A Florida Private Annuity Agreement is a legal contract where an individual transfers property or assets to another person or entity in exchange for regular fixed payments over a designated period. The agreement is usually established for estate planning purposes, allowing the transferor to obtain income during their lifetime while potentially reducing the value of their taxable estate. In Florida, the Private Annuity Agreement is governed by state law and contains specific terms and conditions that both parties must adhere to. This agreement offers several advantages, including potential tax benefits, creditor protection, and flexibility in estate planning. There are different types of Private Annuity Agreements available in Florida: 1. Standard Private Annuity: This type of agreement involves the transfer of property or assets in exchange for regular annuity payments for the life of the transferor. These payments typically stop upon the death of the transferor or another set term agreed upon in the contract. 2. Private Installment Sale Agreement: This variation allows the transferor to receive payments over a fixed period, usually more than one year, instead of their entire life. The advantage of this type of agreement is that it allows for flexibility in structuring payments to better suit the transferor's financial needs. 3. Deferred Private Annuity Agreement: In this arrangement, the transferor agrees to transfer assets to the annuity holder in exchange for future annuity payments that are deferred until a specified date agreed upon in the contract. This type of agreement allows the transferor to potentially earn interest on the transferred assets during the deferral period. When establishing a Florida Private Annuity Agreement, it is crucial to consult with a qualified attorney or financial advisor who specializes in estate planning. They can provide assistance in drafting a comprehensive agreement that adheres to Florida law and suits your individual needs. In conclusion, a Florida Private Annuity Agreement is a legal contract that allows for the transfer of property or assets in exchange for regular fixed payments over a designated period. There are different types of agreements available, including standard private annuity, private installment sale agreements, and deferred private annuity agreements. Each type offers unique benefits and features, making it essential to seek professional advice to determine which option is most suitable for your specific circumstances.

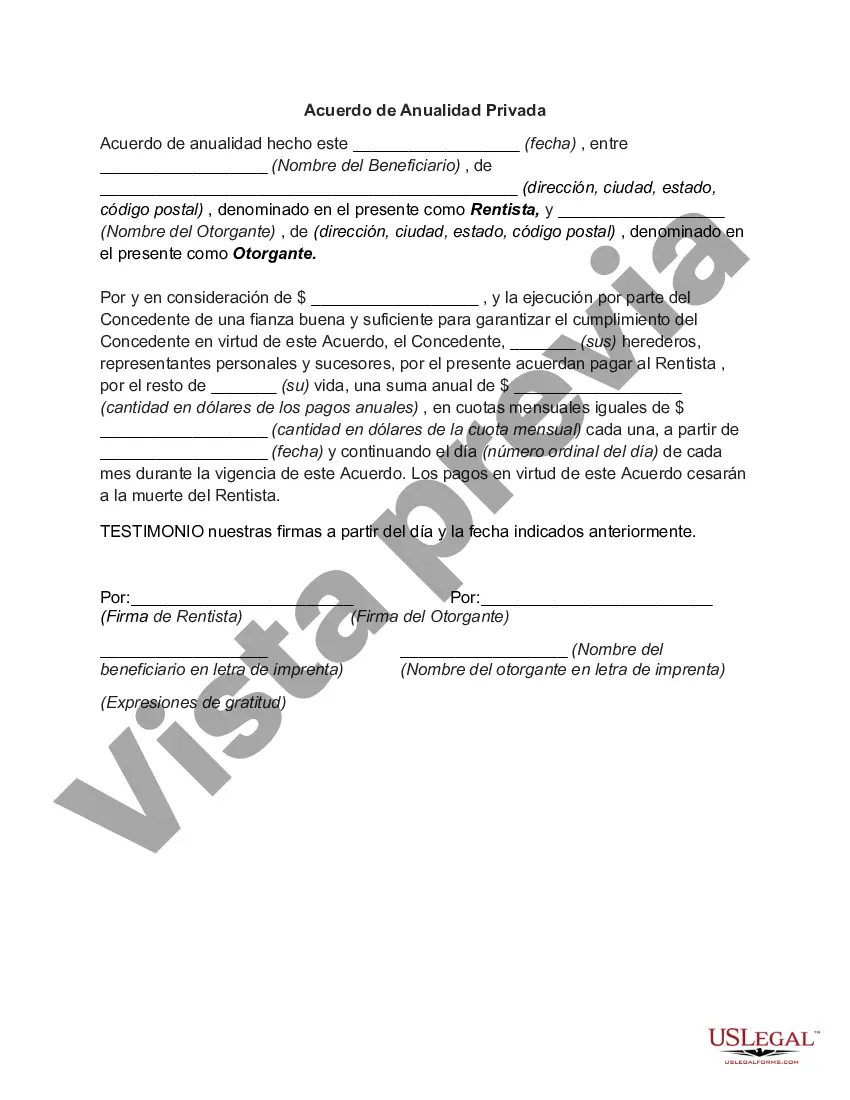

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Florida Acuerdo De Anualidad Privada?

You may devote hours on the Internet attempting to find the lawful file web template that fits the federal and state demands you require. US Legal Forms offers a large number of lawful forms which can be reviewed by professionals. You can easily obtain or printing the Florida Private Annuity Agreement from the services.

If you already have a US Legal Forms accounts, you are able to log in and click the Download button. Afterward, you are able to full, revise, printing, or indication the Florida Private Annuity Agreement. Each lawful file web template you get is your own permanently. To acquire an additional backup of the obtained type, go to the My Forms tab and click the related button.

If you are using the US Legal Forms site for the first time, keep to the simple instructions beneath:

- First, ensure that you have chosen the best file web template for that county/town that you pick. Browse the type description to ensure you have picked the right type. If offered, make use of the Preview button to look with the file web template too.

- In order to discover an additional edition of your type, make use of the Search discipline to get the web template that meets your requirements and demands.

- Once you have identified the web template you need, just click Get now to move forward.

- Pick the prices strategy you need, type your references, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal accounts to pay for the lawful type.

- Pick the format of your file and obtain it in your device.

- Make alterations in your file if required. You may full, revise and indication and printing Florida Private Annuity Agreement.

Download and printing a large number of file templates using the US Legal Forms website, that offers the largest assortment of lawful forms. Use specialist and express-particular templates to deal with your organization or person needs.