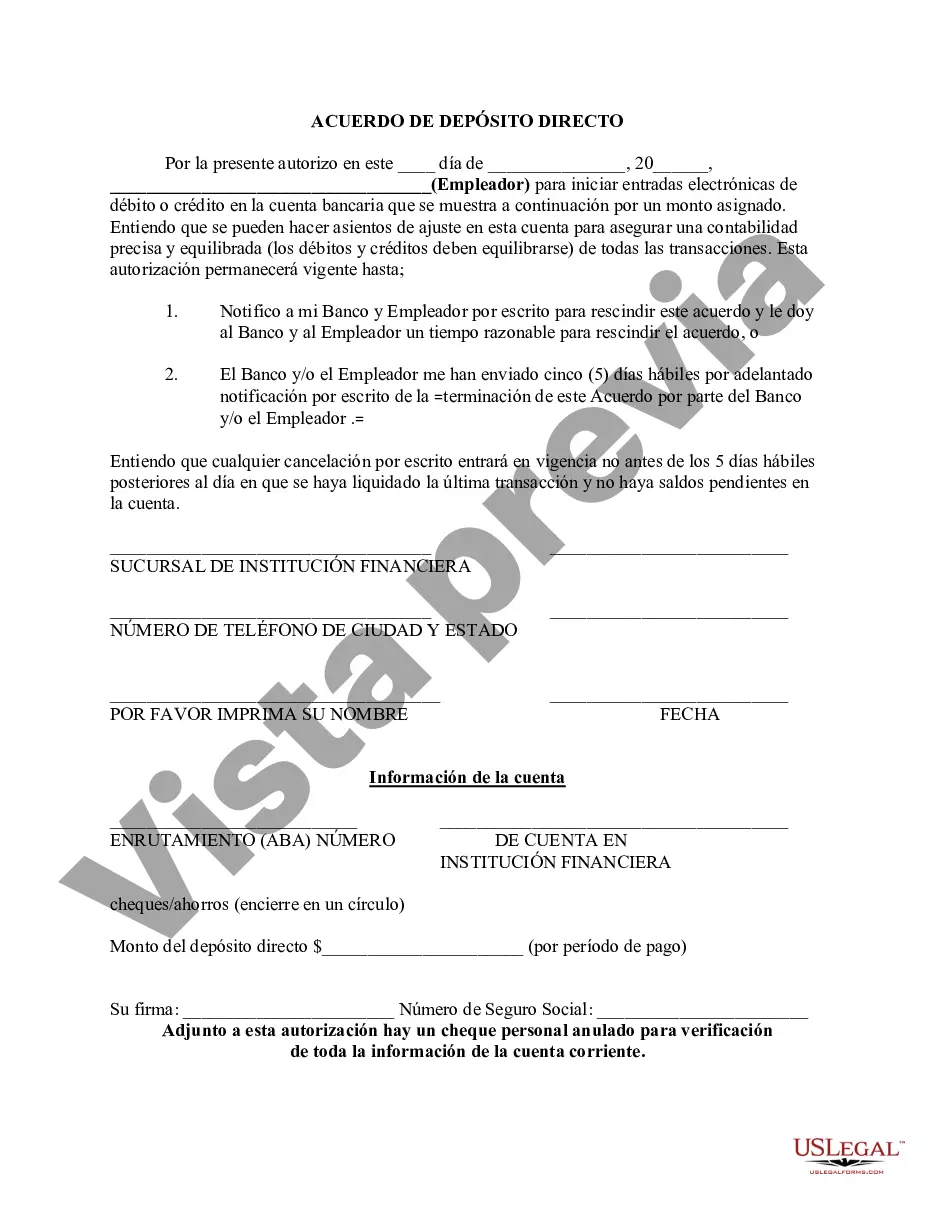

Georgia Direct Deposit Form for Bank of America is a document used by individuals residing in the state of Georgia to authorize the electronic deposit of their income, government benefits, or any other recurring payments directly into their Bank of America account. This form eliminates the need for paper checks and provides a convenient, secure, and efficient way to receive funds. The Georgia Direct Deposit Form for Bank of America typically requires the depositor's personal information, including their full name, address, Social Security Number (SSN), contact details, and Bank of America account number. In addition, the form may ask for the account type (checking or savings) and the bank's routing number to ensure the funds are deposited into the correct account. It is important to note that there may be different types or variations of the Georgia Direct Deposit Form for Bank of America, depending on the purpose of the deposit. Some common variants may include: 1. Payroll Direct Deposit Form: This form is used by employees to authorize their employers to directly deposit their paychecks into their Bank of America account. It typically requires information such as the employer's name, address, and the employee's identification or employee ID number. 2. Government Benefits Direct Deposit Form: Individuals who receive government benefits, such as Social Security, disability, or unemployment, can use this form to authorize the direct deposit of their payments into their Bank of America account. The form may require additional information, such as the name of the government agency providing the benefits and the claim or benefit ID. 3. Pension or Retirement Direct Deposit Form: Retirees or pensioners who receive regular pension or retirement payments can utilize this form to set up direct deposits into their Bank of America account. The form may ask for details about the pension or retirement plan, including the plan administrator's name and contact information. These are just a few examples of the different types of Georgia Direct Deposit Form options available at Bank of America. Depending on the specific source of income, there may be additional variations ensuring the correct authorization and accuracy of the direct deposit process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Formulario de depósito directo para Bank America - Direct Deposit Form for Bank America

Description

How to fill out Georgia Formulario De Depósito Directo Para Bank America?

US Legal Forms - one of many greatest libraries of lawful forms in the USA - delivers a wide range of lawful papers web templates it is possible to acquire or print out. While using website, you may get 1000s of forms for enterprise and person purposes, sorted by categories, suggests, or keywords and phrases.You will discover the latest versions of forms much like the Georgia Direct Deposit Form for Bank America in seconds.

If you have a membership, log in and acquire Georgia Direct Deposit Form for Bank America from your US Legal Forms local library. The Down load option will show up on every form you view. You have access to all in the past saved forms within the My Forms tab of your own accounts.

In order to use US Legal Forms initially, listed here are straightforward guidelines to get you started off:

- Make sure you have picked out the best form for the city/region. Select the Review option to examine the form`s articles. See the form description to actually have chosen the appropriate form.

- In case the form doesn`t suit your demands, make use of the Research discipline at the top of the display to get the one that does.

- If you are pleased with the form, verify your selection by visiting the Buy now option. Then, opt for the prices prepare you favor and supply your accreditations to register for the accounts.

- Procedure the financial transaction. Utilize your bank card or PayPal accounts to finish the financial transaction.

- Pick the structure and acquire the form in your gadget.

- Make modifications. Load, modify and print out and signal the saved Georgia Direct Deposit Form for Bank America.

Each and every format you included with your account lacks an expiry day and is also your own property for a long time. So, if you want to acquire or print out one more backup, just check out the My Forms portion and click on in the form you will need.

Get access to the Georgia Direct Deposit Form for Bank America with US Legal Forms, probably the most substantial local library of lawful papers web templates. Use 1000s of expert and express-particular web templates that fulfill your company or person demands and demands.