Georgia Agreement and plan of reorganization

Description

How to fill out Agreement And Plan Of Reorganization?

Are you presently in the place in which you need to have files for possibly enterprise or person purposes just about every working day? There are plenty of lawful file layouts accessible on the Internet, but locating types you can trust isn`t easy. US Legal Forms provides a large number of kind layouts, just like the Georgia Agreement and plan of reorganization, that are written in order to meet state and federal specifications.

In case you are presently acquainted with US Legal Forms web site and get an account, simply log in. Next, you can acquire the Georgia Agreement and plan of reorganization design.

Unless you come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is for your correct city/region.

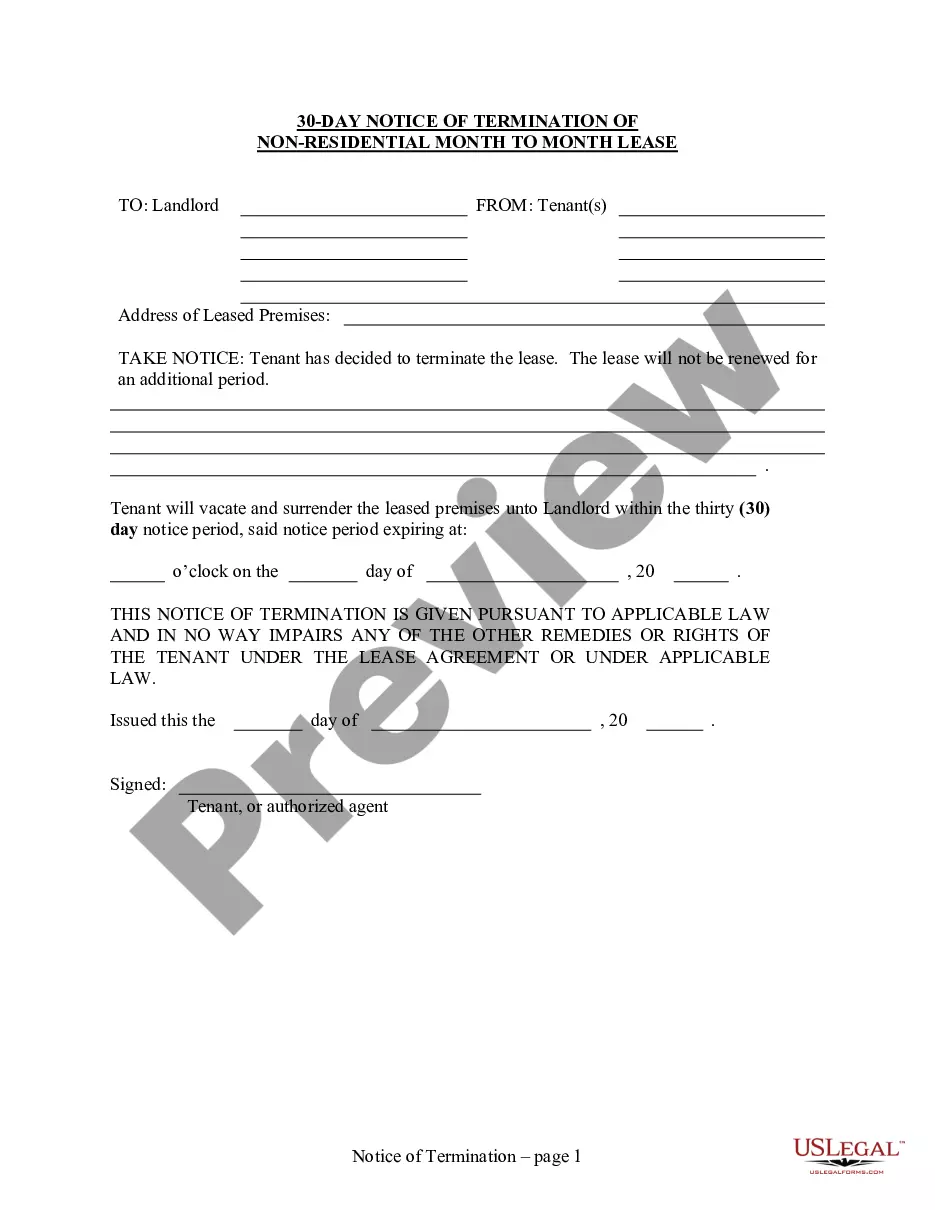

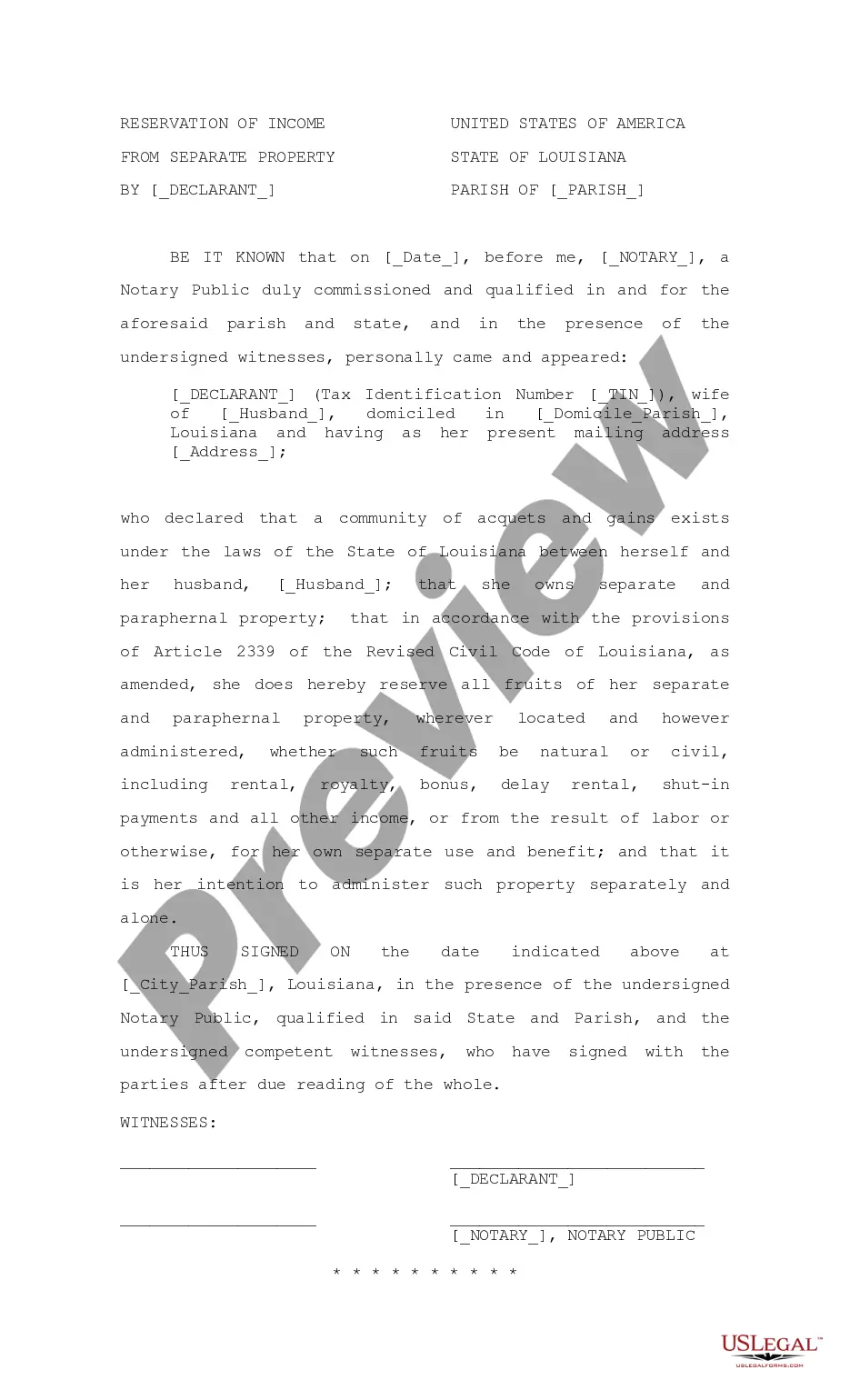

- Utilize the Preview option to examine the form.

- Browse the description to actually have selected the correct kind.

- In case the kind isn`t what you are looking for, make use of the Research industry to obtain the kind that suits you and specifications.

- If you find the correct kind, click Acquire now.

- Opt for the costs program you desire, submit the necessary information and facts to generate your bank account, and pay money for your order utilizing your PayPal or charge card.

- Choose a handy data file formatting and acquire your version.

Get each of the file layouts you possess bought in the My Forms food selection. You may get a extra version of Georgia Agreement and plan of reorganization anytime, if necessary. Just select the necessary kind to acquire or printing the file design.

Use US Legal Forms, one of the most extensive variety of lawful types, to save efforts and avoid blunders. The support provides professionally created lawful file layouts that you can use for a selection of purposes. Generate an account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

368(a)(1)(F). It happens when a company transfers or is classified as transferring all of its assets to another company. Typically, an F Reorganization occurs as a company prepares for a merger or acquisition transaction.

In a Section 355 divisive transaction, a corporation usually distributes stock of one or more controlled subsidiaries to its shareholders without gain recognition at the corporate or shareholder level. The transaction can be structured as a spin-off, split-off, split-up, or splint-off.

IRC Section 368(a)(1) Subsections A through C In a merger-type of reorganization, a subsidiary corporation is absorbed into a parent company, following any applicable state law or merger statute. A consolidation, on the other hand, involves a combination of two equally grounded companies.

Section 368(a)(1)(D) provides that the term ?reorganization? includes a transfer by a corporation of all or a part of its assets to another corporation if immediately after the transfer the transferor, or one or more of its shareholders (including persons who were shareholders immediately before the transfer), or any ...

The most notable advantage of Section 351 over Section 368 is that the former does not require continuity of ownership interest, which restricts the amount of non-taxable consideration (acquirer stock) that the target's shareholders may receive.