A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

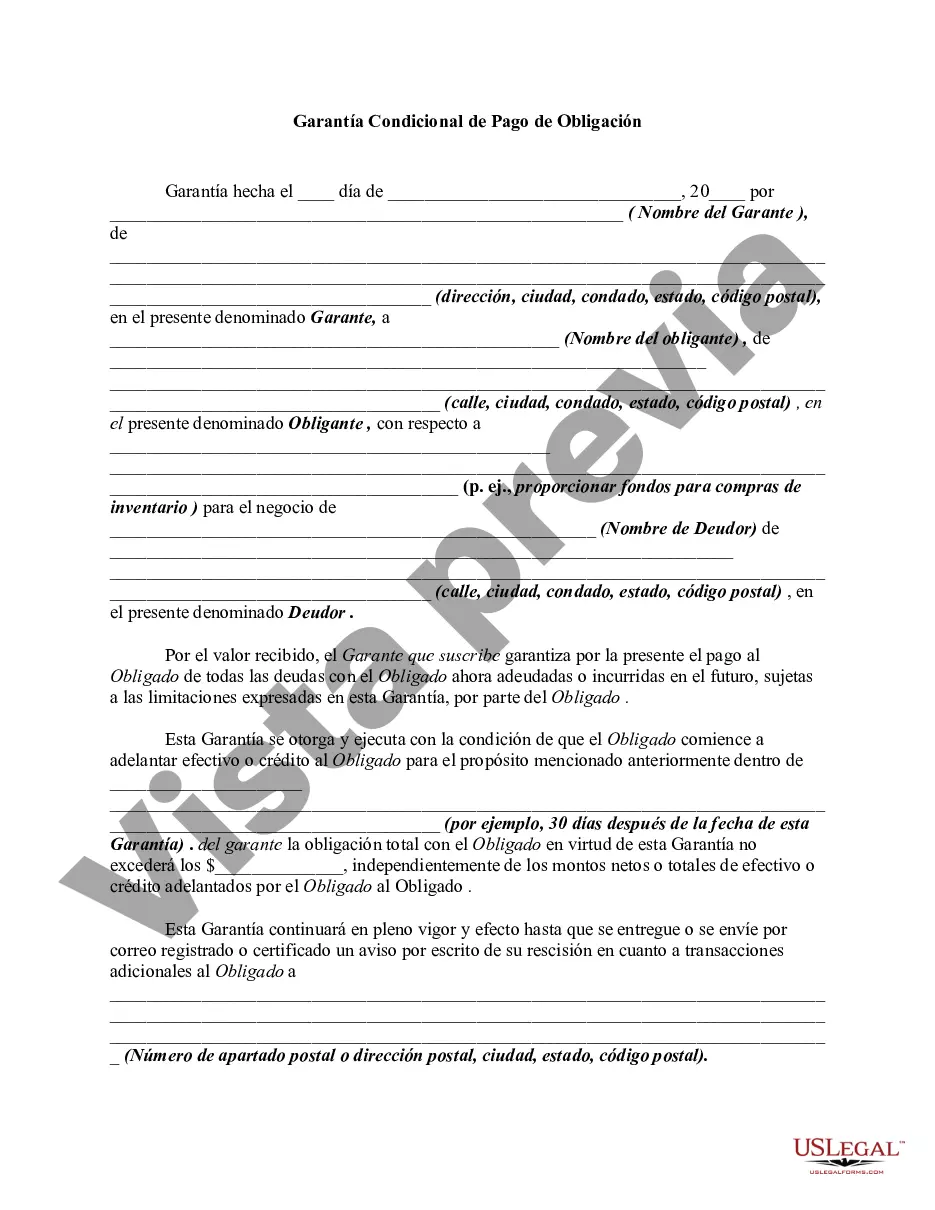

A Georgia Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to be responsible for the payment of a debt or obligation if the primary debtor fails to fulfill their obligations. This type of guaranty provides an additional layer of security for lenders, ensuring that they have recourse in case the borrower defaults. The Georgia Conditional Guaranty of Payment of Obligation is a binding contract that defines the rights, responsibilities, and obligations of both the guarantor and the creditor. It specifies the amount of the debt or obligation, the terms of repayment, and the circumstances under which the guarantor becomes liable, typically after the primary debtor fails to make payments or otherwise breaches the agreement. There are different types of Georgia Conditional Guaranty of Payment of Obligation that can be tailored to suit specific requirements. Some variations include: 1. Unconditional Guaranty: This type of guaranty holds the guarantor fully liable for the entirety of the debt or obligation, with no conditions or limitations. 2. Limited Guaranty: In contrast to an unconditional guaranty, a limited guaranty imposes restrictions on the guarantor's liability. For example, it may include a cap on the amount for which the guarantor will be responsible, or it may specify that the guarantor is only liable for a certain percentage of the debt. 3. Continuing Guaranty: A continuing guaranty remains in effect even if the primary debt is paid off and the obligation is satisfied. This means that the guarantor's liability persists and extends to any future debts or obligations entered into by the borrower. 4. Specific Guaranty: A specific guaranty is limited to a particular debt or obligation. It does not extend to other debts or agreements entered into by the borrower. When drafting or reviewing a Georgia Conditional Guaranty of Payment of Obligation, it is crucial to ensure that all relevant provisions are included, such as the conditions triggering the guarantor's liability, the method and timeline of notice required, and any specific terms related to default or acceleration of the debt. In conclusion, a Georgia Conditional Guaranty of Payment of Obligation is an essential legal document that outlines the terms and conditions of the guarantor's responsibility for the payment of a debt. With various types available, it is important to carefully consider the specific requirements and tailor the guaranty accordingly to protect the interests of both the creditor and the guarantor.A Georgia Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to be responsible for the payment of a debt or obligation if the primary debtor fails to fulfill their obligations. This type of guaranty provides an additional layer of security for lenders, ensuring that they have recourse in case the borrower defaults. The Georgia Conditional Guaranty of Payment of Obligation is a binding contract that defines the rights, responsibilities, and obligations of both the guarantor and the creditor. It specifies the amount of the debt or obligation, the terms of repayment, and the circumstances under which the guarantor becomes liable, typically after the primary debtor fails to make payments or otherwise breaches the agreement. There are different types of Georgia Conditional Guaranty of Payment of Obligation that can be tailored to suit specific requirements. Some variations include: 1. Unconditional Guaranty: This type of guaranty holds the guarantor fully liable for the entirety of the debt or obligation, with no conditions or limitations. 2. Limited Guaranty: In contrast to an unconditional guaranty, a limited guaranty imposes restrictions on the guarantor's liability. For example, it may include a cap on the amount for which the guarantor will be responsible, or it may specify that the guarantor is only liable for a certain percentage of the debt. 3. Continuing Guaranty: A continuing guaranty remains in effect even if the primary debt is paid off and the obligation is satisfied. This means that the guarantor's liability persists and extends to any future debts or obligations entered into by the borrower. 4. Specific Guaranty: A specific guaranty is limited to a particular debt or obligation. It does not extend to other debts or agreements entered into by the borrower. When drafting or reviewing a Georgia Conditional Guaranty of Payment of Obligation, it is crucial to ensure that all relevant provisions are included, such as the conditions triggering the guarantor's liability, the method and timeline of notice required, and any specific terms related to default or acceleration of the debt. In conclusion, a Georgia Conditional Guaranty of Payment of Obligation is an essential legal document that outlines the terms and conditions of the guarantor's responsibility for the payment of a debt. With various types available, it is important to carefully consider the specific requirements and tailor the guaranty accordingly to protect the interests of both the creditor and the guarantor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.