The Florida Charitable Contribution Payroll Deduction Form is an important document used by employees to voluntarily donate a portion of their salary to eligible charitable organizations in the state of Florida. This form allows employees to make tax-deductible contributions directly from their payroll, providing an easy and convenient way to support charitable causes. One type of Florida Charitable Contribution Payroll Deduction Form is the standard form used by most employers in the state. This form typically requires employees to provide their personal information, such as name, address, and social security number, along with their desired contribution amount. Employees can choose to contribute a fixed dollar amount or a percentage of their salary on a regular basis, such as monthly or bi-weekly. Another type of Florida Charitable Contribution Payroll Deduction Form is the special campaign form. This form is used during specific fundraising campaigns or events organized by employers or community organizations. It allows employees to contribute to designated charities or causes for a limited time period. The Florida Charitable Contribution Payroll Deduction Form aims to support various charitable organizations registered in the state. Employees have the flexibility to choose from a wide range of eligible charities, including but not limited to education foundations, healthcare-related organizations, disaster relief funds, environmental initiatives, and social welfare programs. By using the Florida Charitable Contribution Payroll Deduction Form, employees can make a positive impact on their communities while enjoying the benefits of tax deductions. This form promotes a culture of giving and empowers employees to give back to causes they feel passionate about. To sum up, the Florida Charitable Contribution Payroll Deduction Form streamlines the process of making charitable contributions for employees, serving as a medium through which they can support eligible charities in the state. It provides flexibility in terms of contribution amount and frequency, enabling employees to conveniently engage in philanthropy and make a meaningful difference in the lives of others.

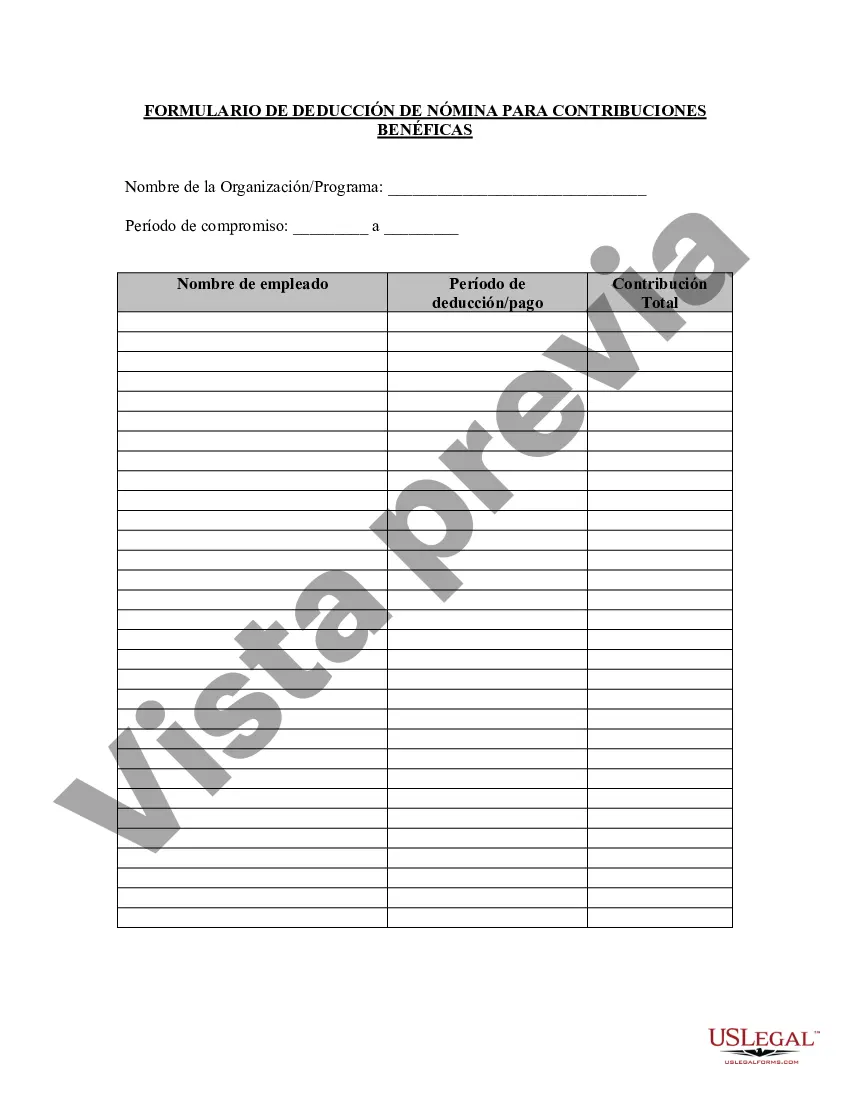

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Florida Formulario De Deducción De Nómina De Contribución Benéfica?

US Legal Forms - one of the biggest libraries of legitimate types in America - delivers a wide array of legitimate papers layouts you are able to acquire or print. Making use of the web site, you can find 1000s of types for company and individual reasons, sorted by categories, claims, or key phrases.You can get the most recent types of types much like the Florida Charitable Contribution Payroll Deduction Form in seconds.

If you already have a registration, log in and acquire Florida Charitable Contribution Payroll Deduction Form through the US Legal Forms library. The Obtain button will show up on each kind you view. You get access to all in the past delivered electronically types inside the My Forms tab of your own profile.

If you would like use US Legal Forms initially, here are simple directions to obtain started off:

- Be sure you have chosen the best kind to your metropolis/state. Click on the Preview button to check the form`s articles. Look at the kind information to actually have selected the right kind.

- If the kind doesn`t match your needs, utilize the Lookup area at the top of the screen to obtain the the one that does.

- Should you be satisfied with the shape, verify your selection by visiting the Acquire now button. Then, opt for the rates prepare you favor and give your accreditations to register to have an profile.

- Approach the deal. Use your Visa or Mastercard or PayPal profile to finish the deal.

- Find the file format and acquire the shape on the device.

- Make modifications. Fill up, change and print and indicator the delivered electronically Florida Charitable Contribution Payroll Deduction Form.

Every single template you added to your money does not have an expiration particular date which is yours eternally. So, if you would like acquire or print yet another copy, just check out the My Forms area and click in the kind you require.

Get access to the Florida Charitable Contribution Payroll Deduction Form with US Legal Forms, one of the most substantial library of legitimate papers layouts. Use 1000s of expert and express-distinct layouts that meet up with your small business or individual needs and needs.