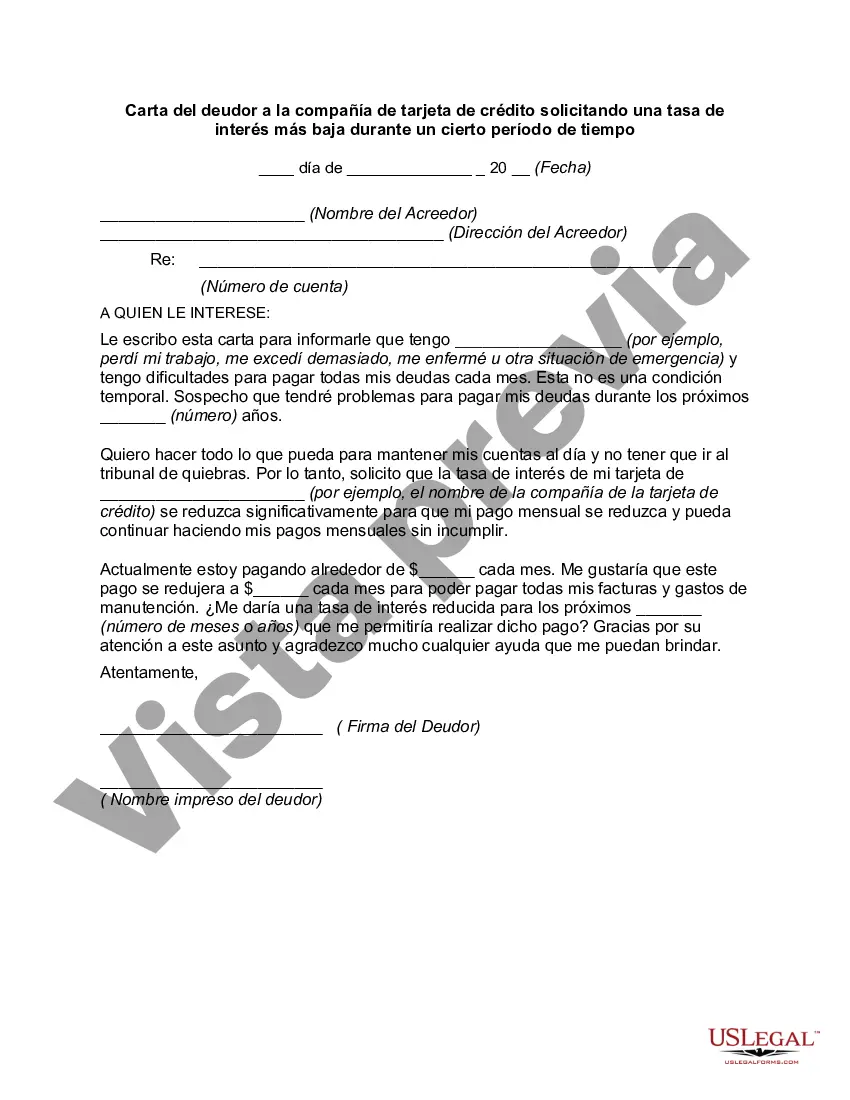

Title: Florida Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In the vibrant state of Florida, debtors seeking financial relief often turn to their credit card companies to request a lower interest rate for a specific period. Writing a well-crafted letter is crucial when addressing this request to ensure the best chance of success. In this article, we will provide a detailed description of what a Florida Letter from a debtor to a credit card company entails, along with relevant keywords to optimize your request. Additionally, we'll outline two types of Florida letters that debtors can use in their pursuit of reduced interest rates. Content: 1. Overview of the Florida Letter: A Florida Letter from a debtor to a credit card company refers to a formal written request to reduce the interest rate charged on an existing credit card balance for a specific time frame. It serves as a persuasive document that highlights the debtor's financial circumstances while presenting a compelling case for the desired interest rate reduction. 2. Elements of a Florida Letter: When composing a letter to request a lower interest rate for a certain period in Florida, it is essential to include the following elements: a) Date: Mention the date of writing the letter. b) Creditor Information: Provide the complete name, address, and contact information of the credit card company. c) Debtor Information: Furnish your full name, address, phone number, and account number(s). d) Introduction: Start with a respectful salutation, and briefly introduce yourself as a valued customer. e) Reason for the Request: Articulate the specific reasons for requesting a lower interest rate, such as financial hardships, medical expenses, or temporary financial setbacks due to unforeseen circumstances (e.g., COVID-19). f) Supporting Documents: Attach relevant documents that bolster your case, such as medical bills, layoff notices, or proof of income reduction. g) Desired Interest Rate and Duration: Clearly state the interest rate you are requesting and the duration for which you seek the reduction. h) Financial Capability: Emphasize your commitment to fulfilling your financial obligations and demonstrate your ability to meet the revised payment terms. i) Conclusion: Express gratitude for their consideration and provide your contact information for any further communication. 3. Relevant Keywords: To enhance the effectiveness of your Florida Letter, consider incorporating the following keywords: — Debrepaymenten— - Financial hardship - Credit card balance — Interest ratreductionio— - Temporary relief — Lower interest rat— - Florida resident — Personal financiasituationio— - Request for compassion — Unforeseen circumstances Types of Florida Letters: 1. Standard Florida Letter: This type of Florida Letter is suitable for debtors experiencing temporary financial difficulties seeking a lower interest rate on their credit card balance for a specific period of time. It follows the guidelines outlined above and emphasizes the debtor's commitment to fulfilling their obligations once the agreed-upon period ends. 2. COVID-19 Related Florida Letter: In light of the ongoing pandemic, debtors in Florida facing financial challenges due to COVID-19 can utilize this type of letter. It focuses on how the pandemic has impacted their financial stability, often including details about job loss, reduced income, or increased medical expenses. These letters aim to appeal to the credit card company's understanding of the extraordinary circumstances individuals are facing. Conclusion: Writing a Florida Letter from a debtor to a credit card company requesting a lower interest rate for a specific period requires careful attention to detail and an understanding of key legal and persuasive components. By crafting a well-structured letter using appropriate keywords, debtors in Florida can effectively communicate their financial hardships and increase their chances of obtaining temporary interest rate relief.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Florida Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

You can commit hours on-line looking for the authorized file web template that fits the state and federal specifications you need. US Legal Forms offers a huge number of authorized varieties which can be reviewed by specialists. You can actually acquire or print out the Florida Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time from our assistance.

If you currently have a US Legal Forms accounts, you may log in and then click the Down load key. After that, you may complete, revise, print out, or indication the Florida Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Every authorized file web template you buy is your own property forever. To have another duplicate of any bought develop, visit the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site for the first time, adhere to the easy guidelines below:

- Initially, make sure that you have chosen the best file web template for that region/city of your choosing. Browse the develop outline to ensure you have selected the correct develop. If accessible, utilize the Preview key to appear from the file web template also.

- If you wish to locate another version of your develop, utilize the Look for field to discover the web template that fits your needs and specifications.

- When you have identified the web template you need, just click Buy now to carry on.

- Select the prices strategy you need, key in your qualifications, and sign up for your account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal accounts to purchase the authorized develop.

- Select the formatting of your file and acquire it to the gadget.

- Make modifications to the file if possible. You can complete, revise and indication and print out Florida Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

Down load and print out a huge number of file themes while using US Legal Forms Internet site, which offers the largest selection of authorized varieties. Use specialist and status-certain themes to deal with your company or person needs.