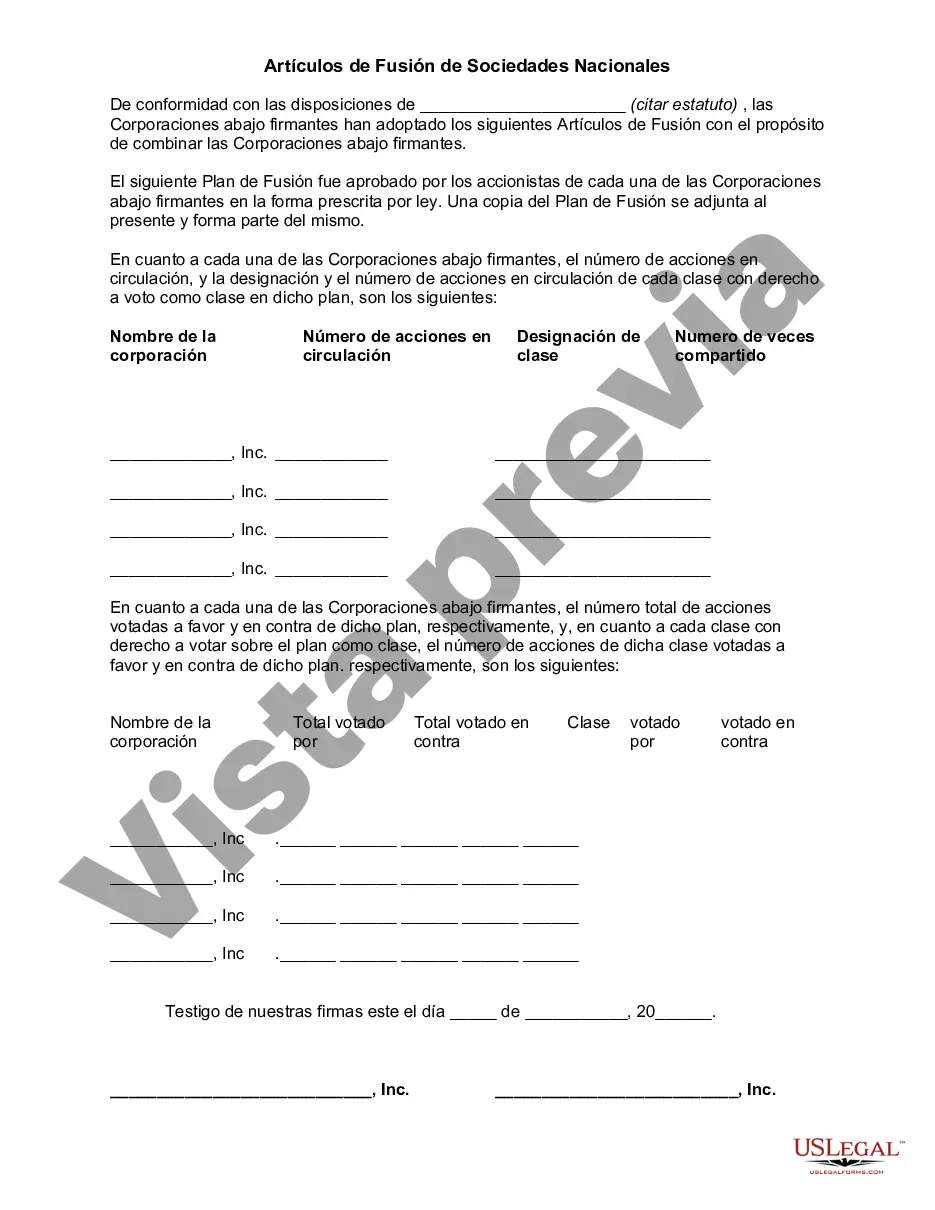

Statutes of the particular jurisdiction may require that merging corporations file copies of the proposed plan of combination with a state official or agency. Generally, information as to voting rights of classes of stock, number of shares outstanding, and results of any voting are required to be included, and there may be special requirements for the merger or consolidation of domestic and foreign corporations.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

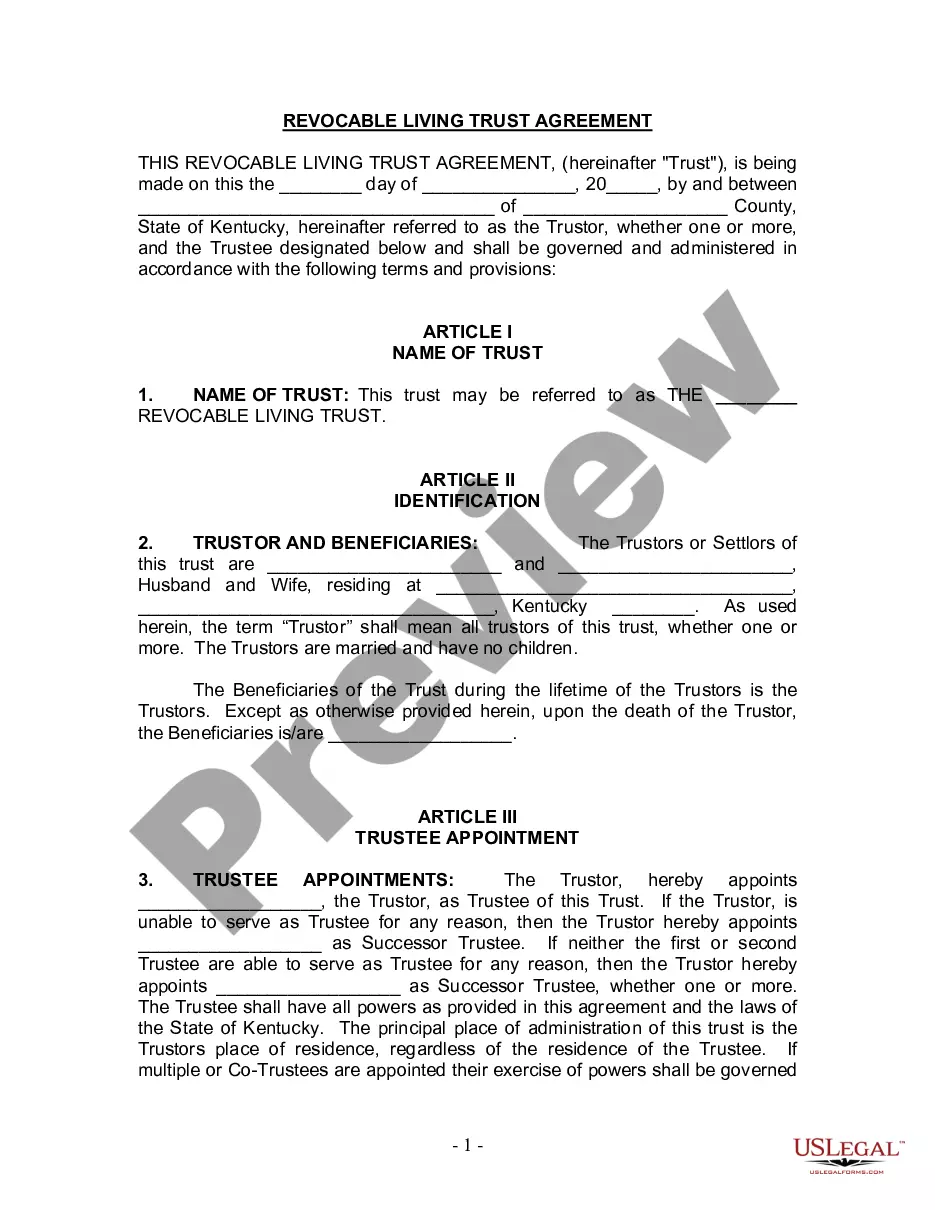

The Florida Articles of Merger of Domestic Corporations is a crucial legal document that outlines the consolidation or merger process between two or more domestic corporations in the state of Florida. This document plays a pivotal role in facilitating the legal and financial aspects of such transactions by providing a comprehensive framework for the merging entities to follow. Keywords: Florida, Articles of Merger, Domestic Corporations, consolidation, merger, legal document, transactions. There are different types of Florida Articles of Merger of Domestic Corporations based on the nature of the merger. These types include: 1. Statutory Merger: This is the most common form of merger, wherein two or more corporations come together to form a single surviving corporation. The assets, liabilities, right, and obligations of the merging corporations are transferred to the surviving corporation. 2. Stock-for-Stock Merger: In this type of merger, the merger consideration is in the form of shares of the acquiring corporation's stock. The shareholders of the merging corporations receive shares in the acquiring corporation in exchange for their existing shares. 3. Asset Acquisition: Unlike a statutory merger, an asset acquisition involves the purchasing corporation acquiring only a specific set of assets and liabilities from the target corporation. Through this type of merger, the acquiring corporation can select the specific assets it wishes to acquire while leaving behind unwanted liabilities. 4. Share Exchange: A share exchange involves the exchange of shares between the merging entities, resulting in one corporation emerging as the surviving entity. The shareholders of the target corporation receive shares in the surviving corporation in proportion to their holdings in the target corporation. 5. Consolidation: A consolidation occurs when two or more corporations merge to create an entirely new corporation. In this process, the merging entities cease to exist, and a new, consolidated corporation is formed. Regardless of the type of merger, the Florida Articles of Merger of Domestic Corporations must adhere to the regulations set forth by the Florida Department of State and be properly filed with the relevant authorities. This legal document ensures transparency, compliance, and protection of the rights and interests of shareholders and stakeholders involved in the merger process, providing a clear framework for the execution of such transactions. In summary, the Florida Articles of Merger of Domestic Corporations is a vital legal document that facilitates the merger or consolidation process between domestic corporations in the state. It outlines the terms, conditions, and procedures for the merger, ensuring compliance with regulatory requirements and protecting the interests of all parties involved.The Florida Articles of Merger of Domestic Corporations is a crucial legal document that outlines the consolidation or merger process between two or more domestic corporations in the state of Florida. This document plays a pivotal role in facilitating the legal and financial aspects of such transactions by providing a comprehensive framework for the merging entities to follow. Keywords: Florida, Articles of Merger, Domestic Corporations, consolidation, merger, legal document, transactions. There are different types of Florida Articles of Merger of Domestic Corporations based on the nature of the merger. These types include: 1. Statutory Merger: This is the most common form of merger, wherein two or more corporations come together to form a single surviving corporation. The assets, liabilities, right, and obligations of the merging corporations are transferred to the surviving corporation. 2. Stock-for-Stock Merger: In this type of merger, the merger consideration is in the form of shares of the acquiring corporation's stock. The shareholders of the merging corporations receive shares in the acquiring corporation in exchange for their existing shares. 3. Asset Acquisition: Unlike a statutory merger, an asset acquisition involves the purchasing corporation acquiring only a specific set of assets and liabilities from the target corporation. Through this type of merger, the acquiring corporation can select the specific assets it wishes to acquire while leaving behind unwanted liabilities. 4. Share Exchange: A share exchange involves the exchange of shares between the merging entities, resulting in one corporation emerging as the surviving entity. The shareholders of the target corporation receive shares in the surviving corporation in proportion to their holdings in the target corporation. 5. Consolidation: A consolidation occurs when two or more corporations merge to create an entirely new corporation. In this process, the merging entities cease to exist, and a new, consolidated corporation is formed. Regardless of the type of merger, the Florida Articles of Merger of Domestic Corporations must adhere to the regulations set forth by the Florida Department of State and be properly filed with the relevant authorities. This legal document ensures transparency, compliance, and protection of the rights and interests of shareholders and stakeholders involved in the merger process, providing a clear framework for the execution of such transactions. In summary, the Florida Articles of Merger of Domestic Corporations is a vital legal document that facilitates the merger or consolidation process between domestic corporations in the state. It outlines the terms, conditions, and procedures for the merger, ensuring compliance with regulatory requirements and protecting the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.