Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

How to fill out Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

Are you presently in a position where you often require documentation for various organizational or particular purposes almost daily.

There are numerous legal document templates available online, but locating ones you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, designed to comply with federal and state regulations.

Utilize US Legal Forms, the largest collection of legal documents, to save time and reduce mistakes.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can obtain the Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/state.

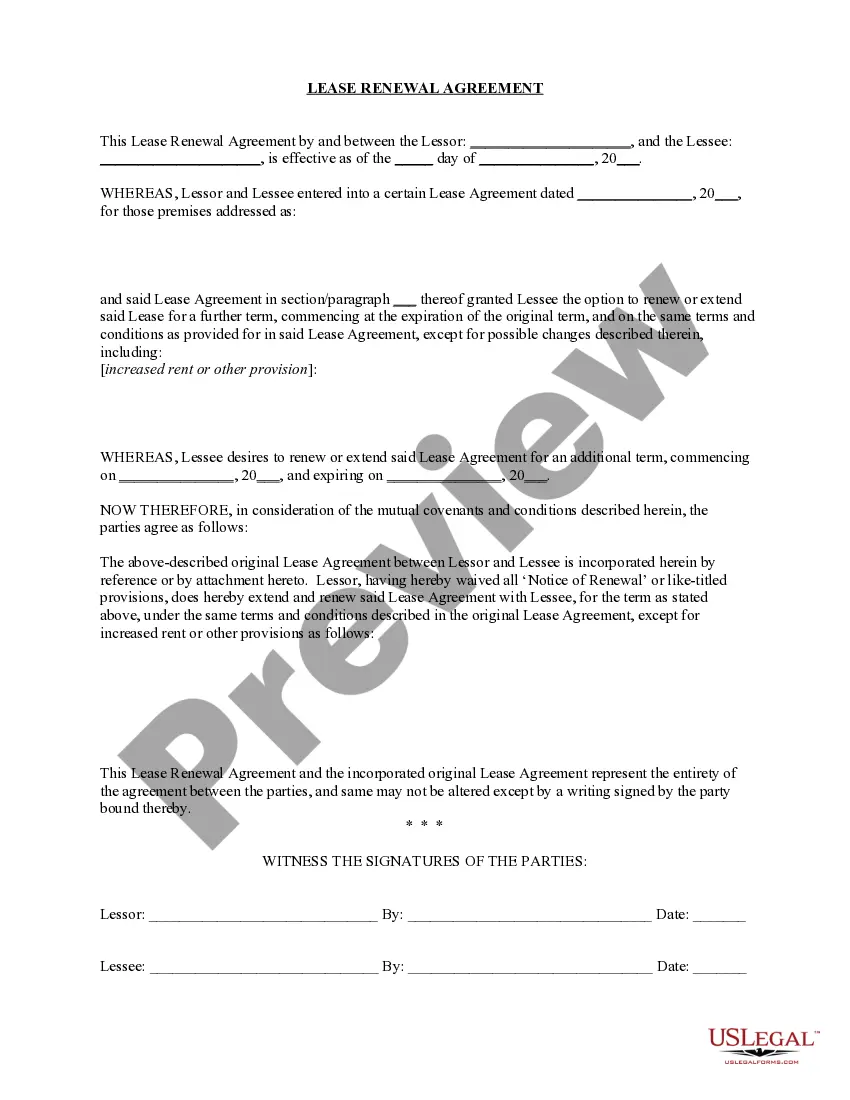

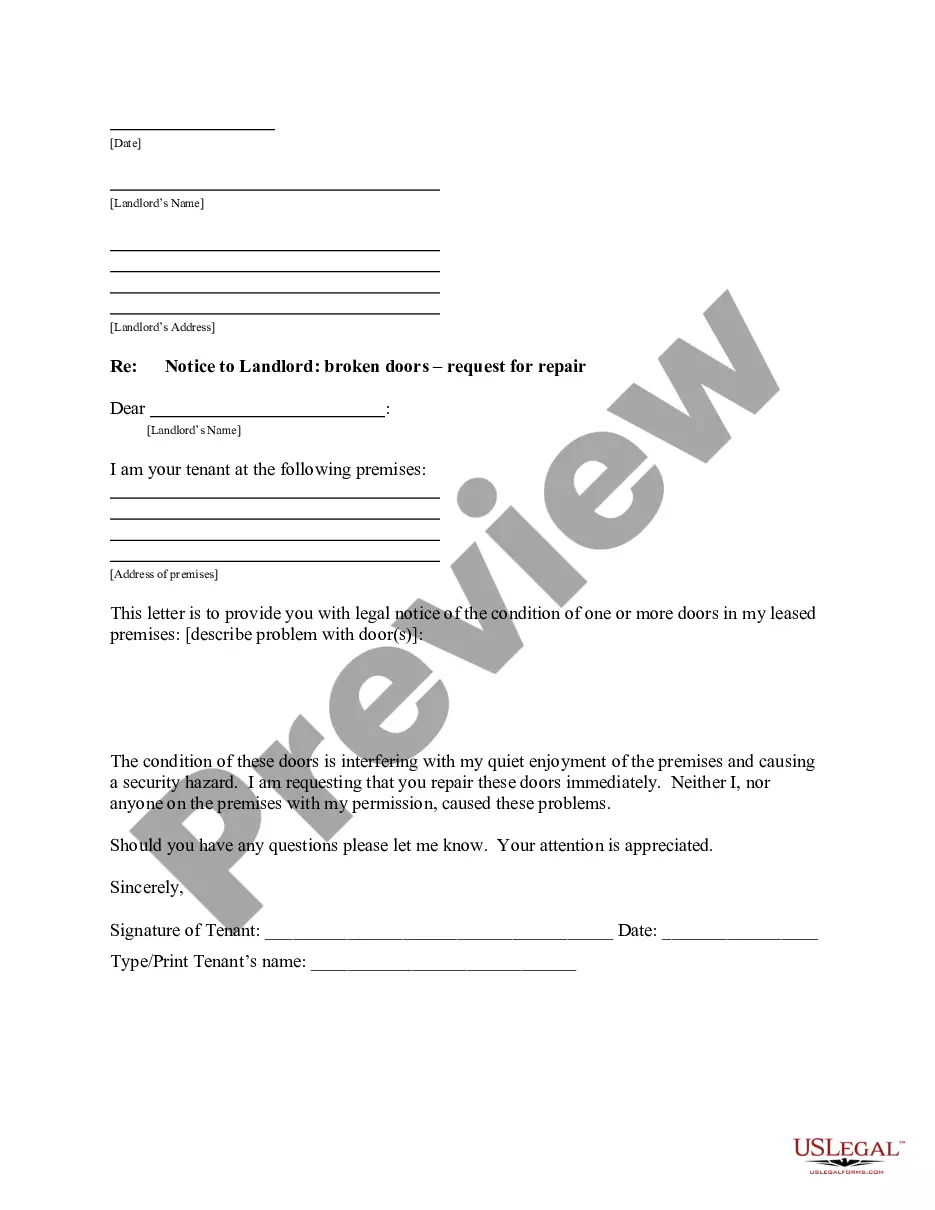

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the right template.

- If the template isn't what you're looking for, use the Lookup field to find a form that suits your needs and requirements.

- Once you find the suitable form, click Acquire now.

- Choose the pricing plan you need, provide the necessary information to create your account, and pay for the order using either your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership at any time, if needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

Using Life Insurance To Fund a Buy-Sell Agreement Life insurance is one of the most popular methods to fund a buy-sell agreement. In this scenario, the company purchases insurance on the life of each of its owners.