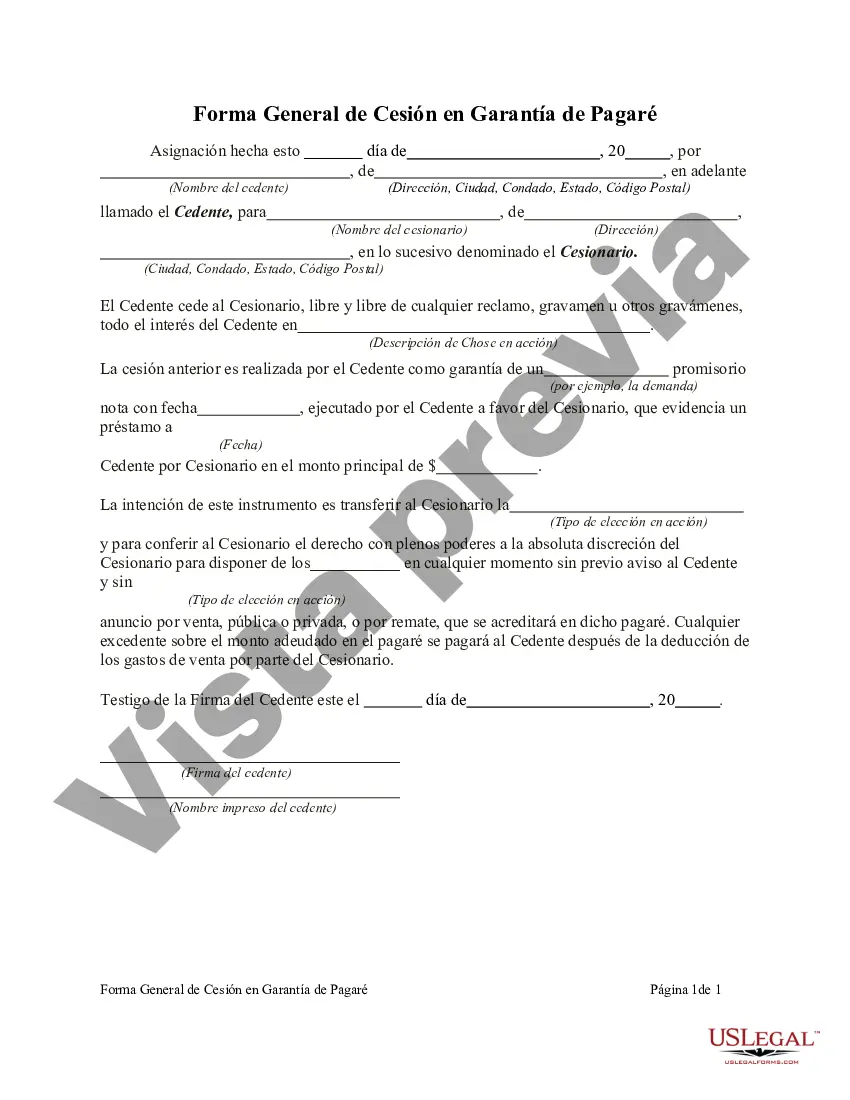

Georgia General Form of Assignment as Collateral for Note is a legal document used to secure a debt by granting a creditor the right to claim and possess certain assets, known as collateral, in case of default. This assignment is governed by the laws of the state of Georgia and serves as a mechanism to protect the interests of lenders. When a borrower takes out a loan or issues a promissory note, they may be required to provide collateral to ensure repayment. The Georgia General Form of Assignment as Collateral for Note allows borrowers to transfer ownership rights of specified collateral to the lender until the debt is fully paid. This form is commonly used in various financial transactions, such as commercial loans, real estate financing, and personal loans. The Georgia General Form of Assignment as Collateral for Note includes essential information such as the names of the borrower and lender, the details of the loan or note, and a comprehensive description of the collateral being assigned. This description should be precise and specific to avoid any confusion about which assets are being used to secure the debt. Different types of collateral that can be assigned under the Georgia General Form of Assignment include but are not limited to: 1. Real Estate: This involves assigning ownership rights of a property, such as land, buildings, or homes, as collateral. The details of the property, including its location, boundaries, and any encumbrances, should be accurately described. 2. Vehicles: Assigning collateral in the form of vehicles requires specific information, such as the make, model, year, vehicle identification number (VIN), and any liens or encumbrances on the vehicle. 3. Accounts Receivable: In some cases, borrowers may assign their outstanding accounts receivable to secure a loan. This type of collateral generally requires a list of customers, the outstanding amounts, and any terms of payment. 4. Equipment: When borrowers use equipment as collateral, they need to provide detailed descriptions of the equipment, including the make, model, serial numbers, and any existing liens or encumbrances. 5. Securities: Assigning securities, such as stocks, bonds, or mutual funds, as collateral involves providing accurate descriptions of each security, including the name of the issuer, the number of shares, the type of security, and any related account or certificate numbers. It is important to note that the Georgia General Form of Assignment as Collateral for Note should be executed properly, following all legal requirements and with the assistance of legal professionals to ensure its validity and enforceability. The specifics of collateral and the precise terms and conditions may vary according to the unique requirements of each loan or note agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Georgia Forma General De Cesión En Garantía De Pagaré?

Are you presently within a situation where you require papers for either company or person functions virtually every day time? There are a variety of legitimate papers layouts available on the Internet, but getting types you can depend on isn`t easy. US Legal Forms gives 1000s of type layouts, just like the Georgia General Form of Assignment as Collateral for Note, that happen to be composed to fulfill state and federal specifications.

If you are already informed about US Legal Forms web site and get your account, merely log in. Following that, it is possible to down load the Georgia General Form of Assignment as Collateral for Note format.

Should you not come with an accounts and wish to begin using US Legal Forms, adopt these measures:

- Find the type you want and ensure it is for that right metropolis/state.

- Use the Review option to examine the shape.

- Browse the information to ensure that you have selected the right type.

- If the type isn`t what you`re searching for, utilize the Search field to discover the type that meets your needs and specifications.

- When you get the right type, click on Purchase now.

- Opt for the prices strategy you need, submit the desired details to generate your account, and pay for the order using your PayPal or bank card.

- Pick a handy file formatting and down load your duplicate.

Find every one of the papers layouts you might have purchased in the My Forms food selection. You can get a further duplicate of Georgia General Form of Assignment as Collateral for Note at any time, if needed. Just click the essential type to down load or print the papers format.

Use US Legal Forms, the most substantial collection of legitimate types, in order to save some time and stay away from mistakes. The service gives skillfully produced legitimate papers layouts that you can use for an array of functions. Produce your account on US Legal Forms and commence generating your lifestyle easier.