Title: Georgia Agreement to Compromise Debt by Returning Secured Property: A Comprehensive Overview Introduction: The Georgia Agreement to Compromise Debt by Returning Secured Property is a legally binding contract that aims to settle outstanding debts by returning secured property to the creditor. This article provides a detailed description of this agreement, including its purpose, key elements, and various types that may exist. Overview: The Agreement to Compromise Debt by Returning Secured Property is a specific type of debt settlement option used in Georgia. It allows individuals or businesses in debt to resolve their financial obligations by returning a property that has been pledged as collateral to the creditor. This mutually agreed-upon arrangement helps both parties avoid lengthy legal battles and find an acceptable compromise. Key Elements of the Agreement: 1. Debt Settlement: The primary objective of this agreement is to settle an existing debt. By returning the secured property, the debtor fulfills their repayment obligation to the creditor or lender. 2. Secured Property: The debtor pledges a specific asset, known as secured property, during an initial borrowing transaction. This asset is typically used as collateral to secure the loan or credit. Possible secured properties can include real estate, vehicles, equipment, or any other valuable asset that holds monetary value. 3. Negotiation: The agreement requires negotiation between the debtor and creditor to determine the terms and conditions of the compromise. Both parties must reach a mutual understanding concerning the return of the secured property in exchange for the debt settlement. 4. Debt Relief: Once the secured property is returned, it is assessed for its value. If the assessed value is equal to or higher than the outstanding debt amount, the debtor's obligations will be considered fulfilled, providing debt relief. Types of Georgia Agreement to Compromise Debt by Returning Secured Property: 1. Real Estate Compromise Agreement: This type of agreement pertains to debts secured by real estate properties, such as residential or commercial buildings, land, or condominiums. 2. Vehicle Compromise Agreement: When a debtor owes a debt secured by a vehicle, such as a car, truck, motorcycle, boat, or any other movable property, this type of agreement is drawn up. 3. Equipment Compromise Agreement: In situations where the debtor has borrowed funds secured by equipment or machinery, like industrial machinery, medical equipment, or farming tools, this specific agreement type is utilized. Conclusion: The Georgia Agreement to Compromise Debt by Returning Secured Property offers a viable solution for debtors struggling to repay their obligations. By returning secured property, debtors can settle their debts and avoid further financial hardship or legal consequences. It is crucial to consult legal professionals conversant with Georgia's laws and regulations to ensure the agreement is properly drafted and meets all the necessary legal requirements.

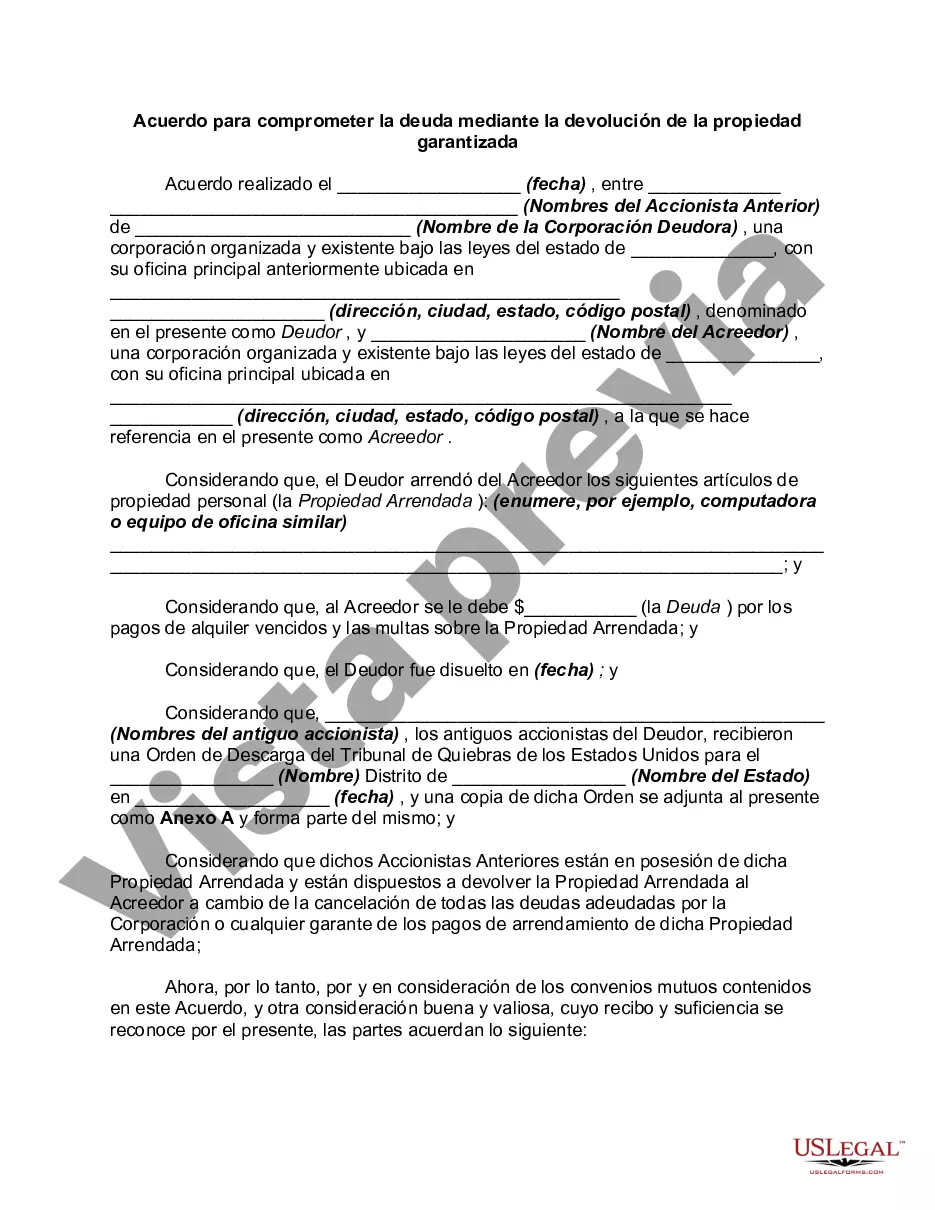

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Georgia Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

You may devote hours on-line looking for the legal record format that suits the state and federal requirements you will need. US Legal Forms provides a large number of legal types that are evaluated by professionals. You can easily download or print the Georgia Agreement to Compromise Debt by Returning Secured Property from my assistance.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Down load switch. After that, it is possible to comprehensive, change, print, or sign the Georgia Agreement to Compromise Debt by Returning Secured Property. Each legal record format you buy is yours permanently. To have an additional version of any purchased form, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms web site initially, follow the basic directions below:

- Initially, make certain you have selected the correct record format for the region/city of your choice. See the form explanation to ensure you have chosen the right form. If offered, utilize the Review switch to appear through the record format at the same time.

- If you wish to find an additional version from the form, utilize the Lookup industry to obtain the format that meets your requirements and requirements.

- When you have found the format you want, simply click Buy now to move forward.

- Pick the costs prepare you want, type your references, and register for your account on US Legal Forms.

- Full the financial transaction. You should use your charge card or PayPal accounts to pay for the legal form.

- Pick the file format from the record and download it for your product.

- Make adjustments for your record if required. You may comprehensive, change and sign and print Georgia Agreement to Compromise Debt by Returning Secured Property.

Down load and print a large number of record themes utilizing the US Legal Forms site, that offers the largest assortment of legal types. Use skilled and state-certain themes to deal with your company or specific requirements.