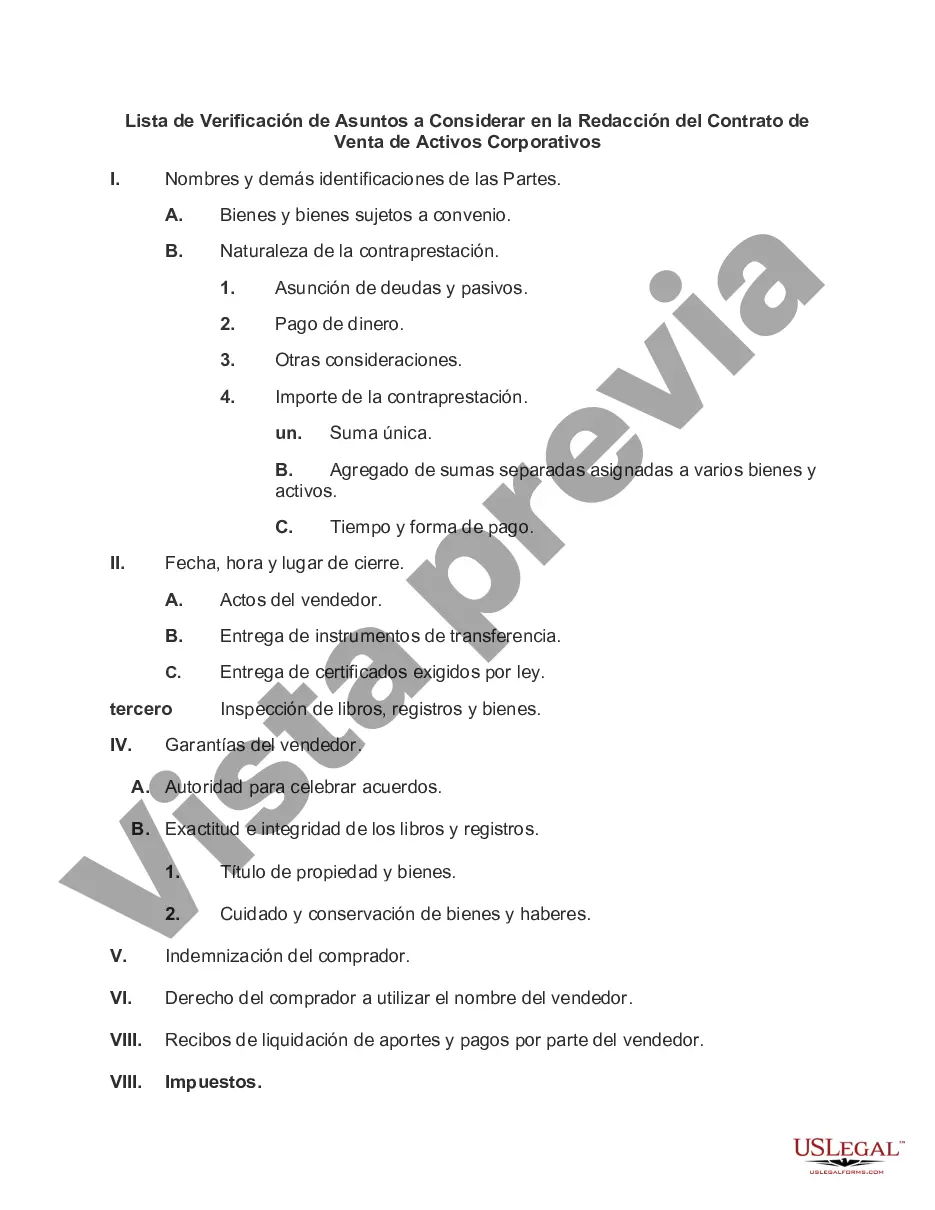

Title: Georgia Checklist of Matters to Consider in Drafting Agreement for Sale of Corporate Assets Introduction: When drafting an agreement for the sale of corporate assets in Georgia, it is important to consider various crucial matters to ensure a smooth transaction that protects the interests of all parties involved. This comprehensive checklist outlines the key factors to be considered during the drafting process, covering legal, financial, and practical aspects. By addressing these matters, both the buyer and seller can minimize potential disputes and achieve a successful sale. Keywords: Georgia, agreement, sale of corporate assets, drafting, checklist, matters to be considered 1. Identification of Parties: — Clearly identify the buyer and seller by their full legal names and any relevant identification numbers, such as tax identification numbers or corporate registration numbers. — Specify the address and contact details of each party for effective communication throughout the transaction process. 2. Asset Description: — Provide a detailed description of the corporate assets to be included in the sale, including tangible assets (property, inventory, equipment, etc.) and intangible assets (intellectual property, trademarks, licenses, etc.). — Clearly define which assets are part of the transaction and exclude any assets not intended for sale. 3. Purchase Price and Payment Terms: — Clearly state the purchase price of the assets and the currency for payment. — Specify the payment terms, including any down payments, installments, or lump-sum payments, and indicate the deadline or milestones for payment. 4. Representations and Warranties: — Outline any representations and warranties made by the seller regarding the assets being sold, such as their ownership, condition, and legality. — Indicate the limitations on warranties, such as disclaimers for future performance or third-party claims. 5. Due Diligence: — Address the buyer's right to conduct due diligence on the assets. — Specify the duration and extent of due diligence, including access to financial records, contracts, permits, and relevant documents. 6. Transfer of Title and Risk: — Establish when the title of the assets will transfer from the seller to the buyer. — Clearly define when the risk of loss or damage passes to the buyer. 7. Conditions Precedent: — Specify any conditions that must be satisfied before the agreement becomes effective, such as obtaining necessary regulatory approvals or third-party consents. 8. Closing Procedures: — Describe the procedures and responsibilities for closing the transaction, including the preparation and exchange of necessary documents, payment methods, and any required approvals or filings. Additional Types of Georgia Checklist of Matters to Consider in Drafting Agreement for the Sale of Corporate Assets: 1. Tax Considerations: — Include provisions addressing the allocation of taxes, tax indemnification, and any tax-related liabilities arising from the sale. 2. Confidentiality and Non-Compete: — Define confidentiality requirements and restrictions on the seller's future competition or solicitation of customers. 3. Employee Matters: — Address the treatment of employees, including their transfer, severance, or termination, in accordance with employment laws. 4. Dispute Resolution: — Determine the method of dispute resolution, such as mediation or arbitration, and the jurisdiction for resolving any conflicts arising from the agreement. By carefully considering and addressing these matters in the agreement, parties involved in the sale of corporate assets in Georgia can protect their legal rights, ensure a fair transaction, and foster a positive business relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Georgia Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

You may commit hours on-line looking for the legal file design that meets the state and federal requirements you need. US Legal Forms provides 1000s of legal kinds which can be analyzed by specialists. You can easily download or print the Georgia Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from my service.

If you already possess a US Legal Forms profile, you may log in and then click the Down load switch. Next, you may full, change, print, or indication the Georgia Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets. Every legal file design you acquire is the one you have eternally. To acquire yet another copy for any acquired kind, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms site the first time, stick to the simple guidelines under:

- First, make sure that you have chosen the best file design for the county/metropolis that you pick. Look at the kind outline to ensure you have chosen the proper kind. If offered, utilize the Review switch to check from the file design too.

- If you wish to locate yet another model of the kind, utilize the Research area to find the design that suits you and requirements.

- When you have identified the design you need, just click Get now to carry on.

- Pick the rates program you need, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal profile to fund the legal kind.

- Pick the file format of the file and download it in your device.

- Make modifications in your file if possible. You may full, change and indication and print Georgia Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

Down load and print 1000s of file themes making use of the US Legal Forms site, which offers the greatest assortment of legal kinds. Use skilled and express-certain themes to take on your business or personal requires.