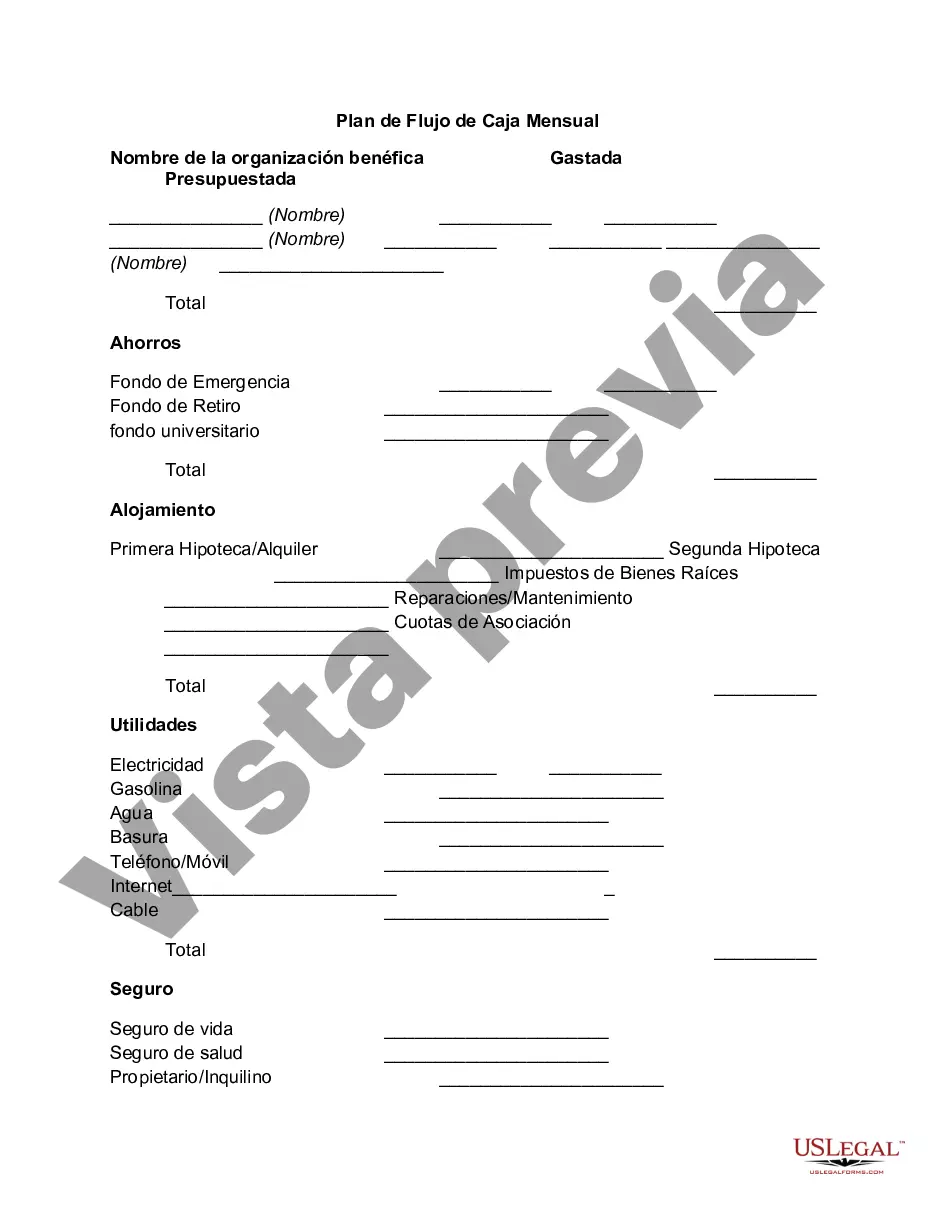

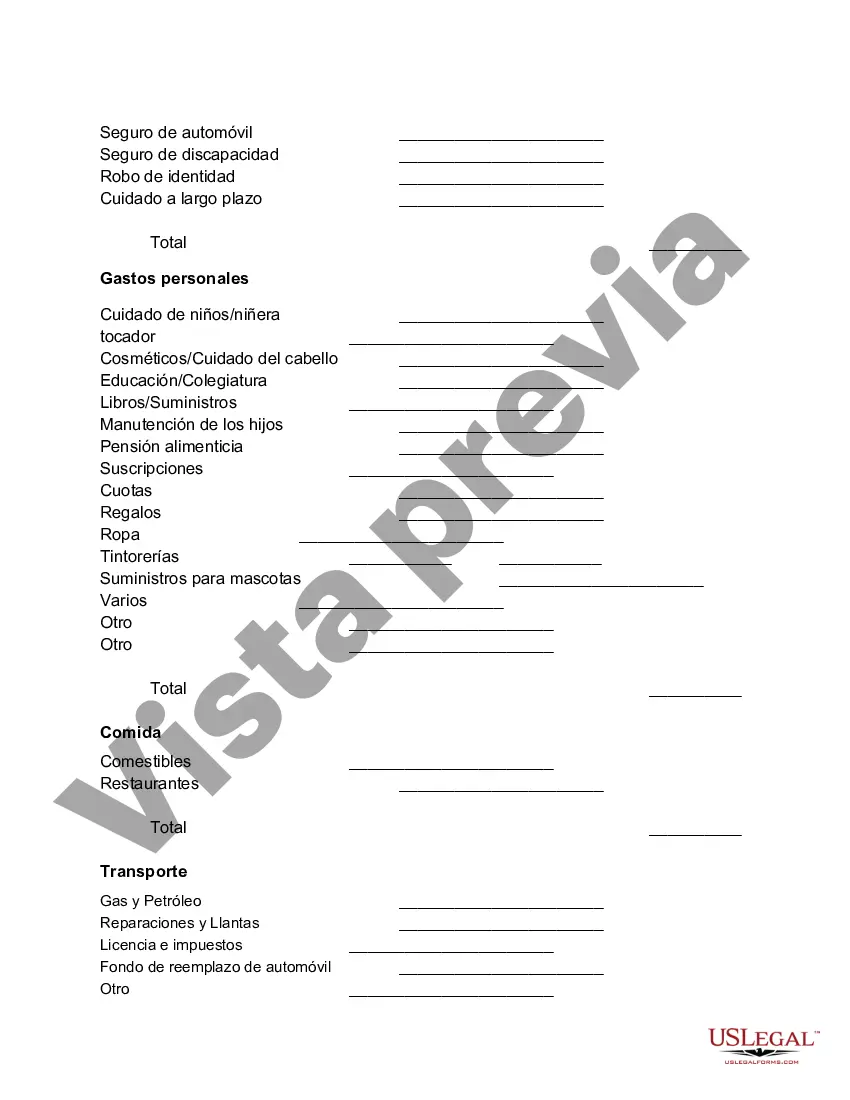

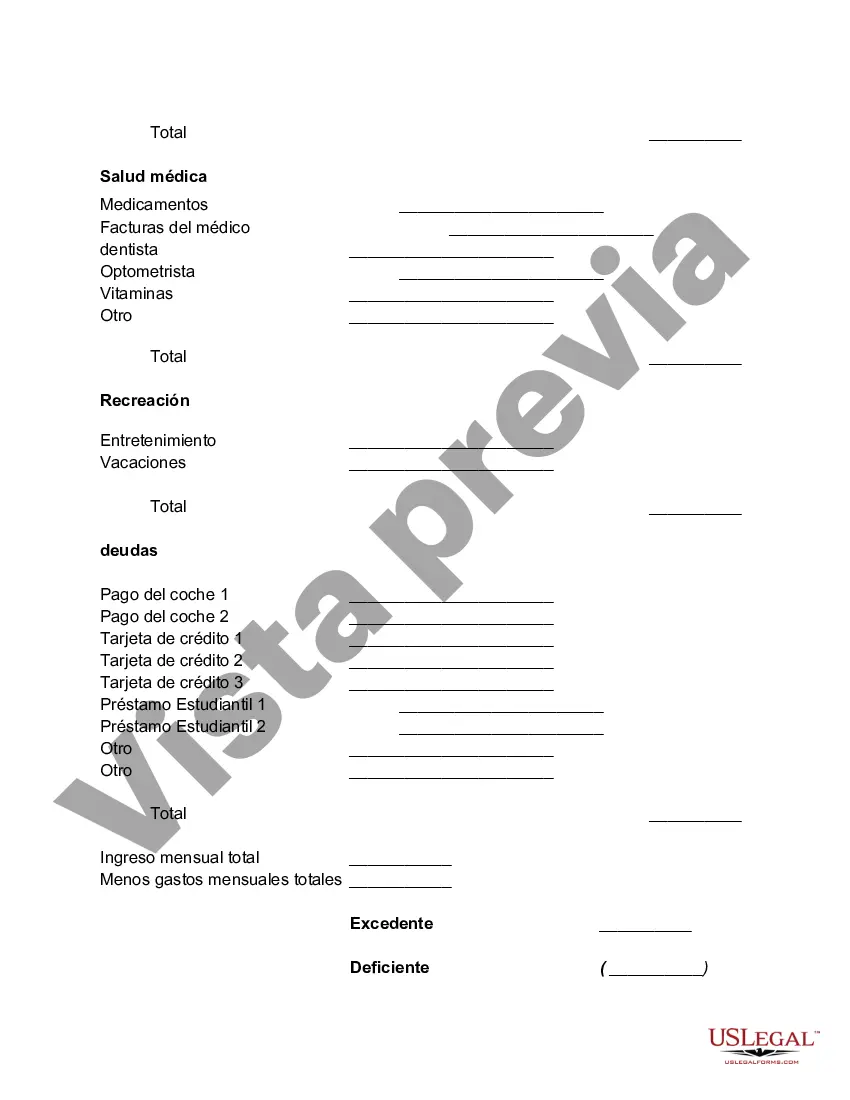

Florida Monthly Cash Flow Plan is a comprehensive financial tool designed to help individuals and families effectively manage their monthly income and expenses in the state of Florida. It provides a structured framework for creating a detailed budget, tracking income sources, and monitoring various expense categories. This plan is particularly tailored to the unique financial landscape and cost of living in Florida. By implementing the Florida Monthly Cash Flow Plan, individuals can gain better control over their money and make informed financial decisions that align with their goals and priorities. This plan enables users to allocate their income to essential expenses such as housing, transportation, utilities, groceries, healthcare, and insurance. It also encourages setting aside funds for savings, emergency reserves, debt repayment, investments, and discretionary spending. The Florida Monthly Cash Flow Plan embraces the concept of financial planning through its emphasis on organizing and tracking cash flow. It provides a clear overview of all income sources and categorizes expenses to ensure a comprehensive understanding of monthly financial inflows and outflows. Furthermore, within the Florida Monthly Cash Flow Plan, there are various types tailored to specific circumstances and financial objectives. These include: 1. Basic Florida Monthly Cash Flow Plan: This plan serves as a foundation for budgeting and cash flow management in Florida. It covers essential expenses, savings, and debt repayment strategies. 2. Florida Monthly Cash Flow Plan for Retirement: Geared towards individuals nearing retirement or those in retirement, this plan focuses on income sources such as pensions, Social Security, and investment returns, while considering potential healthcare costs and lifestyle adjustments. 3. Florida Monthly Cash Flow Plan for Students: Aimed at students in Florida, this plan helps manage income from part-time jobs, scholarships, or parental support, while accounting for education-related expenses and personal spending. 4. Florida Monthly Cash Flow Plan for Small Business Owners: Specifically designed for entrepreneurs in Florida, this plan assists in tracking business revenue, managing operating costs, tax planning, and estimating future cash flows. 5. Florida Monthly Cash Flow Plan for Real Estate Investors: Tailored for individuals involved in real estate investments in Florida, this plan allows for tracking rental income, property expenses, mortgage payments, property management fees, and potential return on investment. Overall, the Florida Monthly Cash Flow Plan provides a structured approach to financial management in Florida, offering flexibility and customization based on different circumstances and financial goals. It is an invaluable tool that empowers individuals to make informed decisions, achieve financial stability, and work towards their long-term financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Florida Plan De Flujo De Caja Mensual?

If you wish to total, down load, or printing lawful document layouts, use US Legal Forms, the greatest collection of lawful varieties, that can be found on-line. Utilize the site`s simple and hassle-free lookup to get the papers you require. Numerous layouts for enterprise and person purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to get the Florida Monthly Cash Flow Plan in a couple of click throughs.

When you are already a US Legal Forms client, log in to your account and then click the Down load switch to find the Florida Monthly Cash Flow Plan. Also you can access varieties you formerly downloaded in the My Forms tab of your own account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for that appropriate city/country.

- Step 2. Utilize the Review method to look through the form`s content material. Never neglect to learn the description.

- Step 3. When you are not happy with the kind, use the Lookup field at the top of the monitor to discover other versions from the lawful kind template.

- Step 4. When you have found the shape you require, click on the Buy now switch. Choose the prices prepare you choose and include your credentials to register for the account.

- Step 5. Method the purchase. You may use your credit card or PayPal account to accomplish the purchase.

- Step 6. Select the format from the lawful kind and down load it on the gadget.

- Step 7. Full, revise and printing or sign the Florida Monthly Cash Flow Plan.

Each lawful document template you get is your own forever. You possess acces to every kind you downloaded with your acccount. Select the My Forms portion and select a kind to printing or down load once again.

Remain competitive and down load, and printing the Florida Monthly Cash Flow Plan with US Legal Forms. There are thousands of professional and express-distinct varieties you may use for your personal enterprise or person demands.