Georgia Option to Purchase — Residential, also known as a lease-to-own agreement, is a legally binding contract that provides tenants with the exclusive right to purchase a residential property after an agreed-upon period. This arrangement allows tenants to test the property before committing to a full purchase, providing flexibility and potential homeownership opportunities. The Georgia Option to Purchase — Residential gives tenants the option to rent the property with an explicit understanding that they can buy it later. This agreement offers several advantages, including the ability to build credit, save for a down payment, and assess the property's suitability before committing to a long-term mortgage. There are two main types of Georgia Option to Purchase — Residential agreements: 1. Lease Option Agreement: This type of agreement enables tenants to purchase the property at a predetermined price within a specified timeframe, typically ranging from one to three years. During the lease term, tenants pay rent as well as an option fee, which grants them the right to purchase the property later. If they choose not to exercise the option, the fee is usually non-refundable. 2. Lease Purchase Agreement: In this arrangement, tenants agree to purchase the property at a fixed price within a specified period, usually shorter than the typical lease option agreement. Unlike lease option agreements, the tenants are legally obligated to buy the property at the end of the lease term. The rent paid during this period contributes toward the eventual purchase. Key considerations when entering into a Georgia Option to Purchase — Residential agreement include— - Option Fee: This is a non-refundable fee paid upfront by tenants, granting them the exclusive right to purchase the property. The amount is usually negotiable and typically ranges from 1% to 5% of the property's purchase price. — Purchase Price: The agreed-upon price for purchasing the property is determined when signing the lease agreement. This price remains fixed throughout the lease term, protecting tenants from market fluctuations. — Maintenance: The responsibility for property maintenance and repairs is typically shared between the landlord and the tenant, as outlined in the lease contract. — Credit and Financial Considerations: Tenants should ensure they meet the financial qualifications necessary to secure mortgage financing before entering into a lease-to-own agreement. Overall, Georgia Option to Purchase — Residential agreements offer a unique pathway to homeownership for individuals who may not be immediately eligible for traditional mortgages. These agreements allow tenants to experience living in the home, save for a down payment, and potentially improve their credit standing during the lease term, ultimately leading to fulfilling their dream of homeownership.

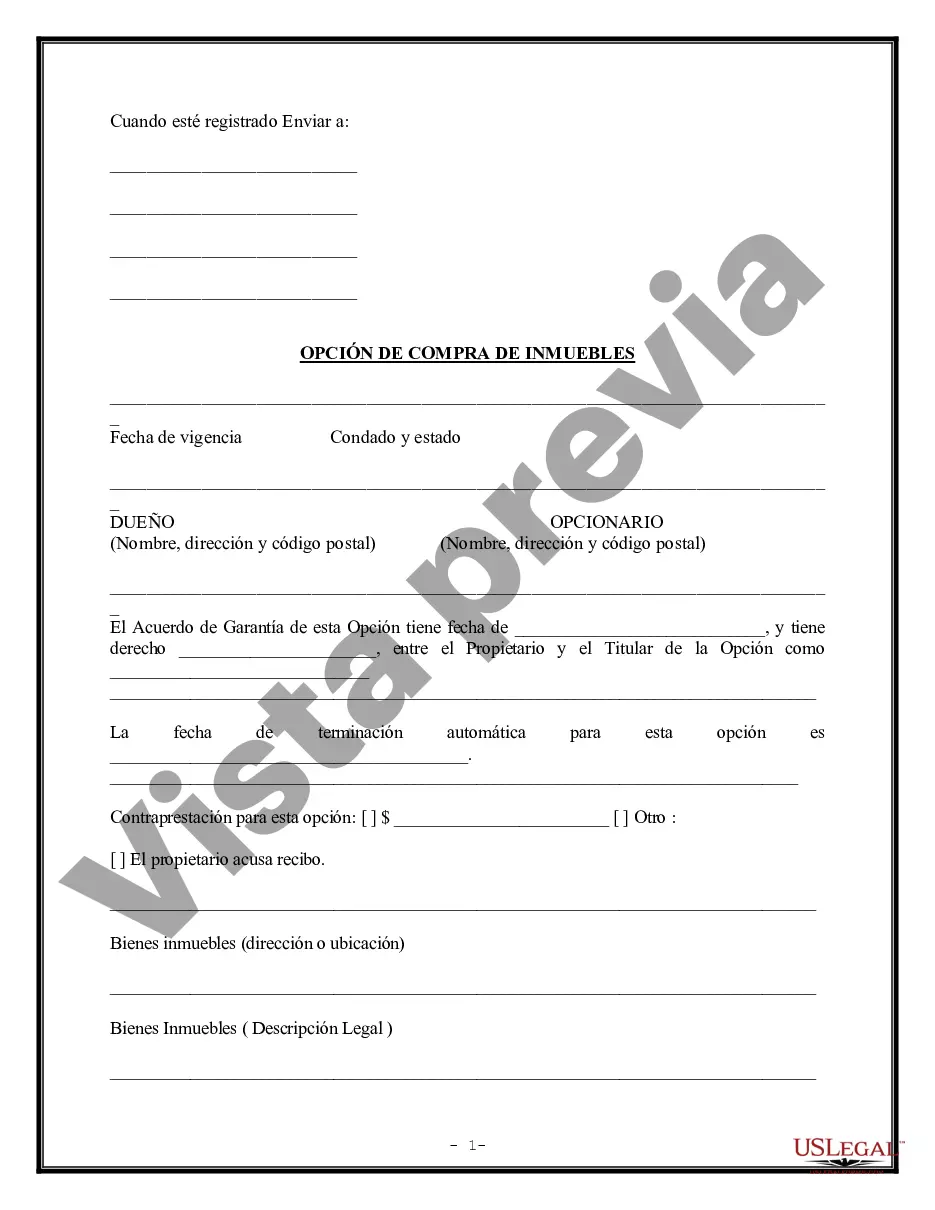

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Opción de Compra - Residencial - Option to Purchase - Residential

Description

How to fill out Georgia Opción De Compra - Residencial?

US Legal Forms - one of many biggest libraries of authorized forms in the USA - delivers a variety of authorized papers themes you are able to download or print out. While using site, you will get thousands of forms for enterprise and specific purposes, categorized by categories, says, or key phrases.You will discover the newest models of forms just like the Georgia Option to Purchase - Residential in seconds.

If you have a registration, log in and download Georgia Option to Purchase - Residential from your US Legal Forms local library. The Download key will show up on each kind you perspective. You have accessibility to all formerly saved forms inside the My Forms tab of your account.

If you want to use US Legal Forms the first time, allow me to share easy recommendations to get you began:

- Be sure you have picked out the right kind to your town/county. Go through the Preview key to analyze the form`s information. Browse the kind outline to actually have chosen the appropriate kind.

- When the kind doesn`t suit your demands, use the Lookup industry towards the top of the monitor to obtain the one who does.

- Should you be content with the shape, validate your option by simply clicking the Buy now key. Then, pick the prices prepare you like and offer your accreditations to register on an account.

- Method the transaction. Make use of bank card or PayPal account to accomplish the transaction.

- Choose the formatting and download the shape on the gadget.

- Make adjustments. Fill up, revise and print out and signal the saved Georgia Option to Purchase - Residential.

Every web template you included in your money does not have an expiration date which is your own forever. So, in order to download or print out yet another copy, just go to the My Forms portion and click on about the kind you will need.

Gain access to the Georgia Option to Purchase - Residential with US Legal Forms, probably the most extensive local library of authorized papers themes. Use thousands of skilled and state-certain themes that meet up with your company or specific requirements and demands.