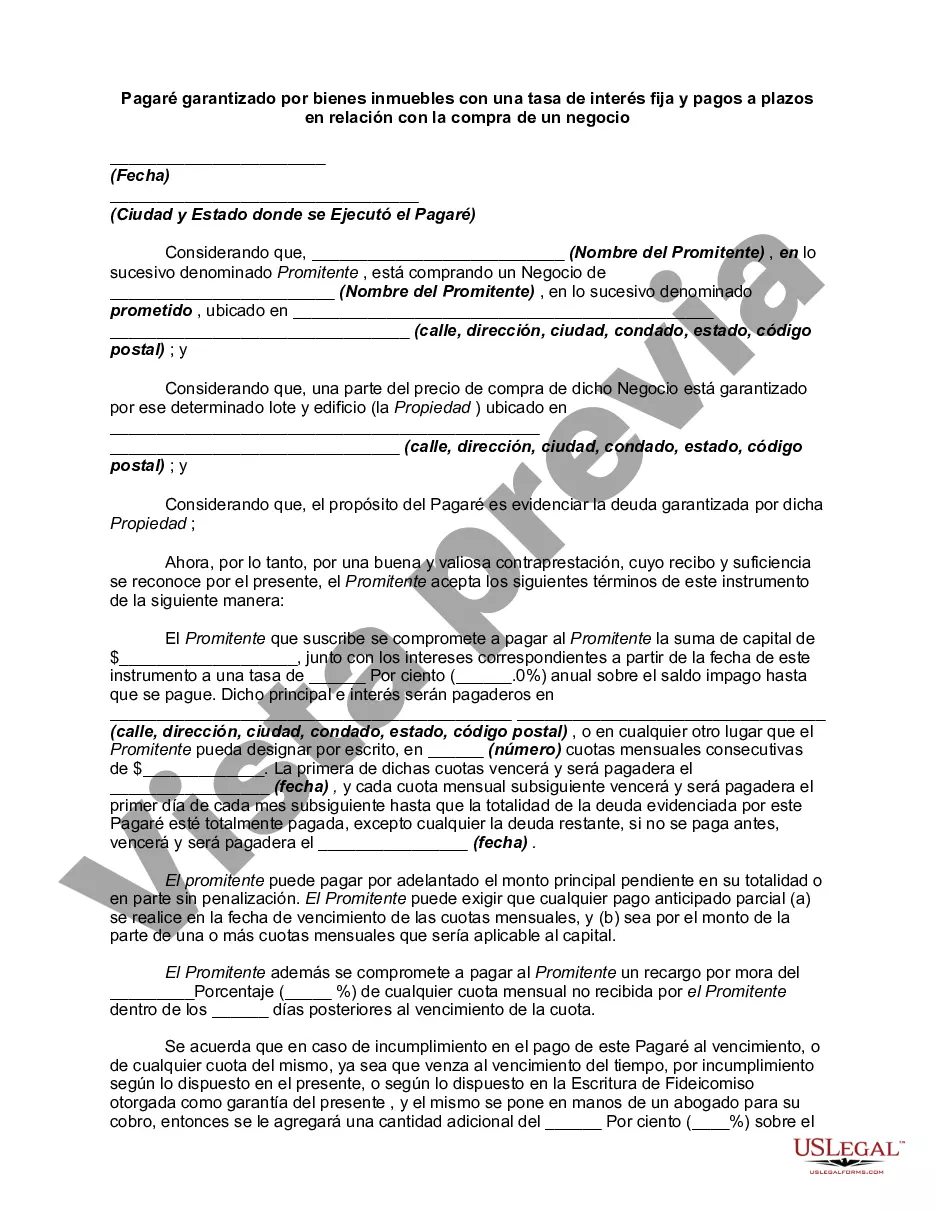

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

A Georgia Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a business property in the state of Georgia. This type of promissory note provides a detailed description of the loan terms, including the fixed interest rate, installment payments, and the collateral, which is the real property being purchased. When entering into such a transaction, it is crucial for both the buyer and the seller to clearly understand the terms and protections offered by the promissory note. The note typically contains information about the parties involved, including their names, contact details, and addresses. It also clearly states the loan amount, the purchase price of the property, and the down payment made by the buyer. In terms of payment, the promissory note specifies the fixed interest rate that will be charged on the loan amount, ensuring both parties agree upon a mutually beneficial rate. The note will also outline the installment payment schedule, including the frequency of payments (e.g., monthly, quarterly), the due dates, and the duration of the loan. This information allows both parties to plan their finances accordingly and ensures that the borrower repays the loan in a timely manner. In addition to the loan terms, the promissory note will detail the collateral being used to secure the loan, which in this case is the real property being purchased. This means that if the borrower defaults on the loan, the lender has the right to seize the property in order to recover the outstanding debt. Different types of Georgia Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may vary in their specific terms and conditions. These variations could include the length of the loan, the interest rate, the down payment, or any additional fees or penalties. Therefore, it is crucial for both parties to carefully review and negotiate the terms of the promissory note to ensure a fair and satisfactory agreement. In summary, a Georgia Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a business property in Georgia. It provides details about the loan amount, interest rate, installment payment schedule, and real property being used as collateral. Understanding the specifics of this type of promissory note is essential for both the buyer and the seller to protect their interests and facilitate a successful business purchase.A Georgia Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a business property in the state of Georgia. This type of promissory note provides a detailed description of the loan terms, including the fixed interest rate, installment payments, and the collateral, which is the real property being purchased. When entering into such a transaction, it is crucial for both the buyer and the seller to clearly understand the terms and protections offered by the promissory note. The note typically contains information about the parties involved, including their names, contact details, and addresses. It also clearly states the loan amount, the purchase price of the property, and the down payment made by the buyer. In terms of payment, the promissory note specifies the fixed interest rate that will be charged on the loan amount, ensuring both parties agree upon a mutually beneficial rate. The note will also outline the installment payment schedule, including the frequency of payments (e.g., monthly, quarterly), the due dates, and the duration of the loan. This information allows both parties to plan their finances accordingly and ensures that the borrower repays the loan in a timely manner. In addition to the loan terms, the promissory note will detail the collateral being used to secure the loan, which in this case is the real property being purchased. This means that if the borrower defaults on the loan, the lender has the right to seize the property in order to recover the outstanding debt. Different types of Georgia Promissory Notes secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business may vary in their specific terms and conditions. These variations could include the length of the loan, the interest rate, the down payment, or any additional fees or penalties. Therefore, it is crucial for both parties to carefully review and negotiate the terms of the promissory note to ensure a fair and satisfactory agreement. In summary, a Georgia Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a business property in Georgia. It provides details about the loan amount, interest rate, installment payment schedule, and real property being used as collateral. Understanding the specifics of this type of promissory note is essential for both the buyer and the seller to protect their interests and facilitate a successful business purchase.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.