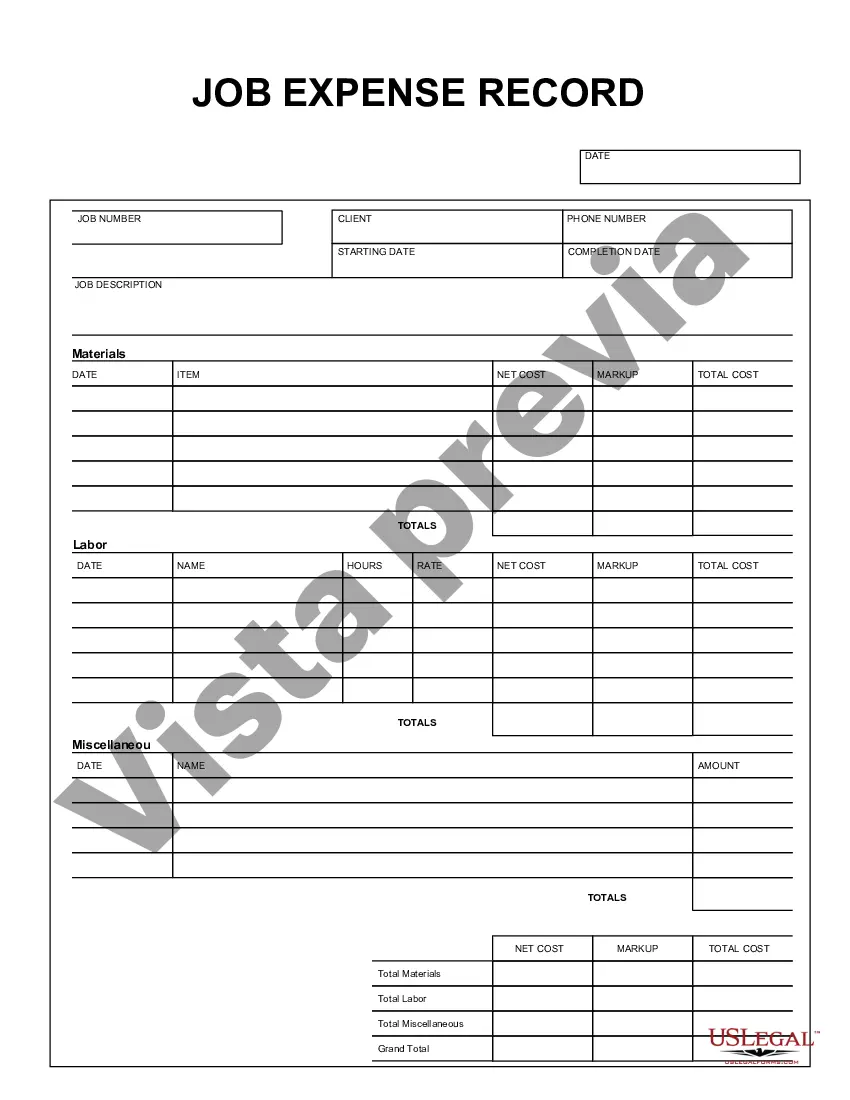

The Georgia Job Expense Record is an essential document for individuals residing in the state of Georgia who need to keep track of job-related expenses for taxation purposes. This record serves as a comprehensive log of expenses incurred in relation to employment activities, ensuring accurate reporting and potential deductions during tax filing. Georgia Job Expense Records come in various formats, designed to cater to different taxpayer needs. Some common types include: 1. Printable Georgia Job Expense Record: This type offers a printable template that individuals can easily fill out manually. It includes sections for recording various job-related expenses, such as transportation, meals, lodging, supplies, and professional development. 2. Online Georgia Job Expense Record: With the advancements in technology, electronic platforms provide a convenient way to maintain expense records. Online versions allow taxpayers to input their job expenses directly into a digital form, often equipped with built-in calculators and categorization features. 3. Georgia Job Expense Record Apps: In the digital era, smartphone applications have gained popularity due to their accessibility and user-friendly interfaces. Georgia Job Expense Record apps enable individuals to track their expenses on-the-go, capturing receipts, categorizing expenses, and storing data securely. 4. Georgia Job Expense Record Software: For those who prefer a more comprehensive and automated solution, specific software is available. This software typically provides advanced reporting features, automated expense tracking, and integration with payroll or accounting systems, simplifying the overall expense management process. The Georgia Job Expense Record serves as a reliable reference when reporting job-related expenses during tax preparation, minimizing the risk of audit or penalties. It is crucial to maintain accurate records, including receipts and supporting documents, to substantiate the legitimacy of expenses claimed. By properly documenting these expenses, taxpayers can potentially reduce their taxable income, resulting in potential tax savings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Georgia Registro De Gastos De Trabajo?

You are able to devote time on the web looking for the legal record format that meets the federal and state requirements you require. US Legal Forms offers thousands of legal varieties that are analyzed by specialists. It is simple to down load or printing the Georgia Job Expense Record from the assistance.

If you have a US Legal Forms accounts, it is possible to log in and click on the Download option. Next, it is possible to full, change, printing, or indicator the Georgia Job Expense Record. Every single legal record format you acquire is your own property eternally. To acquire yet another backup for any bought kind, visit the My Forms tab and click on the corresponding option.

If you use the US Legal Forms internet site the first time, follow the straightforward guidelines beneath:

- First, be sure that you have chosen the best record format for your area/city of your choice. See the kind description to make sure you have picked out the proper kind. If readily available, use the Review option to check from the record format too.

- In order to get yet another variation from the kind, use the Research area to obtain the format that meets your requirements and requirements.

- After you have located the format you want, click Purchase now to move forward.

- Select the prices prepare you want, enter your accreditations, and register for your account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal accounts to pay for the legal kind.

- Select the formatting from the record and down load it for your device.

- Make changes for your record if necessary. You are able to full, change and indicator and printing Georgia Job Expense Record.

Download and printing thousands of record themes utilizing the US Legal Forms Internet site, which offers the greatest assortment of legal varieties. Use professional and express-distinct themes to handle your small business or person demands.