A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

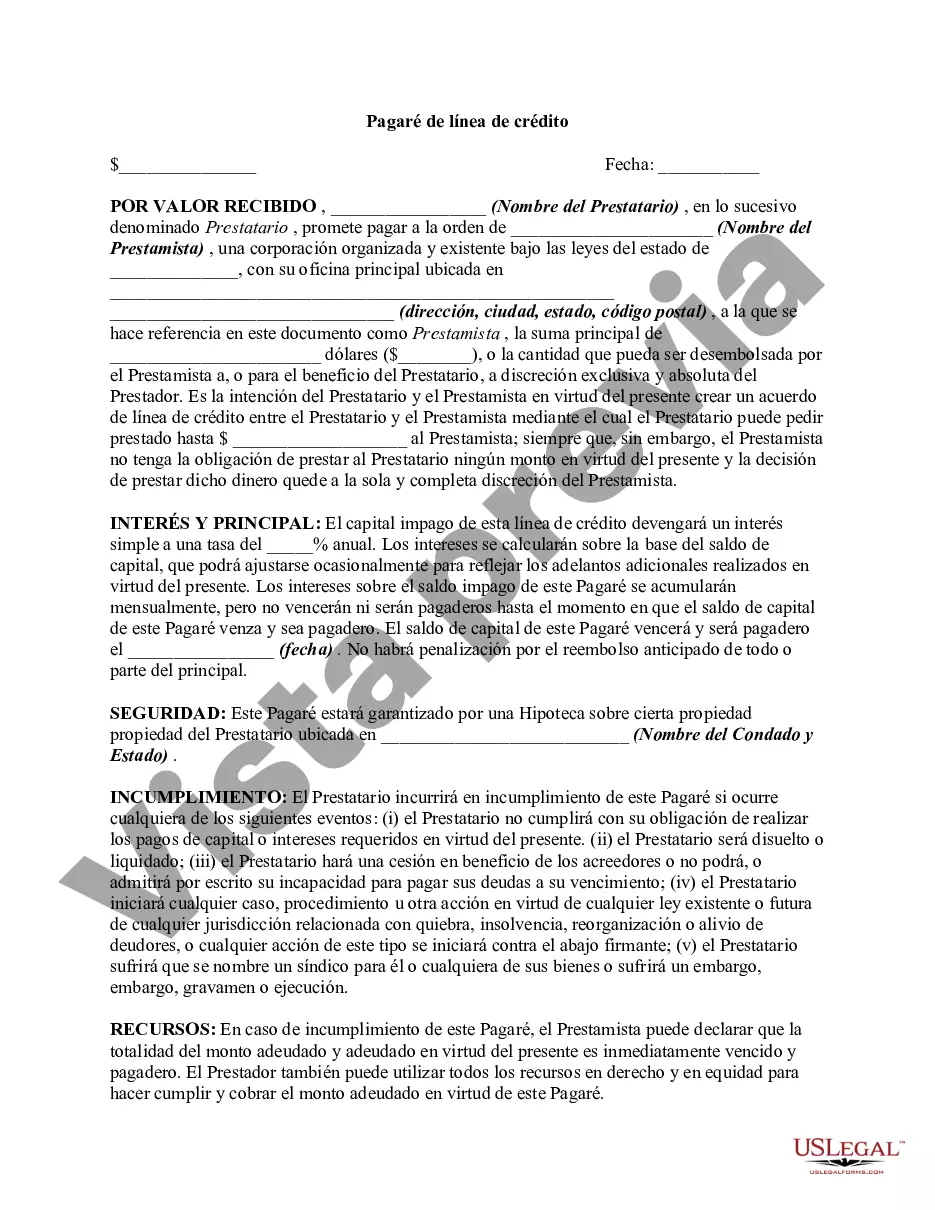

A Georgia Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a lender and a borrower in the state of Georgia. It serves as a written promise by the borrower to repay the borrowed funds according to the specified terms. The Line of Credit Promissory Note is an important document as it clearly defines the obligations and responsibilities of both parties involved, ensuring transparency and protecting the interests of all parties. It typically includes information such as the loan amount, interest rate, repayment schedule, late payment penalties, and any other relevant terms agreed upon by the lender and borrower. There are different types of Georgia Line of Credit Promissory Notes based on the specific requirements and purposes of the borrower. Some common types include: 1. Personal Line of Credit Promissory Note: This type of note is utilized by individuals seeking a line of credit for personal use. It may be used to cover personal expenses, emergencies, or as a source of funding for short-term financial needs. 2. Business Line of Credit Promissory Note: Businesses in Georgia often require a line of credit to manage their working capital, finance inventory purchases, or bridge gaps in cash flow. This note allows businesses to access funds up to a specified credit limit and make repayments as per the agreed terms. 3. Home Equity Line of Credit (HELOT) Promissory Note: This note is used when individuals in Georgia tap into the equity of their homes to secure a line of credit. Homeowners can borrow against their home's appraised value, utilizing the note to define the terms of repayment. 4. Revolving Line of Credit Promissory Note: In a revolving line of credit, the borrower has continuous access to funds up to a predetermined credit limit. This note allows for multiple draws and repayments within the approved limit over a specific period. Regardless of the type, a Georgia Line of Credit Promissory Note serves as a legally binding agreement that protects both lenders and borrowers in the event of any disputes or default on loan payments. It is advisable for both parties to fully understand and agree upon the terms and conditions outlined in the promissory note before signing.A Georgia Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a lender and a borrower in the state of Georgia. It serves as a written promise by the borrower to repay the borrowed funds according to the specified terms. The Line of Credit Promissory Note is an important document as it clearly defines the obligations and responsibilities of both parties involved, ensuring transparency and protecting the interests of all parties. It typically includes information such as the loan amount, interest rate, repayment schedule, late payment penalties, and any other relevant terms agreed upon by the lender and borrower. There are different types of Georgia Line of Credit Promissory Notes based on the specific requirements and purposes of the borrower. Some common types include: 1. Personal Line of Credit Promissory Note: This type of note is utilized by individuals seeking a line of credit for personal use. It may be used to cover personal expenses, emergencies, or as a source of funding for short-term financial needs. 2. Business Line of Credit Promissory Note: Businesses in Georgia often require a line of credit to manage their working capital, finance inventory purchases, or bridge gaps in cash flow. This note allows businesses to access funds up to a specified credit limit and make repayments as per the agreed terms. 3. Home Equity Line of Credit (HELOT) Promissory Note: This note is used when individuals in Georgia tap into the equity of their homes to secure a line of credit. Homeowners can borrow against their home's appraised value, utilizing the note to define the terms of repayment. 4. Revolving Line of Credit Promissory Note: In a revolving line of credit, the borrower has continuous access to funds up to a predetermined credit limit. This note allows for multiple draws and repayments within the approved limit over a specific period. Regardless of the type, a Georgia Line of Credit Promissory Note serves as a legally binding agreement that protects both lenders and borrowers in the event of any disputes or default on loan payments. It is advisable for both parties to fully understand and agree upon the terms and conditions outlined in the promissory note before signing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.