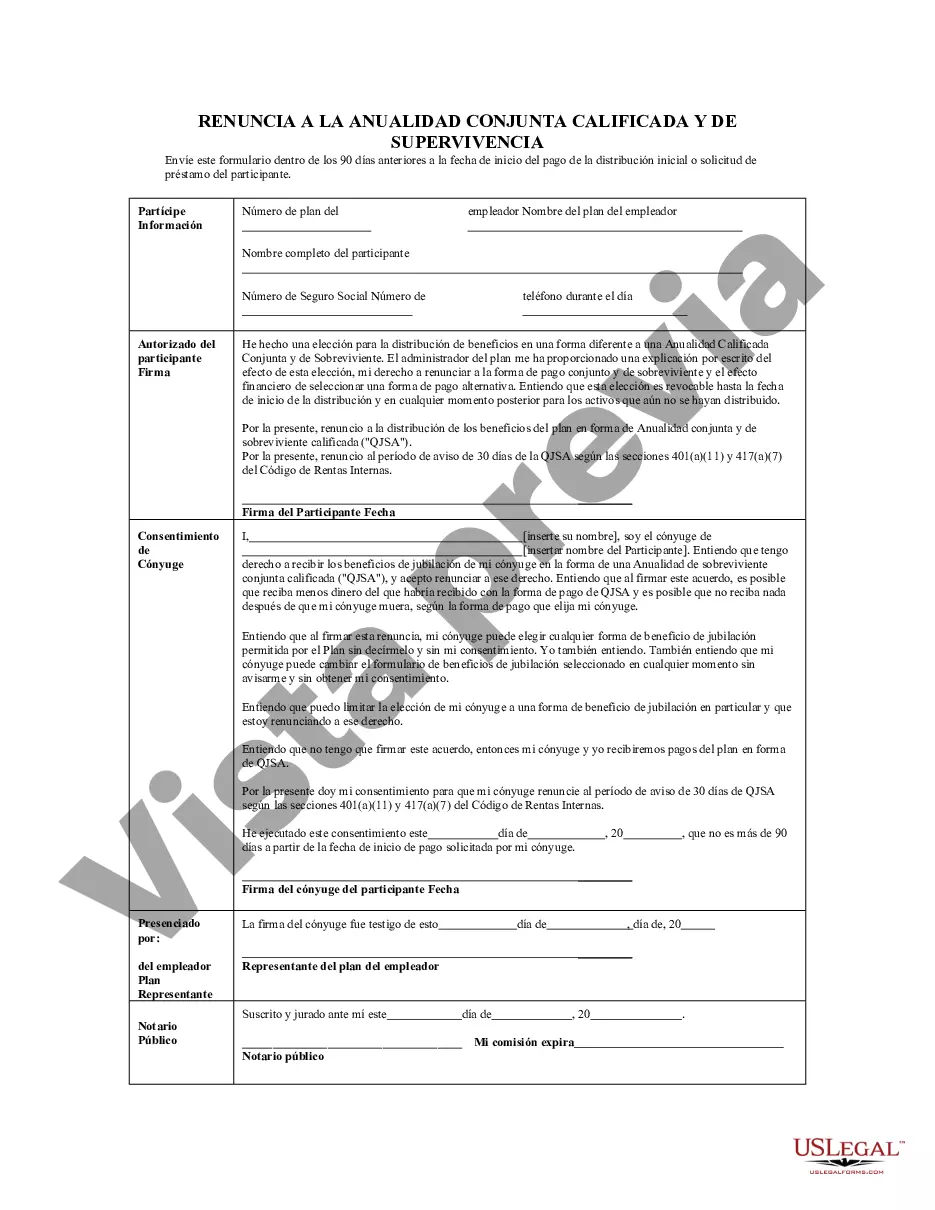

The Florida Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows an individual to waive their right to receive a joint and survivor annuity, which is typically provided under qualified retirement plans. This waiver enables the participant to receive their retirement benefits in a different form, giving them more flexibility and control over their funds. The JSA requirement ensures that retirement plan participants with a spouse receive a lifetime income stream and that their spouse continues to receive support after the participant's death. It states that unless a valid waiver is obtained, the participant's pension benefits must be paid as a joint and survivor annuity, where the benefits continue to the surviving spouse after the participant's passing. In the Florida Waiver of JSA, different types of waivers may exist to suit various circumstances. Some of these types include: 1. Partial Waiver: This type of waiver allows the retirement plan participant to waive a portion of their joint and survivor annuity, while still ensuring their spouse receives a reduced benefit upon their death. 2. Full Waiver: With a full waiver, the retirement plan participant relinquishes their entire right to a joint and survivor annuity. This means that upon the participant's death, the surviving spouse will not receive any further benefits from the annuity. 3. Alternate Beneficiary Designation: Some Florida JSA waivers may provide the option to designate an alternative beneficiary, such as a child or dependent, to receive the benefits instead of the surviving spouse. It's important to note that these types of waivers must meet certain legal requirements to be considered valid and enforceable. The participant must fully understand the implications of waiving their right to a joint and survivor annuity and should consult with a qualified attorney or financial advisor to ensure their decision aligns with their financial goals and circumstances. In conclusion, the Florida Waiver of Qualified Joint and Survivor Annuity (JSA) offers retirement plan participants the flexibility to choose alternative options for their retirement benefits, such as partial or full waivers, or designating an alternate beneficiary. Understanding the different types of waivers and seeking professional advice can help individuals make informed decisions about their retirement income streams.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Florida Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Florida Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

If you wish to complete, down load, or print out legitimate record layouts, use US Legal Forms, the biggest assortment of legitimate kinds, which can be found on-line. Use the site`s simple and convenient look for to obtain the papers you will need. Different layouts for organization and person purposes are sorted by categories and states, or search phrases. Use US Legal Forms to obtain the Florida Waiver of Qualified Joint and Survivor Annuity - QJSA in a couple of clicks.

If you are currently a US Legal Forms buyer, log in to the profile and click on the Obtain key to get the Florida Waiver of Qualified Joint and Survivor Annuity - QJSA. You can also entry kinds you formerly downloaded in the My Forms tab of your profile.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that proper metropolis/country.

- Step 2. Use the Preview option to check out the form`s articles. Don`t forget about to read through the information.

- Step 3. If you are not satisfied using the develop, make use of the Look for discipline at the top of the display screen to discover other versions of your legitimate develop web template.

- Step 4. After you have located the form you will need, click the Buy now key. Opt for the rates prepare you choose and add your credentials to sign up to have an profile.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal profile to finish the financial transaction.

- Step 6. Choose the structure of your legitimate develop and down load it in your gadget.

- Step 7. Complete, revise and print out or sign the Florida Waiver of Qualified Joint and Survivor Annuity - QJSA.

Each legitimate record web template you get is the one you have forever. You might have acces to each develop you downloaded with your acccount. Click on the My Forms area and choose a develop to print out or down load again.

Contend and down load, and print out the Florida Waiver of Qualified Joint and Survivor Annuity - QJSA with US Legal Forms. There are millions of professional and status-certain kinds you may use for your organization or person needs.