The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

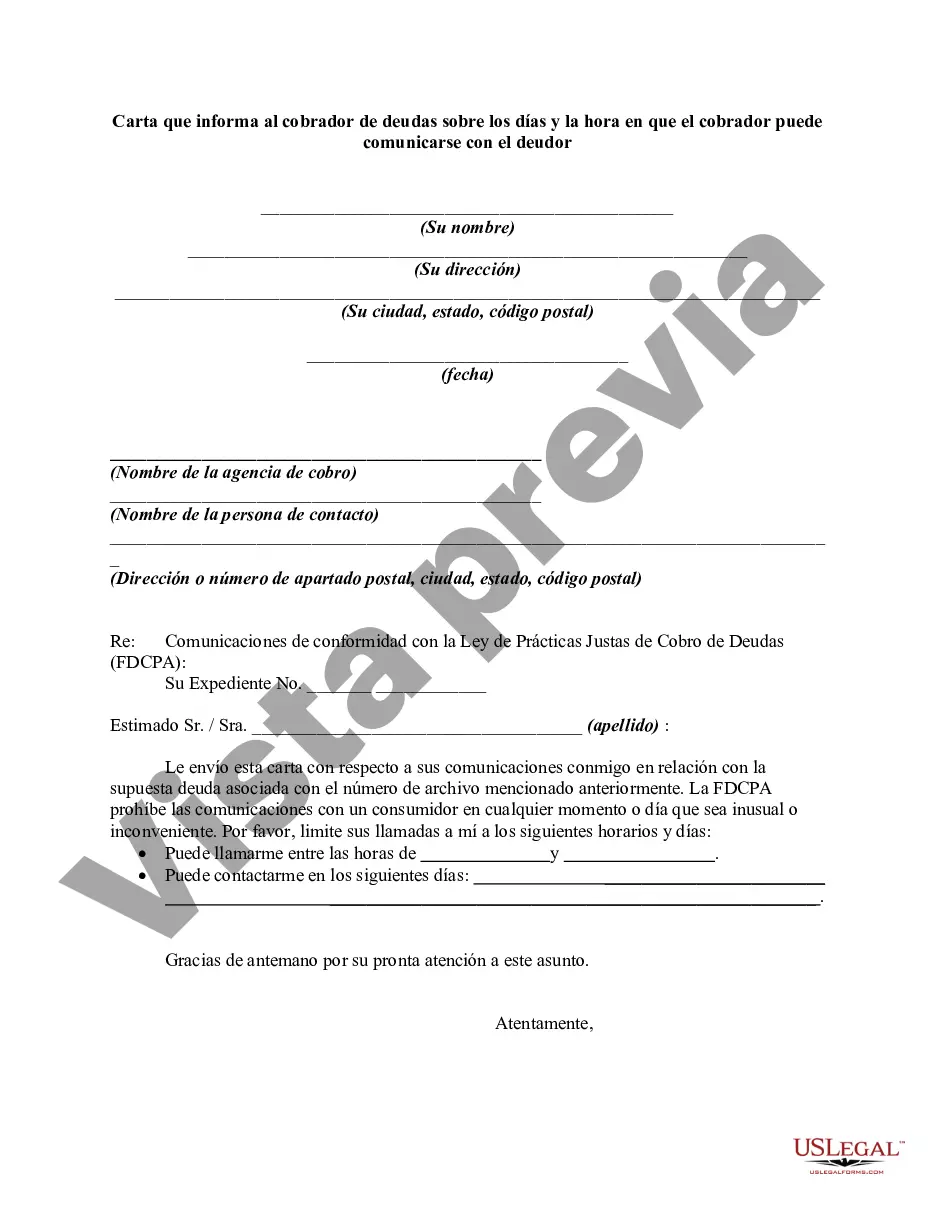

Title: Georgia Letter Informing Debt Collector of Appropriate Contact Days and Time for Debtor Keywords: Georgia, letter, debt collector, informing, days, time, contact, debtor Introduction: Georgia residents have rights and protections when it comes to dealing with debt collectors. To ensure fair treatment and maintain control over the communication process, debtors can use a Georgia Letter Informing Debt Collector of the appropriate days and times for contact. This letter aims to establish boundaries while allowing the debtor to manage their financial affairs effectively. Here, we will explore the importance of this letter and discuss different types of such letters in Georgia. Types of Georgia Letters Informing Debt Collector of Contact Days and Time: 1. Standard Georgia Letter Informing Debt Collector of Contact Days and Time: This is a widely used letter format that provides debt collectors with a clear understanding of when the debtor can be contacted. It might state that the debtor is available to discuss their debt on specific days and during certain times of the day. 2. Georgia Letter Setting Strict Boundaries on Contact Days and Time: For debtors who prefer minimal contact and want to establish stricter boundaries, this type of letter can be sent. It might specify that the debtor is only available for contact on a particular day of the week or during limited hours. This approach allows debtors to have more control over their schedule. 3. Georgia Letter Setting Contact Preferences with Flexibility: This type of letter provides a range of available contact days and times for the debtor, allowing them to set a schedule that best suits their needs. The letter may outline specific days and times that are preferred, but also offer alternative options to accommodate the collector if necessary. Content of Georgia Letter Informing Debt Collector of Contact Days and Time: 1. Sender's Contact Information: Include your full name, address, phone number, and email address at the beginning of the letter for identification purposes. 2. Debt Collector's Information: Include the debt collector's name, address, and relevant contact information such as their phone number and email address. This allows them to easily identify the correct debtor and respond accordingly. 3. Reference Information: Provide any relevant reference numbers, account numbers, and dates to help the debt collector locate the specific debt and account details. 4. Preferred Contact Days and Time: Clearly state the specific days of the week and time slots during which you prefer to be contacted by the debt collector. If applicable, mention any days or time slots that are inconvenient or completely unavailable for contact. 5. Boundaries and Restrictions: If necessary, include any restrictions or boundaries regarding the method of contact. For example, specify if you prefer not to receive calls during working hours but are open to communication via email or postal mail. 6. Request for Confirmation: Include a request for a written acknowledgement from the debt collector, confirming that they have received and understood your preferences for contact days and time. This helps ensure that both parties are on the same page. Conclusion: By utilizing a Georgia Letter Informing Debt Collector of Contact Days and Time, debtors can establish boundaries, maintain control, and effectively manage their interactions with debt collectors. It is important to be clear and assertive in communicating preferences to avoid unnecessary hassles and disruptions in daily life.Title: Georgia Letter Informing Debt Collector of Appropriate Contact Days and Time for Debtor Keywords: Georgia, letter, debt collector, informing, days, time, contact, debtor Introduction: Georgia residents have rights and protections when it comes to dealing with debt collectors. To ensure fair treatment and maintain control over the communication process, debtors can use a Georgia Letter Informing Debt Collector of the appropriate days and times for contact. This letter aims to establish boundaries while allowing the debtor to manage their financial affairs effectively. Here, we will explore the importance of this letter and discuss different types of such letters in Georgia. Types of Georgia Letters Informing Debt Collector of Contact Days and Time: 1. Standard Georgia Letter Informing Debt Collector of Contact Days and Time: This is a widely used letter format that provides debt collectors with a clear understanding of when the debtor can be contacted. It might state that the debtor is available to discuss their debt on specific days and during certain times of the day. 2. Georgia Letter Setting Strict Boundaries on Contact Days and Time: For debtors who prefer minimal contact and want to establish stricter boundaries, this type of letter can be sent. It might specify that the debtor is only available for contact on a particular day of the week or during limited hours. This approach allows debtors to have more control over their schedule. 3. Georgia Letter Setting Contact Preferences with Flexibility: This type of letter provides a range of available contact days and times for the debtor, allowing them to set a schedule that best suits their needs. The letter may outline specific days and times that are preferred, but also offer alternative options to accommodate the collector if necessary. Content of Georgia Letter Informing Debt Collector of Contact Days and Time: 1. Sender's Contact Information: Include your full name, address, phone number, and email address at the beginning of the letter for identification purposes. 2. Debt Collector's Information: Include the debt collector's name, address, and relevant contact information such as their phone number and email address. This allows them to easily identify the correct debtor and respond accordingly. 3. Reference Information: Provide any relevant reference numbers, account numbers, and dates to help the debt collector locate the specific debt and account details. 4. Preferred Contact Days and Time: Clearly state the specific days of the week and time slots during which you prefer to be contacted by the debt collector. If applicable, mention any days or time slots that are inconvenient or completely unavailable for contact. 5. Boundaries and Restrictions: If necessary, include any restrictions or boundaries regarding the method of contact. For example, specify if you prefer not to receive calls during working hours but are open to communication via email or postal mail. 6. Request for Confirmation: Include a request for a written acknowledgement from the debt collector, confirming that they have received and understood your preferences for contact days and time. This helps ensure that both parties are on the same page. Conclusion: By utilizing a Georgia Letter Informing Debt Collector of Contact Days and Time, debtors can establish boundaries, maintain control, and effectively manage their interactions with debt collectors. It is important to be clear and assertive in communicating preferences to avoid unnecessary hassles and disruptions in daily life.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.