Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Georgia Declaration of Gift Over Several Year periods is a legal document that allows individuals in the state of Georgia to gift property or assets to another person over a span of multiple years. This declaration provides a structured approach for the gradual transfer of assets, enabling individuals to distribute their wealth in a controlled manner while considering tax implications and other legal requirements. The primary purpose of the Georgia Declaration of Gift Over Several Year periods is to assist individuals in efficiently managing their estate and minimizing potential gift taxes. By dividing the overall gift into smaller increments over several years, the individual can take advantage of annual exclusion limits imposed by the federal government and potentially reduce the overall tax burden associated with the transfer of assets. There are different types of Georgia Declarations of Gift Over Several Year periods, tailored to the specific needs and circumstances of the individuals involved. These can include: 1. Real Estate Declaration of Gift: This type of declaration focuses on the transfer of real estate properties over a period of several years. It outlines the details of the property being gifted, the schedule of transfer, and any specific conditions or obligations associated with the gift. 2. Financial Asset Declaration of Gift: This type of declaration pertains to the gifting of financial assets such as stocks, bonds, or mutual funds over time. It outlines the specific assets being gifted, their value, and the schedule for transfer. 3. Business Interest Declaration of Gift: If the individual owns a business or holds interests in a company, this type of declaration can be used to gradually transfer those interests to another person. It details the nature of the business, the percentage of ownership being gifted, and the timeline for the transfer. 4. Trust Declaration of Gift: In some cases, individuals may choose to establish a trust to facilitate the gradual transfer of assets over several years. This type of declaration outlines the terms and conditions of the trust, including the assets being gifted, the beneficiaries involved, and the distribution schedule. Overall, the Georgia Declaration of Gift Over Several Year periods provides a valuable framework for individuals who wish to distribute their wealth gradually and strategically. By considering the specific type of assets being gifted and tailoring the declaration to their unique circumstances, individuals can ensure a smooth transfer of assets while minimizing potential tax implications.The Georgia Declaration of Gift Over Several Year periods is a legal document that allows individuals in the state of Georgia to gift property or assets to another person over a span of multiple years. This declaration provides a structured approach for the gradual transfer of assets, enabling individuals to distribute their wealth in a controlled manner while considering tax implications and other legal requirements. The primary purpose of the Georgia Declaration of Gift Over Several Year periods is to assist individuals in efficiently managing their estate and minimizing potential gift taxes. By dividing the overall gift into smaller increments over several years, the individual can take advantage of annual exclusion limits imposed by the federal government and potentially reduce the overall tax burden associated with the transfer of assets. There are different types of Georgia Declarations of Gift Over Several Year periods, tailored to the specific needs and circumstances of the individuals involved. These can include: 1. Real Estate Declaration of Gift: This type of declaration focuses on the transfer of real estate properties over a period of several years. It outlines the details of the property being gifted, the schedule of transfer, and any specific conditions or obligations associated with the gift. 2. Financial Asset Declaration of Gift: This type of declaration pertains to the gifting of financial assets such as stocks, bonds, or mutual funds over time. It outlines the specific assets being gifted, their value, and the schedule for transfer. 3. Business Interest Declaration of Gift: If the individual owns a business or holds interests in a company, this type of declaration can be used to gradually transfer those interests to another person. It details the nature of the business, the percentage of ownership being gifted, and the timeline for the transfer. 4. Trust Declaration of Gift: In some cases, individuals may choose to establish a trust to facilitate the gradual transfer of assets over several years. This type of declaration outlines the terms and conditions of the trust, including the assets being gifted, the beneficiaries involved, and the distribution schedule. Overall, the Georgia Declaration of Gift Over Several Year periods provides a valuable framework for individuals who wish to distribute their wealth gradually and strategically. By considering the specific type of assets being gifted and tailoring the declaration to their unique circumstances, individuals can ensure a smooth transfer of assets while minimizing potential tax implications.

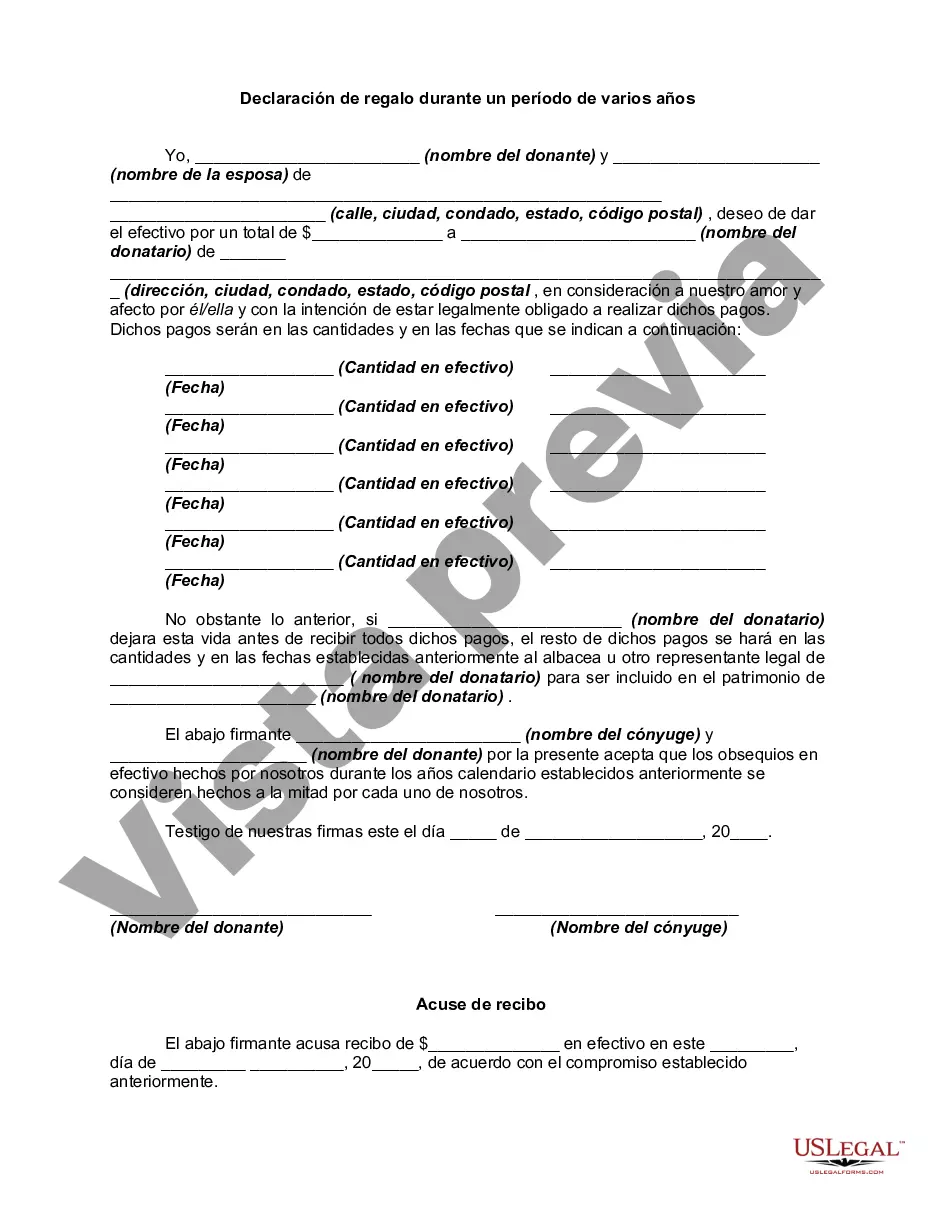

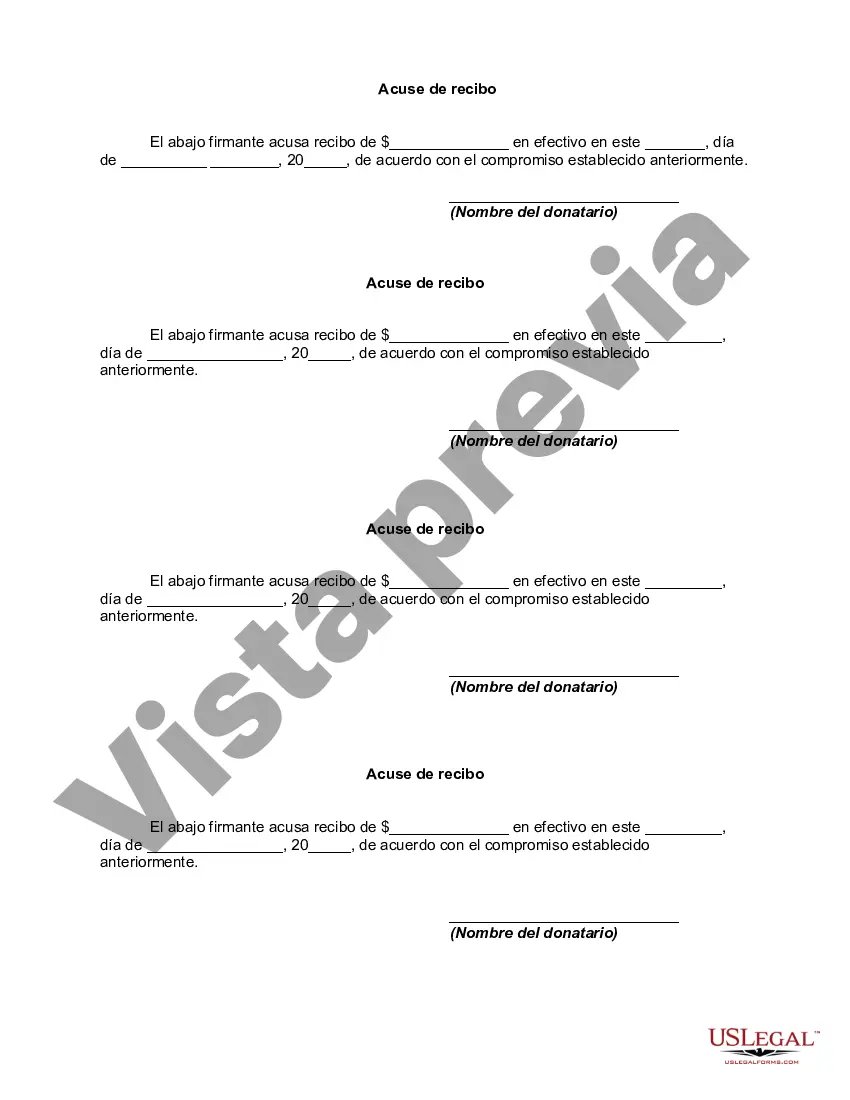

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.