A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the trustor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the trustor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

A spendthrift trust is a trust that restrains the voluntary and involuntary transfer of the beneficiary's interest in the trust. They are often established when the beneficiary is too young or doesn't have the mental capacity to manage their own money. Spendthrift trusts typically contain a provision prohibiting creditors from attaching the trust fund to satisfy the beneficiary's debts. The aim of such a trust is to prevent it from being used as security to obtain credit.

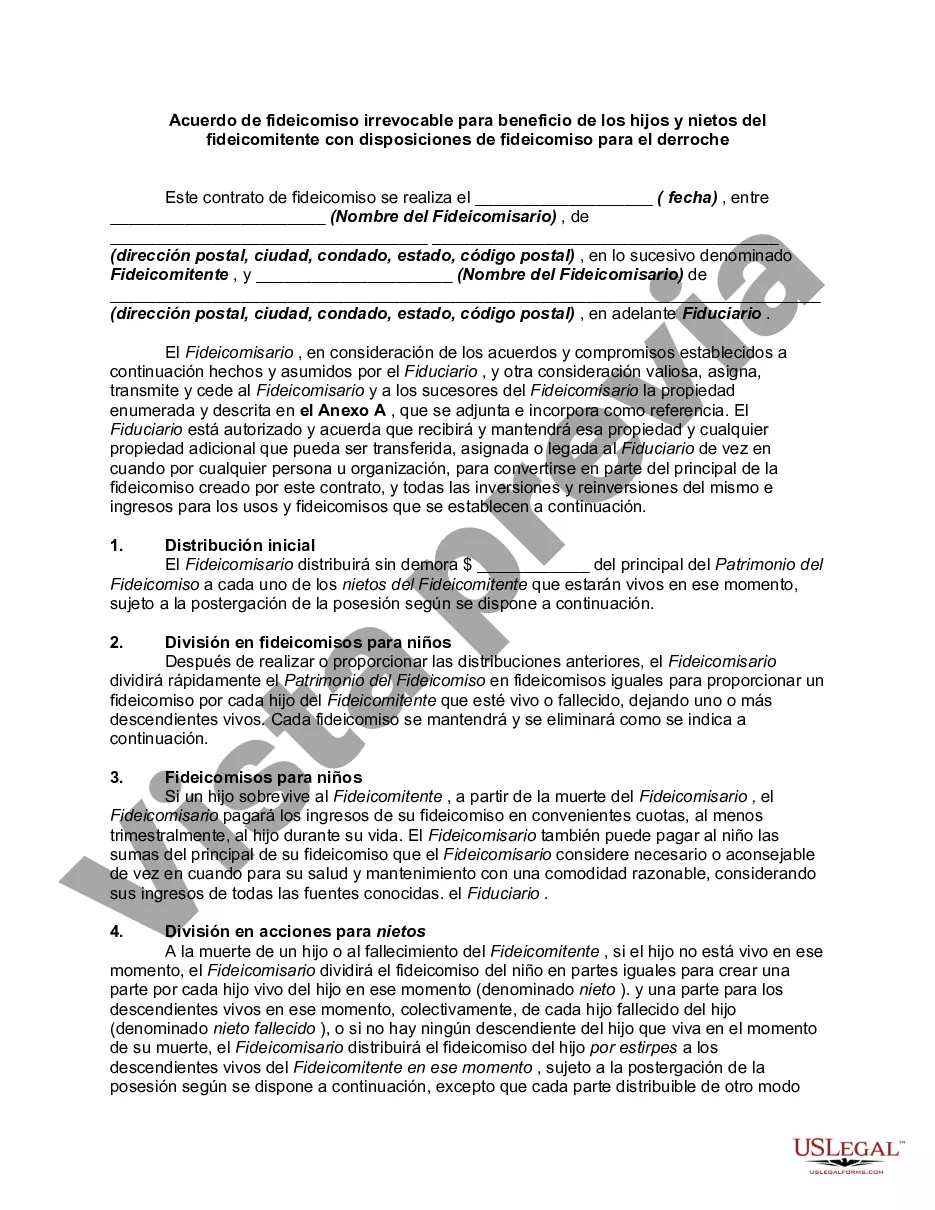

An Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal document used in Georgia to establish a trust for the purpose of protecting and providing for the financial well-being of the trust or's descendants. This type of trust includes provisions that protect the beneficiaries from their own poor financial decisions or outside creditors. The Georgia Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is highly customizable to fit the specific needs and wishes of the trust or. Here are some variations or different types of the trust agreement that can be established: 1. Discretionary Trust: This type of trust grants the trustee sole discretion in distributing the trust's income or principal to the beneficiaries. The trustee assesses the financial needs and circumstances of each beneficiary and has the power to delay or limit distributions to protect them from financial mismanagement or potential threats from external creditors. 2. Support Trust: In a support trust, the trustee is directed to use the trust's income or principal to provide for the "support and maintenance" of the beneficiaries. This allows the trustee to use their discretion to determine the appropriate amount and frequency of distributions based on the beneficiary's needs while safeguarding the assets from spendthrift behaviors or potential creditors. 3. Age-restricted Trust: This type of trust includes provisions that specify an age at which the beneficiaries can receive unrestricted access to the trust assets. Until that specified age, the trustee is responsible for managing and distributing the trust's income or principal for the beneficiaries' benefit according to the trust or's instructions. This provision protects younger beneficiaries from prematurely accessing the funds or facing financial risks. 4. Educational Trust: An educational trust places an emphasis on funding the beneficiaries' education. The trustee is directed to use trust assets for educational expenses, such as tuition, books, and living expenses, while also ensuring the long-term financial security of the beneficiaries. This provision promotes the beneficiaries' educational advancement while minimizing the risk of misusing the trust assets for non-educational purposes. 5. Retirement Trust: A retirement trust is designed to provide financial security for the beneficiaries during their retirement years. The trustee is responsible for managing the trust's assets in a way that generates income to support the beneficiaries' retirement needs. The spendthrift provisions help protect the assets from potential creditors, ensuring a secure and lasting retirement income. In summary, the Georgia Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions allows individuals to establish a customized trust for their descendants that provides financial protection, management, and support while shielding the trust's assets from the beneficiaries' improper financial decisions or potential creditor claims. The different types of this trust agreement cater to various goals, whether its discretionary support, age restrictions, educational funding, or retirement planning. A qualified attorney can help tailor the trust agreement to fit the specific needs and objectives of the trust or.An Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is a legal document used in Georgia to establish a trust for the purpose of protecting and providing for the financial well-being of the trust or's descendants. This type of trust includes provisions that protect the beneficiaries from their own poor financial decisions or outside creditors. The Georgia Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions is highly customizable to fit the specific needs and wishes of the trust or. Here are some variations or different types of the trust agreement that can be established: 1. Discretionary Trust: This type of trust grants the trustee sole discretion in distributing the trust's income or principal to the beneficiaries. The trustee assesses the financial needs and circumstances of each beneficiary and has the power to delay or limit distributions to protect them from financial mismanagement or potential threats from external creditors. 2. Support Trust: In a support trust, the trustee is directed to use the trust's income or principal to provide for the "support and maintenance" of the beneficiaries. This allows the trustee to use their discretion to determine the appropriate amount and frequency of distributions based on the beneficiary's needs while safeguarding the assets from spendthrift behaviors or potential creditors. 3. Age-restricted Trust: This type of trust includes provisions that specify an age at which the beneficiaries can receive unrestricted access to the trust assets. Until that specified age, the trustee is responsible for managing and distributing the trust's income or principal for the beneficiaries' benefit according to the trust or's instructions. This provision protects younger beneficiaries from prematurely accessing the funds or facing financial risks. 4. Educational Trust: An educational trust places an emphasis on funding the beneficiaries' education. The trustee is directed to use trust assets for educational expenses, such as tuition, books, and living expenses, while also ensuring the long-term financial security of the beneficiaries. This provision promotes the beneficiaries' educational advancement while minimizing the risk of misusing the trust assets for non-educational purposes. 5. Retirement Trust: A retirement trust is designed to provide financial security for the beneficiaries during their retirement years. The trustee is responsible for managing the trust's assets in a way that generates income to support the beneficiaries' retirement needs. The spendthrift provisions help protect the assets from potential creditors, ensuring a secure and lasting retirement income. In summary, the Georgia Irrevocable Trust Agreement for the Benefit of Trust or's Children and Grandchildren with Spendthrift Trust Provisions allows individuals to establish a customized trust for their descendants that provides financial protection, management, and support while shielding the trust's assets from the beneficiaries' improper financial decisions or potential creditor claims. The different types of this trust agreement cater to various goals, whether its discretionary support, age restrictions, educational funding, or retirement planning. A qualified attorney can help tailor the trust agreement to fit the specific needs and objectives of the trust or.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.