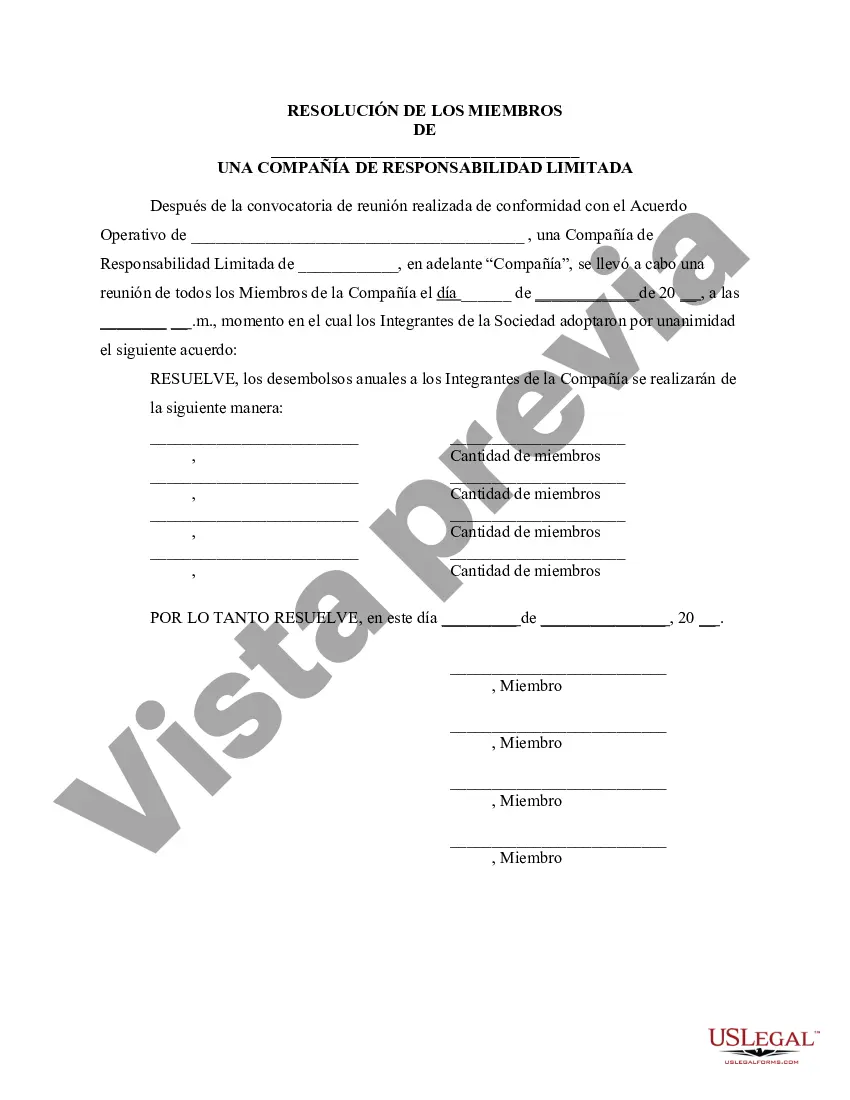

Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a formal document that outlines the decisions made by the members of a limited liability company (LLC) regarding the amount of annual disbursements that will be distributed to the company's members. This resolution is crucial in managing the financial operations of an LLC and determining the allocation of profits among its members. Keywords: Florida, Resolution of Meeting, LLC Members, Annual Disbursements, Company Different types of Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company may include: 1. Resolution to Determine Annual Disbursement Amount: This type of resolution is used when the LLC members gather to decide on the specific amount of money that will be disbursed to the company's members annually. The resolution should specify the exact dollar amount or a predetermined calculation method for determining the disbursement. 2. Resolution to Allocate Disbursements Proportionately: This resolution is implemented when the LLC members agree to allocate annual disbursements based on each member's ownership interest or percentage share in the company. The resolution should clearly state the percentage or fractional amount of disbursements each member will receive. 3. Resolution to Establish Disbursement Guidelines: In this type of resolution, the LLC members collectively create a set of guidelines or criteria to determine the amount and eligibility of annual disbursements. The guidelines can be based on factors such as individual contributions to the company, seniority, or any other relevant criteria agreed upon by the members. 4. Resolution to Revise Annual Disbursement Amount: This resolution comes into effect when the LLC members propose a change in the previously agreed-upon annual disbursement amount. The resolution should outline the reasons for the revision and the new amount that will be implemented. 5. Resolution to Ratify Previous Disbursements: This type of resolution is used to officially approve and ratify the disbursements made in previous years. This ensures that all members are in agreement with the past allocation of funds and serves as a record for financial transparency and compliance purposes. Remember, it is important to consult with legal professionals or advisors when drafting and executing any resolutions to ensure compliance with Florida state laws and your LLC's operating agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Florida Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

If you wish to total, down load, or print out lawful file layouts, use US Legal Forms, the biggest selection of lawful kinds, which can be found on the Internet. Make use of the site`s simple and easy hassle-free lookup to obtain the papers you will need. Various layouts for business and specific functions are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company in a couple of mouse clicks.

When you are currently a US Legal Forms consumer, log in to your account and click the Obtain switch to obtain the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. You may also entry kinds you earlier downloaded inside the My Forms tab of your own account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for that proper area/land.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Don`t overlook to read the description.

- Step 3. When you are not satisfied with the kind, utilize the Search area towards the top of the screen to get other versions of the lawful kind template.

- Step 4. After you have found the form you will need, select the Buy now switch. Choose the costs plan you prefer and put your accreditations to register for an account.

- Step 5. Process the purchase. You should use your credit card or PayPal account to complete the purchase.

- Step 6. Pick the file format of the lawful kind and down load it in your gadget.

- Step 7. Total, edit and print out or sign the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Each and every lawful file template you acquire is yours for a long time. You might have acces to each kind you downloaded with your acccount. Select the My Forms portion and choose a kind to print out or down load once again.

Contend and down load, and print out the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with US Legal Forms. There are many skilled and status-certain kinds you can use for the business or specific needs.