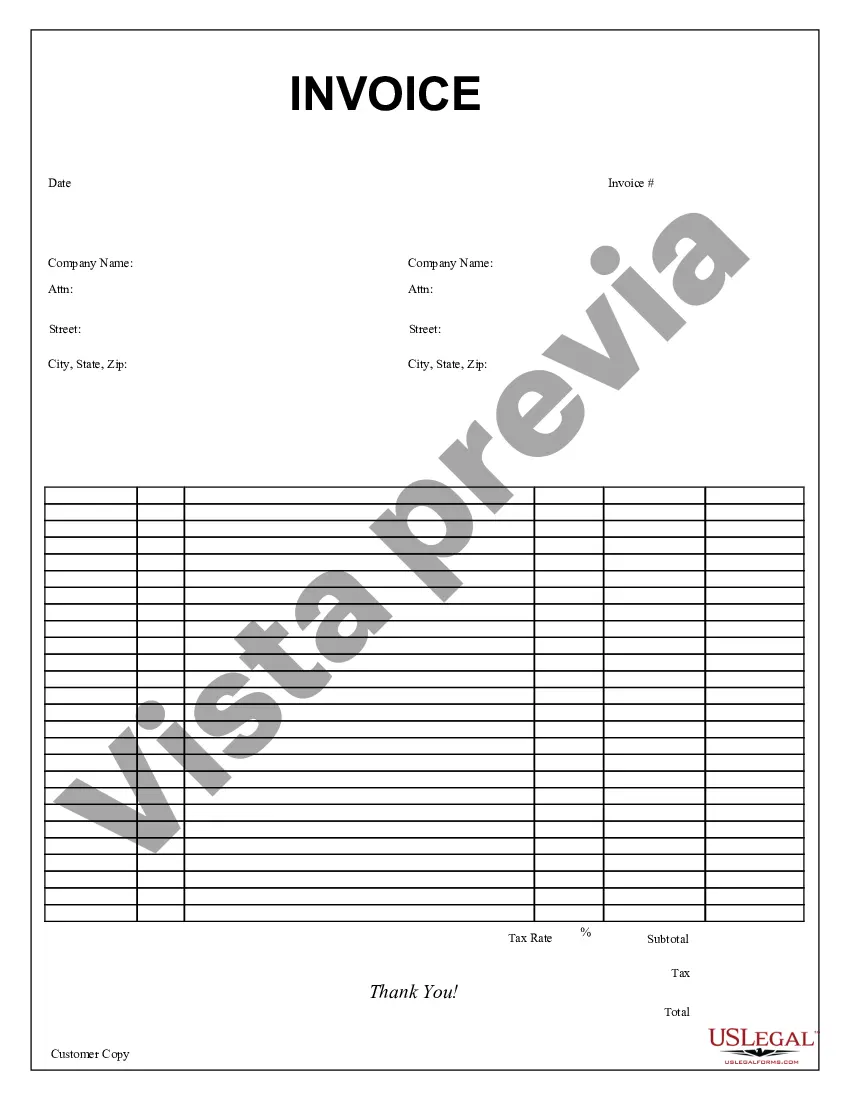

A Florida purchase invoice refers to a document that outlines the details of a purchase transaction conducted within the state of Florida. It serves as evidence of the agreement between the buyer and the seller, providing crucial information related to the purchase such as prices, quantities, item descriptions, payment terms, and any applicable taxes. This invoice is essential for record-keeping purposes, as well as for tax reporting and compliance. Keywords: Florida purchase invoice, purchase transaction, buyer, seller, agreement, prices, quantities, item descriptions, payment terms, taxes, record-keeping, tax reporting, compliance. There are various types of Florida purchase invoices based on the nature of the transaction or the business involved. Some common types include: 1. Retail Purchase Invoice: This type of invoice is generated when a customer purchases goods or products from a retail store in Florida. It includes details such as the customer's name, address, the date and time of purchase, the items bought, their prices, any applicable discounts, sales taxes, and the total amount payable. 2. Wholesale Purchase Invoice: This invoice is used in business-to-business transactions where a company buys products or goods from a wholesaler based in Florida. It contains similar details to a retail purchase invoice but may include additional information specific to wholesale transactions, such as bulk quantities, trade discounts, and any applicable trade terms. 3. Online Purchase Invoice: With the rise of e-commerce, online purchases have become increasingly common. When a Florida-based customer buys products or services online, they receive an online purchase invoice via email or as a downloadable document. This invoice typically includes details such as the customer's name, address, the date and time of purchase, the items or services purchased, their prices, any shipping fees, applicable taxes, and the total amount payable. 4. Service Purchase Invoice: In certain cases, businesses in Florida provide services rather than physical products. In such instances, a service purchase invoice is used to document the transaction. This invoice includes details such as the client's name, address, the date and time of service, a description of the services provided, the hourly rate or flat fee, any applicable taxes, and the total amount due. It is crucial for both buyers and sellers to retain copies of these Florida purchase invoices for their financial records, as they provide a comprehensive overview of the transaction and can be used as evidence in case of disputes or audits. Additionally, these invoices aid in maintaining accurate accounting and tax records, ensuring compliance with Florida's tax laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Factura de compra - Purchase Invoice

Description

How to fill out Florida Factura De Compra?

Finding the right lawful document format might be a struggle. Naturally, there are a variety of templates available on the Internet, but how will you obtain the lawful develop you will need? Use the US Legal Forms website. The service offers a large number of templates, for example the Florida Purchase Invoice, that you can use for organization and personal demands. All of the types are checked out by professionals and meet up with state and federal requirements.

In case you are currently registered, log in to the profile and click the Down load switch to have the Florida Purchase Invoice. Use your profile to search through the lawful types you might have bought formerly. Check out the My Forms tab of your own profile and obtain an additional copy from the document you will need.

In case you are a new end user of US Legal Forms, allow me to share simple instructions for you to adhere to:

- Initial, make certain you have chosen the correct develop for your town/region. You may look over the form using the Review switch and look at the form explanation to make sure this is basically the best for you.

- When the develop will not meet up with your expectations, make use of the Seach industry to find the appropriate develop.

- When you are certain that the form would work, click on the Buy now switch to have the develop.

- Opt for the pricing strategy you need and enter the needed information and facts. Create your profile and buy an order using your PayPal profile or Visa or Mastercard.

- Pick the document file format and obtain the lawful document format to the gadget.

- Total, revise and printing and indicator the obtained Florida Purchase Invoice.

US Legal Forms will be the biggest catalogue of lawful types where you can find different document templates. Use the service to obtain expertly-made files that adhere to status requirements.