A financial hardship resulting in a need for such an affidavit such as this form can be defined as a material change in the financial situation of a person that is or will affect their ability to pay their debts. Many things can cause a hardship such as a payment Increase on your mortgage note, loss of your job, business failure, damage to property, death of a spouse or other family member, severe illness, divorce, medical bills, or just accruing too much debt.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

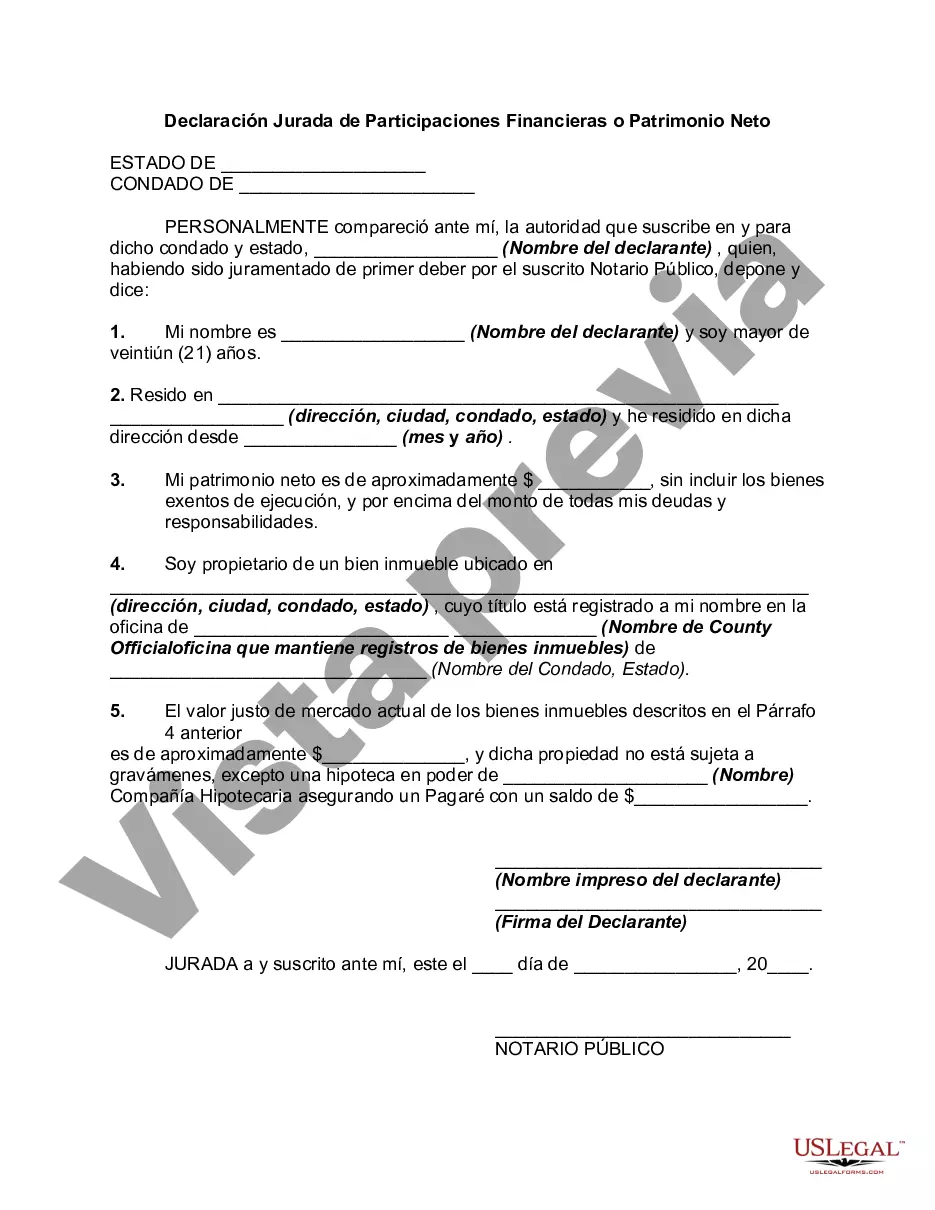

The Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to provide an accurate assessment of an individual's financial status. It discloses an individual's assets and liabilities, offering a comprehensive view of their financial standing. This affidavit serves various purposes, particularly in legal proceedings such as divorce, child support, and financial settlements. For different specific scenarios, there are various types of Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities that you may encounter. Some of these types include: 1. Divorce Affidavit of Financial Holdings: This affidavit is commonly used in divorce proceedings to establish an equitable division of assets and liabilities between spouses. It outlines and certifies the financial resources of both parties, ensuring transparency during negotiations and settlements. 2. Child Support Affidavit of Net Worth: This type of affidavit is crucial in determining child support payments. It helps courts calculate the appropriate amount of financial support based on the income, assets, and liabilities of the parent responsible for providing support. 3. Probate Affidavit of Assets and Liabilities: When an individual passes away, their assets and liabilities are typically dealt with in probate court. This affidavit is used to list all the relevant assets and liabilities of the deceased to facilitate the distribution of their estate among beneficiaries. 4. Business Transaction Affidavit of Financial Holdings: In certain business deals, parties may require an affidavit to disclose their financial capacity. This type of affidavit highlights the assets and liabilities of a business entity or individual, offering reassurance to the other party regarding their financial stability and ability to fulfill obligations. 5. Loan Application Affidavit of Net Worth: When applying for a loan, some financial institutions may request an affidavit disclosing the applicant's assets and liabilities. This provides the lender with an understanding of the borrower's financial situation, enabling them to make informed lending decisions. In conclusion, the Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document used in various scenarios to accurately assess an individual's or entity's financial standing. It ensures transparency, facilitates fair proceedings, and aids in making informed decisions related to financial matters.The Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to provide an accurate assessment of an individual's financial status. It discloses an individual's assets and liabilities, offering a comprehensive view of their financial standing. This affidavit serves various purposes, particularly in legal proceedings such as divorce, child support, and financial settlements. For different specific scenarios, there are various types of Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities that you may encounter. Some of these types include: 1. Divorce Affidavit of Financial Holdings: This affidavit is commonly used in divorce proceedings to establish an equitable division of assets and liabilities between spouses. It outlines and certifies the financial resources of both parties, ensuring transparency during negotiations and settlements. 2. Child Support Affidavit of Net Worth: This type of affidavit is crucial in determining child support payments. It helps courts calculate the appropriate amount of financial support based on the income, assets, and liabilities of the parent responsible for providing support. 3. Probate Affidavit of Assets and Liabilities: When an individual passes away, their assets and liabilities are typically dealt with in probate court. This affidavit is used to list all the relevant assets and liabilities of the deceased to facilitate the distribution of their estate among beneficiaries. 4. Business Transaction Affidavit of Financial Holdings: In certain business deals, parties may require an affidavit to disclose their financial capacity. This type of affidavit highlights the assets and liabilities of a business entity or individual, offering reassurance to the other party regarding their financial stability and ability to fulfill obligations. 5. Loan Application Affidavit of Net Worth: When applying for a loan, some financial institutions may request an affidavit disclosing the applicant's assets and liabilities. This provides the lender with an understanding of the borrower's financial situation, enabling them to make informed lending decisions. In conclusion, the Georgia Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document used in various scenarios to accurately assess an individual's or entity's financial standing. It ensures transparency, facilitates fair proceedings, and aids in making informed decisions related to financial matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.