of the buyer's due diligence process, with a list of documents, records, and information required to verify the accuracy of the business's representations. 5. Integration Strategy: An explanation of the buyer's plans for integrating the acquired business into their operations, including synergies, cost-saving opportunities, and growth potential. 6. Transition and Timeline: A clear roadmap outlining the post-acquisition transition process, including the expected timeline, responsibilities, and key milestones. 7. Assumptions and Contingencies: Identification of potential assumptions made during the proposal formulation and any contingencies that might impact the acquisition, such as regulatory approvals or financing arrangements. 8. Confidentiality and Non-Disclosure Agreement: A section emphasizing the need for confidentiality throughout the proposal's evaluation and negotiation phases, protecting sensitive business information. Conclusion: When contemplating a Florida business purchase, having a well-prepared proposal is crucial for buyers to articulate their intentions, address potential concerns, and demonstrate the value they can bring to the target business. Understanding the different types of proposals and incorporating essential elements helps streamline the process and enhances the likelihood of a successful acquisition.Title: Exploring the Florida Business Purchase Proposal: Types and Key Elements Introduction: A Florida Business Purchase Proposal refers to a comprehensive document outlining a potential buyer's proposition to acquire an existing business situated in the state of Florida. It encompasses various significant aspects of the purchase agreement, including the terms, financials, framework, and considerations. This article will delve into the different types of Florida Business Purchase Proposals and provide a detailed description of the key elements typically included in such proposals. Types of Florida Business Purchase Proposals: 1. Acquisition Proposal: An acquisition proposal involves a potential buyer presenting a formal offer to purchase an existing Florida business outright. It details the buyer's intentions, terms, expected acquisition timeline, and the overall strategic fit. 2. Merger Proposal: A merger proposal outlines the integration of two or more businesses into a single entity. In Florida, business owners can propose merging their company with another to increase market share, pool resources, and expand operations. This type of proposal highlights the potential synergies and benefits the merger would yield. 3. Asset Purchase Proposal: An asset purchase proposal is specifically designed for buyers interested in acquiring specific assets of an existing Florida business, instead of acquiring the entire company. It clearly outlines the identified assets, their valuation, and the agreed-upon terms of transfer. Key Elements of a Florida Business Purchase Proposal: 1. Executive Summary: A brief overview of the buyer's intentions, including the purpose, rationale, and desired outcome of the acquisition. 2. Business Profile: A comprehensive description of the target Florida business, including its history, core operations, market position, competitive analysis, and financial performance. 3. Purchase Price and Terms: A detailed explanation of the proposed purchase price, payment structure, methods, and any additional terms related to the financial transaction. 4. Due Diligence: An outline of the buyer's due diligence process, with a list of documents, records, and information required to verify the accuracy of the business's representations. 5. Integration Strategy: An explanation of the buyer's plans for integrating the acquired business into their operations, including synergies, cost-saving opportunities, and growth potential. 6. Transition and Timeline: A clear roadmap outlining the post-acquisition transition process, including the expected timeline, responsibilities, and key milestones. 7. Assumptions and Contingencies: Identification of potential assumptions made during the proposal formulation and any contingencies that might impact the acquisition, such as regulatory approvals or financing arrangements. 8. Confidentiality and Non-Disclosure Agreement: A section emphasizing the need for confidentiality throughout the proposal's evaluation and negotiation phases, protecting sensitive business information. Conclusion: When contemplating a Florida business purchase, having a well-prepared proposal is crucial for buyers to articulate their intentions, address potential concerns, and demonstrate the value they can bring to the target business. Understanding the different types of proposals and incorporating essential elements helps streamline the process and enhances the likelihood of a successful acquisition.

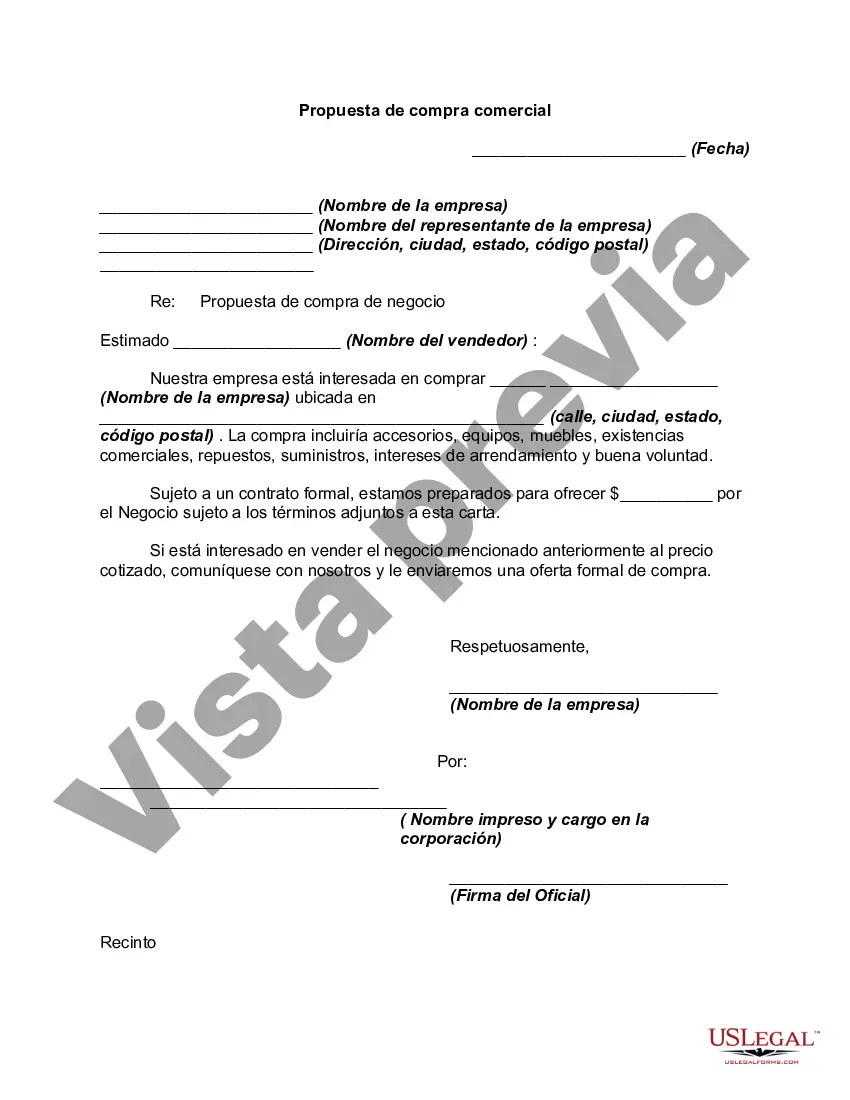

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.