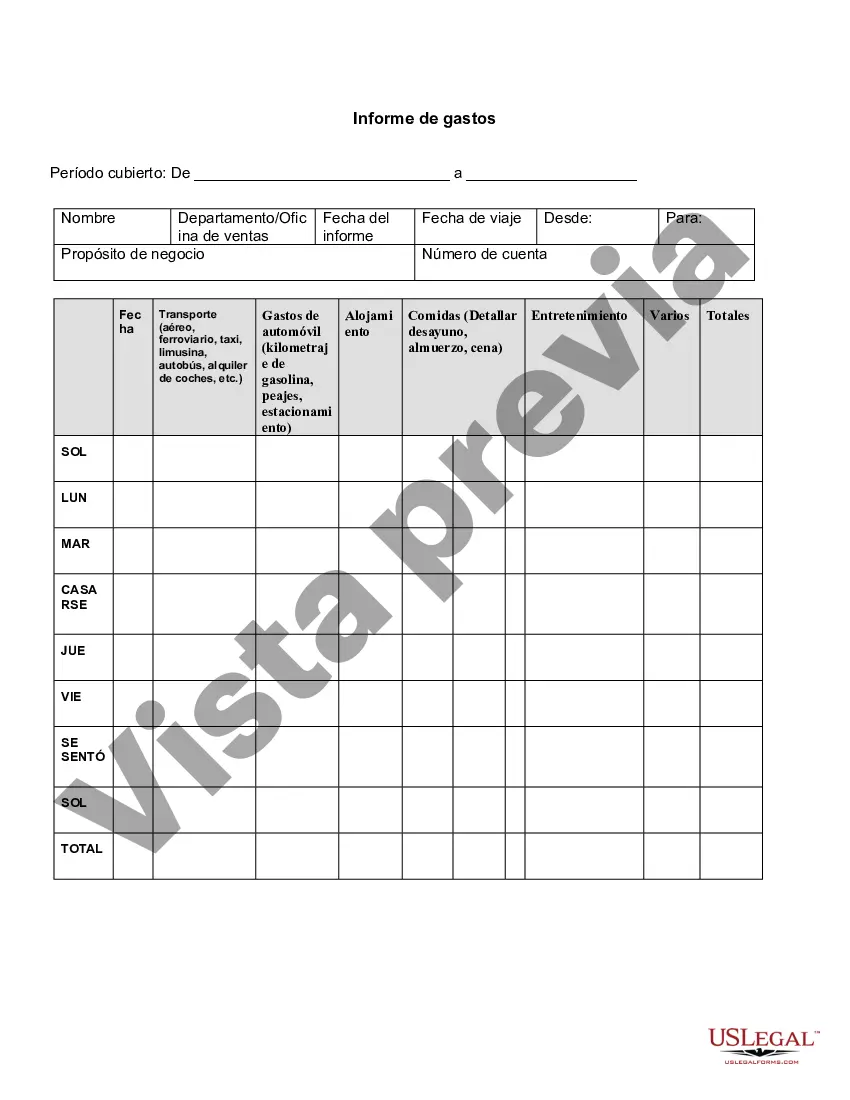

Georgia Expense Report is a comprehensive document that records and tracks all financial transactions related to business expenses incurred by individuals or organizations in the state of Georgia. This report is essential for maintaining accurate and transparent financial records while ensuring compliance with accounting regulations and taxation laws. The Georgia Expense Report provides a detailed breakdown of all expenses, including but not limited to travel costs, accommodation, meals, transportation, entertainment, office supplies, and other miscellaneous expenditures. This document helps businesses analyze and manage their expenses, identify cost-saving opportunities, and calculate reimbursement amounts effectively. Different types of Georgia Expense Reports may include: 1. Individual Expense Report: This report is used by individuals, such as employees or consultants, to document their personal expenses related to business activities. It typically includes receipts or invoices, date and description of the expense, amount spent, and relevant categories for proper allocation. 2. Corporate Expense Report: This report is prepared by companies or organizations to reimburse employees for approved business expenses. It requires employees to provide detailed information about each expense, including proof of purchase, purpose, date, location, and relevant project or client. 3. Travel Expense Report: This specific type of report focuses on expenses incurred during business-related travel within Georgia. It covers costs like airfare, hotel accommodations, ground transportation, meals, conference fees, and other travel-related expenses. Proper documentation is required for each expenditure to avoid any discrepancies or misuse. 4. Entertainment Expense Report: As Georgia businesses often entertain clients, colleagues, or potential partners, this report tracks expenses related to business-related entertainment activities, such as meals, events, shows, or recreational outings. It emphasizes the importance of accurate record-keeping and adhering to specified budgets. 5. Project Expense Report: This report is designed for businesses working on specific projects within Georgia. It tracks all project-related expenditures, including labor costs, equipment rentals, subcontractor fees, and any other expenses directly associated with completing the project. It helps in analyzing project profitability and allocation of resources. In conclusion, the Georgia Expense Report is a vital tool for efficiently managing and documenting business-related expenses within the state. It ensures financial accuracy, aids in compliance with regulations, and helps businesses make informed decisions about cost optimization. By utilizing different types of expense reports, individuals and organizations can maintain transparency, optimize spending, and properly allocate resources for sustainable growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Informe de gastos - Expense Report

Description

How to fill out Georgia Informe De Gastos?

Choosing the best legal papers template can be quite a have difficulties. Needless to say, there are tons of themes accessible on the Internet, but how can you discover the legal type you want? Make use of the US Legal Forms site. The assistance offers a large number of themes, including the Georgia Expense Report, which can be used for organization and personal needs. All the forms are checked out by experts and meet up with state and federal requirements.

Should you be previously authorized, log in to your profile and click the Download option to find the Georgia Expense Report. Make use of your profile to look through the legal forms you might have bought earlier. Proceed to the My Forms tab of your own profile and acquire another version of your papers you want.

Should you be a whole new consumer of US Legal Forms, allow me to share straightforward instructions for you to follow:

- First, be sure you have selected the proper type for your personal town/state. It is possible to look over the shape utilizing the Preview option and study the shape explanation to guarantee it is the best for you.

- If the type does not meet up with your requirements, make use of the Seach field to find the appropriate type.

- When you are sure that the shape is proper, click on the Get now option to find the type.

- Opt for the rates plan you would like and enter in the needed information and facts. Design your profile and pay money for the transaction making use of your PayPal profile or bank card.

- Select the submit formatting and download the legal papers template to your gadget.

- Complete, edit and print and signal the received Georgia Expense Report.

US Legal Forms will be the greatest library of legal forms for which you can find numerous papers themes. Make use of the service to download appropriately-produced documents that follow status requirements.