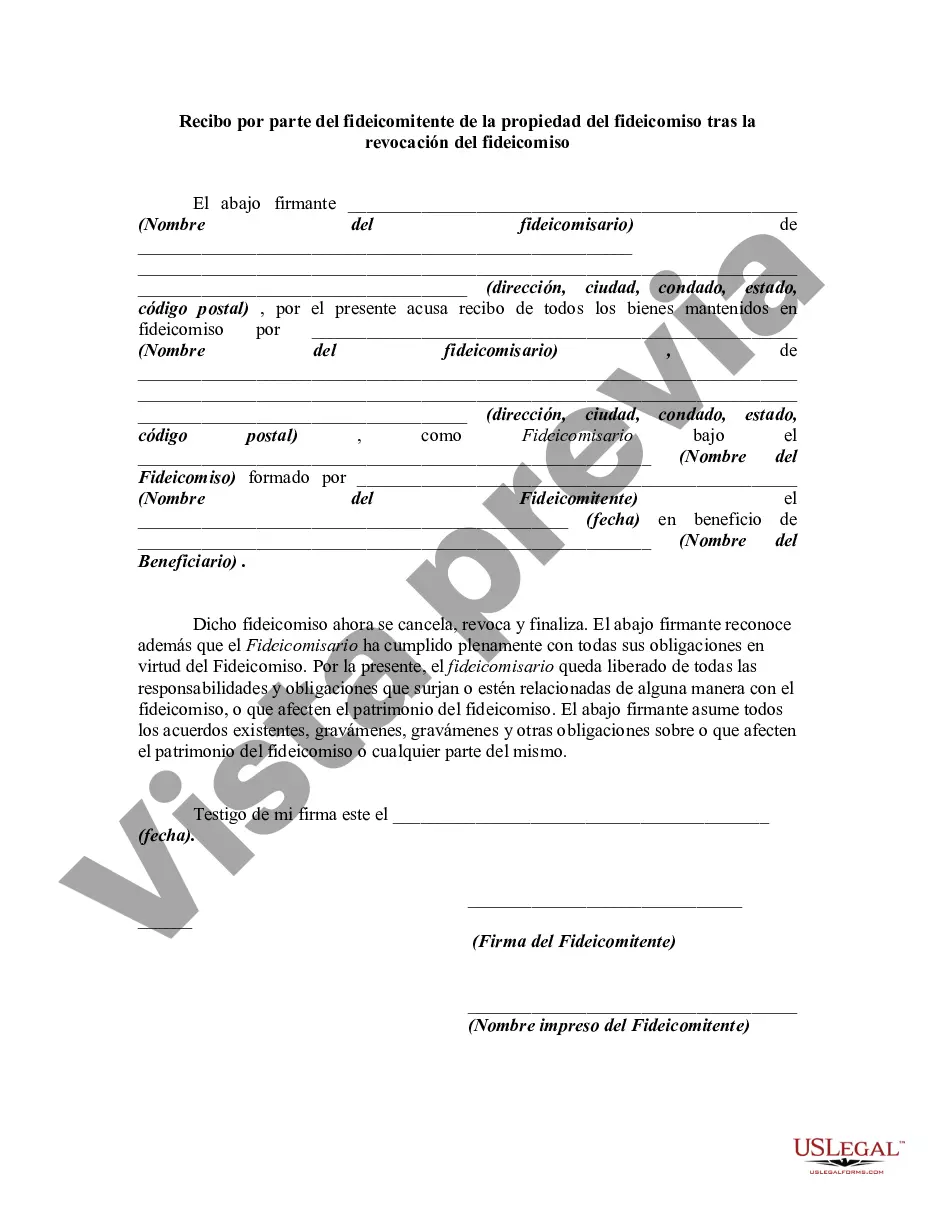

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust serves as a legal document that acknowledges the return of trust property to the trust or after the revocation of a trust in the state of Georgia. This detailed description will provide insights into the purpose, elements, and significance of the Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust, along with the different types associated with it. The Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust is a crucial document that ensures a smooth transition of assets from a trust back to the trust or upon the revocation of the trust. When a trust is revoked, the trust property, including any real estate, financial investments, or personal belongings held within the trust, needs to be transferred back to the trust or. The receipt acts as evidence that the trust or has received all the trust property to which they are entitled. Key elements included in the Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust are: 1. Trust or Information: The document begins by capturing the trust or's details, including their full legal name, address, and contact information. This information ensures that the receipt is specific to the trust or revoking the trust. 2. Trust Information: The document then outlines the details of the trust being revoked, such as the trust's name and the date it was established. These details help in identifying the specific trust in question. 3. Property Description: The receipt provides a comprehensive description of the trust property being returned to the trust or. It includes a detailed inventory of all assets, including real estate properties, bank accounts, stocks, bonds, valuable possessions, or any other property held within the trust. 4. Trustee Details: The receipt mentions the name and contact information of the trustee responsible for returning the trust property. This information acts as a reference point for any future communication or clarification related to the trust assets. 5. Signatures: To validate the receipt, both the trust or and the trustee need to sign and date the document. These signatures signify that the trust or acknowledges the receipt of the trust property, and the trustee confirms the transfer of assets back to the trust or. Different types of Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust can include variations based on the type of trust being revoked, such as: 1. Living Trust Revocation Receipt: This type of receipt is used when a living trust, created during the trust or's lifetime, is revoked. It ensures a smooth transfer of assets from the living trust back to the trust or. 2. Testamentary Trust Revocation Receipt: When a testamentary trust, established through a will, is revoked, this type of receipt is utilized. It acts as proof that the trust or has received all the trust property mentioned in the will. 3. Revocable Trust Revocation Receipt: This receipt is used when a revocable trust is revoked by the trust or. It ensures the transfer of assets held within the revocable trust back to the trust or. In conclusion, the Georgia Receipt by Trust or for Trust Property Upon Revocation of Trust is a vital legal document used in the state of Georgia to acknowledge the return of trust property to the trust or after the revocation of a trust. It encompasses all the necessary information to accurately identify the trust or, the trust being revoked, and the trust property being transferred. By providing a comprehensive description of the trust assets and obtaining the signatures of both the trust or and trustee, this receipt serves as an essential record to ensure a smooth transition of assets and prevent any disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.