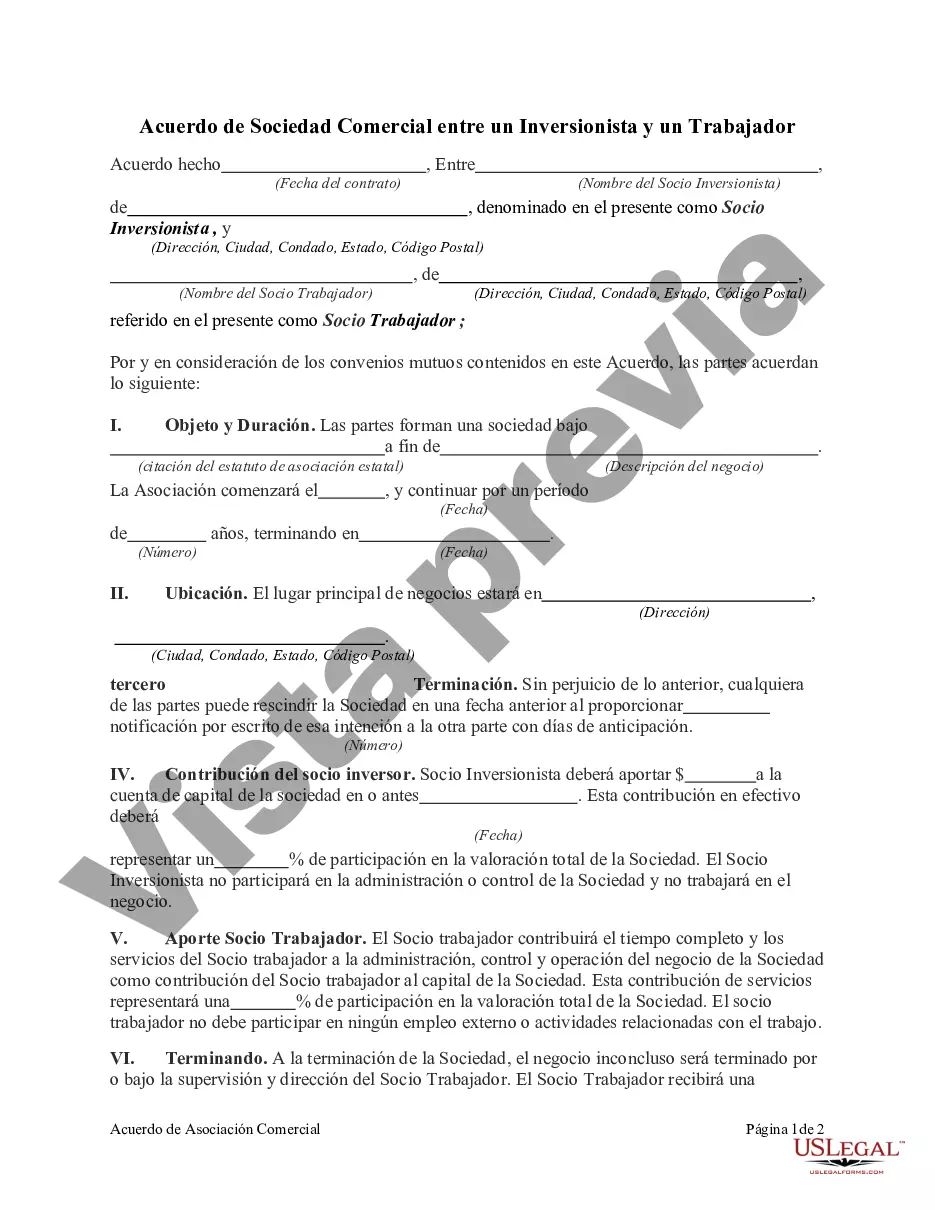

Georgia Commercial Partnership Agreement is a legally binding contract that outlines the terms and conditions agreed upon between an investor and a worker, enabling them to establish a commercial partnership in the state of Georgia, USA. This partnership agreement sets the foundation for a collaborative business venture by establishing roles, responsibilities, and profit-sharing arrangements. The agreement protects the interests of both parties and establishes a framework for efficient decision-making, risk management, and dispute resolution. The Georgia Commercial Partnership Agreement between an investor and worker typically entails the following essential clauses: 1. Parties: Clearly identifies the investor and worker involved in the partnership, including their legal names, addresses, and contact information. 2. Purpose: Describes the nature of the partnership and the specific business activities it aims to undertake collectively. This could include joint investments, venture capital funding, real estate development, or any other mutually agreed commercial activity. 3. Capital Contribution: Specifies the monetary or non-monetary contributions that both the investor and worker agree to make towards the partnership. This may include capital, assets, expertise, or any other agreed form of investment. 4. Profit Distribution: Outlines how profits and losses will be shared between the investor and worker. This clause may define the allocation of profits based on each party's capital contribution or as agreed upon in the partnership agreement. 5. Management and Decision-Making: Defines the decision-making structure of the partnership, detailing roles, responsibilities, and decision-making authority of each party. This section may also outline meeting procedures and protocols. 6. Duration of Partnership: Specifies the intended duration of the partnership. It may be open-ended or have a specific end date, based on the agreement between the parties. 7. Dissolution and Termination: Outlines the conditions and procedures for dissolving or terminating the partnership. This includes provisions for handling outstanding liabilities, liquidation of assets, and the distribution of remaining funds. 8. Confidentiality and Non-Compete: Establishes provisions to protect confidential information and trade secrets shared between the investor and worker during the partnership. Also, it may include non-compete clauses barring either party from engaging in similar business or partnerships during and after the partnership duration. Types of Georgia Commercial Partnership Agreements between an Investor and Worker may include: 1. General Partnership Agreement: This is a common type of partnership agreement where both the investor and worker share responsibilities, profits, and liabilities equally. 2. Limited Partnership Agreement: In this type of partnership, there are general partners (investor and worker) who are actively involved in managing the business and bear unlimited liability. Additionally, limited partners contribute capital but have limited involvement in the business's day-to-day operations and have limited liability. 3. Joint Venture Agreement: A joint venture agreement is established to undertake a specific project or business venture. In this partnership, both the investor and worker pool their resources to achieve mutual objectives and share profits accordingly. Overall, the Georgia Commercial Partnership Agreement between an investor and worker provides a comprehensive framework to establish and govern the terms and conditions of their collaborative business venture. It ensures the smooth operation of the partnership by outlining rights, obligations, and dispute resolution mechanisms to protect both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Acuerdo de Sociedad Comercial entre un Inversionista y un Trabajador - Commercial Partnership Agreement between an Investor and Worker

Description

How to fill out Georgia Acuerdo De Sociedad Comercial Entre Un Inversionista Y Un Trabajador?

If you want to full, acquire, or printing authorized document templates, use US Legal Forms, the greatest assortment of authorized kinds, that can be found online. Use the site`s basic and convenient lookup to get the files you require. Numerous templates for enterprise and person functions are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Georgia Commercial Partnership Agreement between an Investor and Worker within a couple of click throughs.

When you are presently a US Legal Forms customer, log in to the profile and click the Down load key to have the Georgia Commercial Partnership Agreement between an Investor and Worker. You may also entry kinds you earlier delivered electronically from the My Forms tab of your own profile.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form to the proper town/region.

- Step 2. Utilize the Preview choice to check out the form`s content material. Do not forget to read the description.

- Step 3. When you are unsatisfied with all the develop, take advantage of the Research industry on top of the display screen to discover other models of the authorized develop format.

- Step 4. After you have located the form you require, click the Acquire now key. Select the pricing plan you favor and put your credentials to register for an profile.

- Step 5. Approach the purchase. You should use your bank card or PayPal profile to accomplish the purchase.

- Step 6. Select the format of the authorized develop and acquire it on your own system.

- Step 7. Total, modify and printing or indication the Georgia Commercial Partnership Agreement between an Investor and Worker.

Every authorized document format you buy is your own eternally. You have acces to each develop you delivered electronically with your acccount. Select the My Forms portion and choose a develop to printing or acquire yet again.

Contend and acquire, and printing the Georgia Commercial Partnership Agreement between an Investor and Worker with US Legal Forms. There are many professional and express-distinct kinds you may use to your enterprise or person demands.