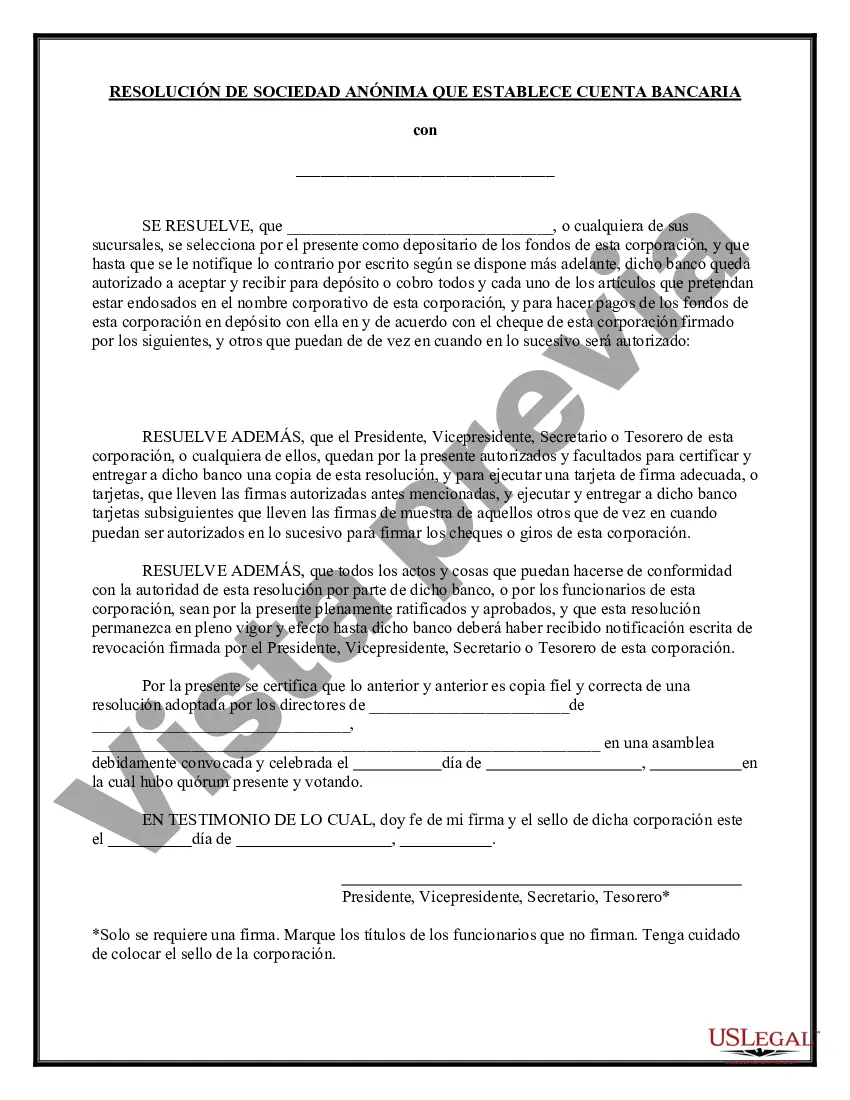

Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories is a legal document used by corporations in the state of Georgia to determine the depository bank where the corporation's funds will be held and to appoint individuals who will have signing authority on the corporation's accounts. This resolution is crucial for a corporation as it ensures efficient banking operations, financial transparency, and compliance with state regulations. The Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories document typically includes the following key information: 1. Corporation Details: The resolution will start by providing information about the corporation, including its legal name, address, and employer identification number (EIN). This ensures that the resolution is specific to that particular corporation. 2. Selection of Depository Bank: The resolution will outline the corporation's decision to select a specific depository bank to hold its funds. The name of the bank, its address, and any identification numbers or account details will be mentioned. 3. Account Signatories: The resolution will list the individuals who are authorized to sign on behalf of the corporation for banking transactions. These individuals are usually key executives or members of the corporation's board of directors who are responsible for financial matters. Their names, positions, and addresses will be included in this section. 4. Resolutions and Approvals: This section will contain statements confirming that the resolution was approved by the corporation's board of directors or shareholders. It may also include any specific requirements or approvals needed from other parties, such as lenders or shareholders. 5. Effective Date: The resolution will specify the date on which it comes into effect. This date can be the same as the date of approval or a future date determined by the corporation. Different types of Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories may exist based on the specific needs and circumstances of different corporations. For example: 1. Standard Resolution: This is the basic resolution used by most corporations to select a depository bank and appoint account signatories. It covers the essential elements mentioned above. 2. Amended Resolution: If a corporation needs to change its depository bank or modify the individuals authorized to sign on its behalf, an amended resolution is used. This resolution will reference the original resolution and state the changes made. 3. Emergency Resolution: In urgent situations where immediate banking decisions need to be made, a corporation may adopt an emergency resolution. This allows for the prompt selection of a depository bank and appointment of temporary signatories until a regular board meeting can be held. It is crucial for corporations in Georgia to carefully draft and execute the Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories, as it affects their financial operations and compliance with state regulations. Obtaining legal advice or consulting an attorney while creating and executing this resolution is recommended to ensure adherence to all legal requirements and best practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Georgia Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

If you need to total, acquire, or print authorized file layouts, use US Legal Forms, the biggest selection of authorized forms, that can be found online. Make use of the site`s easy and handy search to get the files you want. Various layouts for business and specific functions are sorted by groups and says, or keywords and phrases. Use US Legal Forms to get the Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories with a handful of click throughs.

If you are currently a US Legal Forms consumer, log in to the bank account and click on the Obtain option to obtain the Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories. Also you can gain access to forms you earlier saved from the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form to the correct town/country.

- Step 2. Use the Preview method to examine the form`s information. Never overlook to read through the information.

- Step 3. If you are not satisfied using the form, take advantage of the Lookup industry near the top of the display screen to locate other versions of your authorized form format.

- Step 4. Upon having identified the form you want, go through the Get now option. Opt for the rates strategy you prefer and add your references to sign up on an bank account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the format of your authorized form and acquire it on your own device.

- Step 7. Comprehensive, edit and print or indication the Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories.

Each and every authorized file format you acquire is the one you have eternally. You might have acces to every single form you saved with your acccount. Click on the My Forms portion and select a form to print or acquire again.

Be competitive and acquire, and print the Georgia Resolution Selecting Depository Bank for Corporation and Account Signatories with US Legal Forms. There are millions of skilled and status-specific forms you can utilize to your business or specific requirements.